India’s Semiconductor Ambitions | 18 Sep 2024

This editorial is based on “Securing India’s semiconductor future” which was published in The HinduBusiness Line on 18/09/2024. The article highlights India's strategic push to build a domestic semiconductor ecosystem to reduce reliance on imports and strengthen national security, driven by the Semiconductor Mission and PLI scheme. However, challenges like high investment costs and resource management issues persist, but the effort is crucial for securing a place in the global electronics value chain.

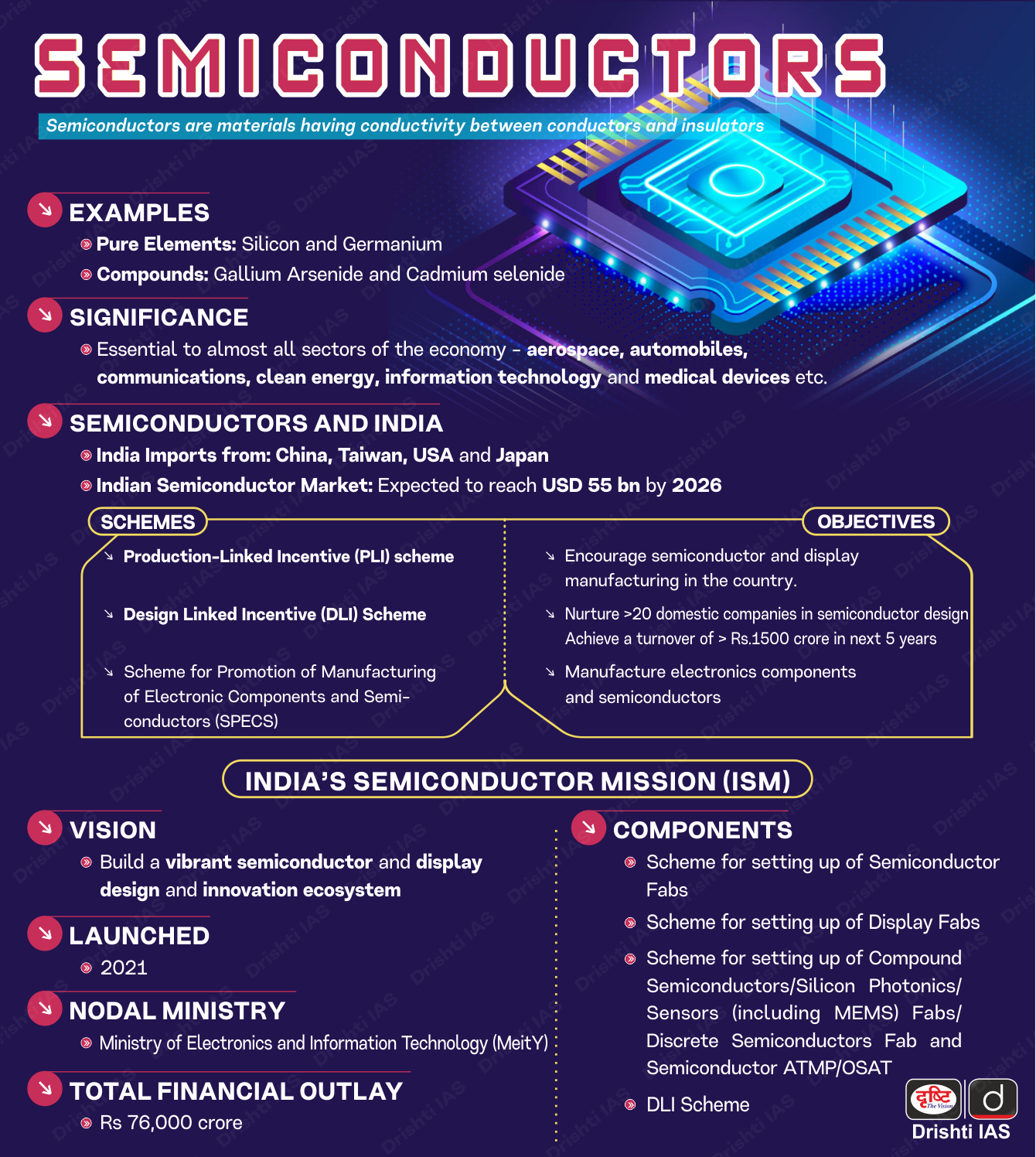

For Prelims: Semiconductor ecosystem, Semiconductor Mission, Production-Linked Incentive, Semicon India Programme, Design Linked Incentive (DLI) scheme, 5G, artificial intelligence, quantum computing, Special economic zones

