Model Bilateral Investment Treaty | 01 Jul 2020

This article is based on “What ails India’s Model BIT?” which was published on The Hindu business line on 28/6/2020. It talks about the issues related to the Model Bilateral Investment Treaty, 2016.

Covid-19 pandemic, which led to a protracted lockdown policy, has raised the fear of an impending economic recession in India. In pursuit of economic recovery, the Government has launched Atmanirbhar Bharat Abhiyan with an objective of making domestic firms competitive and more integrated supply value chains.

However, in order to make Indian manufacturing truly self-reliant, domestic manufacturing needs to be complemented by a more welcoming stance on foreign investments such as FDIs, FIIs.

Though India ranked among the top 10 global destinations for FDI in 2019, the inflows have remained at less than 2% of GDP. This is despite India leapfrogging 79 places from 142 in 2014 to 63 in 2020 in World Bank’s ‘Ease of Doing Business’ rankings.

One way to understand such sub-optimal flows is to look at the lacunae emanating from the Model Bilateral Investment Treaty, 2016.

Bilateral Investment Treaties

- Bilateral Investment Treaties: BITs are treaties between two countries aimed at protecting investments made by investors of both countries.

- Objective of BITs: BITs protect investments by imposing conditions on the regulatory behaviour of the host state and thus, prevent undue interference with the rights of the foreign investor. These conditions may include:

- Imposing obligations on host states to accord fair and equitable treatment (FET) to foreign investment and not to discriminate against foreign investment.

- Allowing for repatriation of profits subject to conditions agreed to between the two countries.

- Most importantly, allowing individual investors to bring cases against host states if the latter’s sovereign regulatory measures are not consistent with the BIT, for monetary compensation.

India and BITs

- Since signing the first BIT in 1994 with the UK, India has inked 86 such bilateral treaties, the latest being with Brazil in 2020.

- BITs have been one the major drivers of FDI inflows into India.

- A 2016 study suggests that by providing substantive protection and commitment to foreign investors, BITs indeed contributed to rising FDIs in the 2001-2012 period.

- However, there have been many cases of the penalty awarded by an International Dispute Settlement (ISDS) tribunal served against India.

- For example in cases involving regulatory measures such as the imposition of retrospective taxes, cancellation and revocation of spectrum and telecom licences.

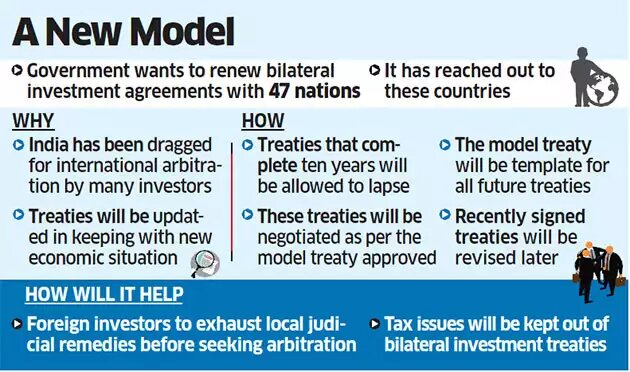

- This led to a review of the BITs. and in 2016 India launched the Model BIT. It aims to act as a base for negotiating new BITs with other States, as well as for re-negotiation of the existing ones.

- As per Model BIT in 2016, India moved away from an overly investor-friendly approach to a somewhat protectionist approach concerning foreign investments.

- Since its adoption, India has unilaterally terminated 66-odd BITs between 2016 to 2019, sending negative signals to the global investor community.

- This is evident as no country has shown any inclination to re-negotiate based on the Model BIT.

- Since 2016, India has signed just three treaties, none of which is in force yet.

Issues Related to Model BIT

- Narrowing Definition of Investment: Model BIT narrowed the definition of investment that needed to qualify for BIT protection.

- Shift From Asset-based to Enterprise-based: Model BIT indicates that India proposes a narrow ‘enterprise-based’ definition for investment, whereby only direct investments are protected under the treaty.

- Negative List: Besides this, the definition of investment in the Model BIT also contains a negative list, which precludes portfolio investments, interest in debt- securities, intangible rights, etc. from the definition of investment.

- Thus, the new definition does not take into account the increased scope of foreign investments in the modern era of globalization and liberalization.

- Exhaustion of Domestic Remedy Clause: Model BIT contains a clause mandating exhaustion of domestic remedy prior to initiating international arbitration proceedings.

- According to the ‘Ease of Doing Business 2020’ report, India currently ranks 163 out of 190 countries in ease of enforcing contracts, and it takes 1,445 days and 31% of the claim value for dispute resolution.

- This surely does little to increase confidence in foreign investors.

- Wide Discretionary Powers to Host State: Also, it included a ‘Treatment of Investments’ clause with a broadly-worded undertaking that neither party shall subject investments to measures that are manifestly abusive and in violation of due process.

- However, what is the yardstick for assessment of violation of “due process” is not defined.

- Further, Model BIT states that if the Host State decides that the alleged breach under the BIT is a subject matter of taxation at any point in time, the decision of the Host State therein shall be non-justiciable and exempt from review by an arbitral tribunal.

- The Model BIT simplistically assumes that a foreign investor shall have complete confidence in domestic judicial interpretations and mechanisms.

- This could potentially give wide discretion to the Host State to unilaterally exclude any dispute from the jurisdiction of a tribunal, merely by asserting that the conduct in question relates to taxation.

Steps To Be Taken

- Adopting a Hybrid Definition: Given averseness of Foreign investors, there is a need to revise the definition of investment in the form of a hybrid between an asset-based and enterprise-based definition.

- While keeping intact a negative list (to exclude those specific categories or sectors that the Parties deem necessary), such a definition would ensure that direct and indirect investments are protected under the BIT, while still leaving scope for exclusions for regulatory reasons by the State.

- Following International Norms: India may explore the option to revise the standard of treatment clause to align it with international practices and include the traditional standard of protection of fair and equitable treatment.

- Also, must give clarification regarding the open-ended terms in the Model BIT. This could result in India facing fewer disputes and BIT claims.

Conclusion

The initiatives such as Make in India 2.0 and liberalisation of FDI caps across sectors are steps in the right direction. Unless the Government adopts a more balanced approach in the Model BIT 2016, foreign investors would be reluctant to make investments into India.

As global companies contemplate moving their investments away from China, it is an opportune time to review and revise the Model BIT from the present inward-looking protectionist approach to a more pragmatic one.

|

Drishti Mains Question “In order to address the shortfall in foreign inflows in India, there is a need for adoption of a more balanced approach in the Model Bilateral Investment Treaty 2016”. Discuss. |

This is based on “Death in custody” which was published on The Indian Express on June 30th, 2020. Now watch this on our Youtube channel.