For Mains: Current Status of the Semiconductor Industry in India, Key Roadblocks in India's Semiconductor Dream.

India is making a strategic push to establish a domestic semiconductor ecosystem, driven by the need to reduce reliance on imports and mitigate global supply chain vulnerabilities. The government launched the Semiconductor Mission in 2021 with a USD 10 billion investment. This move is crucial for national security, especially in sensitive sectors like defense and telecom. Recent geopolitical tensions and the Covid-19 pandemic have highlighted the risks of over-dependence on foreign semiconductor supplies, particularly from countries like Taiwan, Japan, and South Korea.

While India has made progress with initiatives like the Production-Linked Incentive (PLI) scheme, significant challenges remain. Establishing semiconductor fabs is capital-intensive, requiring billions of dollars in investment and presenting resource management challenges, particularly regarding water usage. Despite these hurdles, India's push into semiconductors is a long-term strategic effort aimed at securing a position in the global electronics value chain and enhancing technological self-reliance.

What is the Current Status of the Semiconductor Industry in India?

- Current Status of the Semiconductor Industry in India

- 2022 Market Size: USD 26.3 billion

- Projected Growth: Expected to reach USD 271.9 billion by 2032, with a CAGR of 26.3%.

- Import-Export Scenario

- Imports:

- 2021: USD 5.36 billion

- India remains a net importer, although efforts are underway to reduce dependence.

- Exports:

- 2022: USD 0.52 billion (highest to date).

- Imports:

- Government Initiatives

- India Semiconductor Mission (ISM): A dedicated division under Digital India Corporation to build a robust semiconductor and display ecosystem.

- Fiscal support of 50% of the project cost for semiconductor fabs and display fabs.

- Semicon India Programme: Launched in December 2021 with an allocation of ₹76,000 crore ($9.2 billion) to boost semiconductor and display manufacturing.

- Budget for FY24 increased to ₹6,903 crore ($833.7 million) to support further development.

- International Collaborations:

- MoU with the European Commission to strengthen semiconductor ecosystems as part of the EU-India Trade and Technology Council.

- MoC with Japan to bolster semiconductor supply chain resilience between the two nations.

- India Semiconductor Mission (ISM): A dedicated division under Digital India Corporation to build a robust semiconductor and display ecosystem.

What is the Significance of Semiconductors for India?

- Economic Growth and Industrial Development: Semiconductors are crucial for India's economic growth, particularly in the electronics manufacturing sector.

- The global semiconductor market is projected to reach USD 1 trillion by 2030, and India aims to capture a significant share.

- The government's USD 10 billion Semiconductor Mission launched in 2021 is expected to generate 35,000 high-quality jobs and indirect employment for 100,000 people.

- Successful implementation could boost India's electronics manufacturing to USD 300 billion by 2026.

- National Security and Strategic Autonomy: Semiconductors are vital for national security, especially in defense and telecommunications sectors.

- The role of semiconductors in national security and strategic autonomy is increasingly vital as these tiny electronic components power everything from smartphones and computers to advanced military systems and critical infrastructure.

- By developing domestic semiconductor capabilities, India can ensure a stable supply for critical defense systems and secure communication networks.

- Technological Self-Reliance and Innovation: Developing a robust semiconductor ecosystem can significantly enhance India's technological self-reliance.

- Currently, India imports about 65-70% of electronic components, mainly from China.

- The semiconductor push, including initiatives like the Design Linked Incentive (DLI) scheme, aims to foster domestic innovation and reduce import dependence.

- This is crucial for emerging technologies like 5G, artificial intelligence, and quantum computing.

- Global Supply Chain Integration: India's semiconductor initiatives aim to position the country as a key player in the global electronics supply chain.

- Currently, India contributes only about 3% to the global electronics manufacturing value chain.

- The government's policies, including Production-Linked Incentives (PLI), are designed to attract global players and integrate India into international supply networks.

- Job Creation and Skill Development: The semiconductor industry, while capital-intensive, has the potential to create high-quality jobs and drive skill development in India.

- More importantly, it can spur the development of a skilled workforce in cutting-edge technologies.

- The industry's requirements for specialized skills in areas like chip design, nanofabrication, and advanced packaging are likely to boost STEM education and research in Indian institutions.

What are the Key Roadblocks in India's Semiconductor Dream?

- Infrastructure Challenges: India's vast geographical area and uneven development have posed significant infrastructure challenges for the semiconductor industry.

- The lack of reliable power supply, water scarcity, and inadequate transportation facilities can hinder the establishment and operation of semiconductor manufacturing plants.

- For instance, during the recent 2024 heatwave in India, many regions experienced power shortages, affecting industrial activities, including semiconductor manufacturing.

- Talent Gap: The semiconductor industry requires highly skilled professionals with expertise in various domains, such as chip design, manufacturing, and testing.

- India, despite its large pool of engineering talent, faces a shortage of semiconductor experts.

- A recent study found that India will face a shortage of 250,000 to 300,000 semiconductor professionals by 2027.

- This gap can hinder the development of a robust semiconductor ecosystem and limit the country's ability to attract global semiconductor manufacturers.

- India, despite its large pool of engineering talent, faces a shortage of semiconductor experts.

- High Manufacturing Costs: Semiconductor manufacturing is a capital-intensive industry with high operational costs.

- The cost of setting up and running a semiconductor fabrication plant in India can be significantly higher than in established manufacturing hubs like Taiwan, South Korea, and the United States.

- The import semiconductor manufacturing price index rose 4.9% in 2021 and increased a further 2.4% in 2022.

- This cost differential can make India less attractive to global semiconductor companies, limiting their investments in the country.

- The cost of setting up and running a semiconductor fabrication plant in India can be significantly higher than in established manufacturing hubs like Taiwan, South Korea, and the United States.

- Global Supply Chain Dynamics: The semiconductor industry is highly interconnected and dependent on a global supply chain.

- Disruptions in this supply chain, such as those caused by geopolitical tensions or natural disasters, can have significant implications for India's semiconductor ambitions.

- The Russia-Ukraine conflict's impact on neon supply, essential for chip manufacturing, highlighted this vulnerability

- India's ability to secure a reliable supply of raw materials, components, and technology is crucial for its success in the semiconductor industry.

- Disruptions in this supply chain, such as those caused by geopolitical tensions or natural disasters, can have significant implications for India's semiconductor ambitions.

- Environmental Concerns: The semiconductor industry is energy-intensive and can have environmental impacts, such as water consumption and greenhouse gas emissions.

- Semiconductor manufacturing contributes to 31% of global greenhouse gas emissions, and the increasing usage of electronic chips drives this upward trend.

- The production of smart meters and other electronics requires a substantial amount of electricity and fossil fuels.

- India's efforts to promote sustainable development and address environmental concerns can create additional challenges for the semiconductor sector.

- Semiconductor manufacturing contributes to 31% of global greenhouse gas emissions, and the increasing usage of electronic chips drives this upward trend.

- Competition from Other Emerging Markets: India faces competition from other emerging markets, such as Vietnam, Malaysia, and Indonesia, which are also seeking to attract semiconductor investments.

- Malaysia has secured a crucial place in the first wave of semiconductor competition, successfully attracting companies like Infineon.

- These countries may offer more favorable incentives, infrastructure, and talent pools, making them more attractive to global semiconductor companies.

What Steps can India Undertake to turn its Semiconductor Vision into a Reality?

- Enhance Semiconductor Education and Training:India should significantly expand and upgrade semiconductor engineering programs at universities and technical institutes.

- This could involve partnerships with global semiconductor companies to develop industry-relevant curricula and provide hands-on training.

- For example, the Indian Institute of Science (IISc) in Bangalore could collaborate with Taiwan Semiconductor Manufacturing Company Limited to create a specialized semiconductor fabrication program, complete with a state-of-the-art clean room facility for practical learning.

- Develop Indigenous Chip Design Capabilities: India should invest heavily in chip design capabilities, leveraging its existing software expertise.

- The government could establish dedicated chip design centers in tech hubs like Bangalore, Hyderabad, and Pune, providing infrastructure and incentives for startups and established firms.

- For instance, the recent success of Shakti, an open-source RISC-V processor developed by IIT Madras, demonstrates India's potential in this area. Expanding such initiatives could lead to the development of India-specific chip designs for various applications.

- Create a Robust Semiconductor Supply Chain: India needs to build a comprehensive semiconductor supply chain within the country.

- This involves attracting investments in various segments, from raw material production to advanced packaging.

- India could establish Special economic zones (SEZs) dedicated to semiconductor ecosystem development, offering tax breaks and streamlined regulations to attract global players like Applied Materials or Lam Research.

- Establish a Sovereign Semiconductor Fund: India could create a dedicated sovereign fund specifically for semiconductor investments.

- This fund would provide long-term capital for semiconductor projects, reducing reliance on foreign investments.

- This approach has been successful in countries like South Korea, where the government's active financial support has been crucial in building a robust semiconductor industry.

- The fund could prioritize investments in cutting-edge technologies like 3nm and 2nm chip fabrication, positioning India at the forefront of semiconductor innovation.

- Implement a "Chip Diplomacy" Strategy: India should leverage its geopolitical position and large market to negotiate technology transfers and partnerships with leading semiconductor nations.

- This could involve offering preferential market access or strategic partnerships in exchange for semiconductor technology and expertise.

- For instance, India could work with Japan to establish a joint semiconductor research center, focusing on advanced packaging technologies.

- This approach aligns with India's recent efforts to strengthen ties with technologically advanced nations and could help bypass some of the challenges in acquiring semiconductor technology independently.

- Develop a "Green Semiconductor" Initiative: India could position itself as a leader in environmentally sustainable semiconductor manufacturing.

- This initiative would focus on developing and implementing technologies that reduce water usage, lower energy consumption, and minimize chemical waste in semiconductor production.

- For instance, India could partner with companies like Applied Materials to set up a pilot fab that uses recycled water and renewable energy sources.

- This approach not only addresses environmental concerns but also aligns with global trends towards sustainable manufacturing, potentially attracting environmentally conscious investors and partners.

- Establish a National Semiconductor Commons: India should create a shared infrastructure model for semiconductor research and prototyping.

- This "Semiconductor Commons" would provide access to expensive equipment and facilities that startup companies or institutions might not be able to afford.

- For example, a national network of nanofabrication facilities could be established, similar to theThe National Nanotechnology Infrastructure Network (NNIN) in the US.

- This would lower the barrier to entry for startups and researchers, fostering innovation in chip design and manufacturing processes.

- The commons could also serve as a platform for collaboration between academia, industry, and government, accelerating the pace of semiconductor innovation in India.

Conclusion

To realize its semiconductor ambitions, India must enhance its education and training in chip design, develop a robust domestic supply chain, and pursue strategic international collaborations. By addressing infrastructure and talent gaps, while also fostering sustainable practices, India can secure its place as a key player in the global semiconductor industry and achieve technological self-reliance.

|

Drishti Mains Question: Discuss the significance of developing a robust semiconductor manufacturing ecosystem in India, and analyze the key challenges and policy measures required to achieve self-reliance in this critical sector. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Which one of the following laser types is used in a laser printer? (2008)

(a) Dye laser

(b) Gas laser

(c) Semiconductor laser

(d) Excimer laser

Ans: (c)