India’s Critical Minerals Roadmap | 23 Jan 2025

This editorial is based on “China’s moves must recast India’s critical minerals push” which was published in The Hindu on 23/01/2025. The article brings into picture China's strategic control over critical minerals, India's limited progress despite policy reforms, and the need for aggressive fiscal incentives and capital support to unlock its mineral potential.

For Prelims: Critical mineral, Mines and Minerals Amendment Act, Lithium reserves in Jammu & Kashmir, Rare earth imports, Atmanirbhar Bharat, Chandrayaan-3 mission, Economic Survey 2023-24, India’s $10 billion semiconductor initiative, China’s Belt and Road Initiative, Mineral Security Partnership, National Solar Mission.

For Mains: Significance of Critical Minerals, Key Challenges India Faces Regarding Critical Minerals.

China's strategic control over critical minerals, essential for high-tech industries, is intensifying global economic and geopolitical tensions. India, despite policy reforms like the Mines and Minerals Amendment Act, has auctioned only 48% of available blocks, with limited foreign investment. Strategic minerals such as lithium and rare earth elements are increasingly tied to national security. However, systemic barriers in exploration and classification hinder progress. To unlock its mineral potential, India must consider aggressive fiscal incentives and upfront capital support, akin to semiconductor investment models.

What are Critical Minerals?

- About: Critical minerals are those minerals that are essential for a country’s economic development and national security.

- Their limited availability or concentrated extraction and processing in a few geographical locations can create supply chain vulnerabilities or disrupt critical industries.

- Global Significance: Critical minerals like lithium, graphite, cobalt, titanium, and rare earth elements underpin future global economies and are indispensable for sectors such as high-tech electronics, telecommunications, transport, and defense. They are also pivotal for the transition to a low-carbon economy to achieve global Net Zero commitments through renewable energy technologies.

- India’s Identification of Critical Minerals: Recognizing the importance of critical minerals, the Government of India has identified 30 critical minerals through a three-stage assessment process.

- This list includes lithium, cobalt, nickel, rare earth elements, titanium, molybdenum, and vanadium, among others.

- The parameters used for selection include resource availability, import dependency, and their significance for future technologies, clean energy, and agriculture.

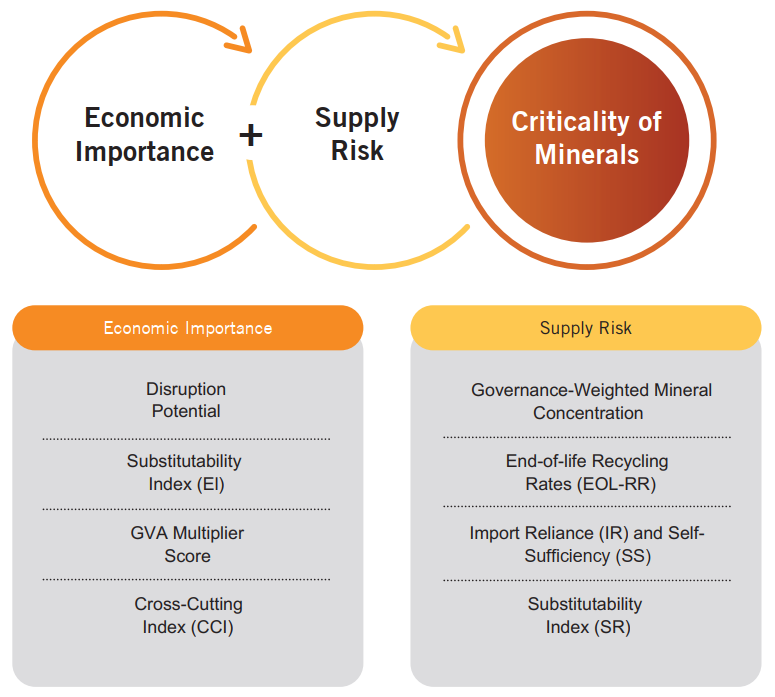

- Factors Affecting Criticality:

What Role does Critical Minerals Play in India's Economic Transformation?

- Catalyzing India’s Green Energy Transition: Critical minerals like lithium, cobalt, and nickel are indispensable for India’s shift towards renewable energy and EV adoption.

- They form the backbone of technologies such as lithium-ion batteries, solar panels, and wind turbines.

- The 2023 amendments to the Mines and Minerals Act and the discovery of 5.9 million tonnes of lithium reserves in Jammu & Kashmir underscore India's intent to develop domestic capacity.

- A World Bank report highlights that the production of minerals like graphite, lithium, and cobalt may surge by 500% by 2050 to support the rising demand for clean energy technologies, as India has set a target to become a net-zero emitter of greenhouse gases (GHG) by 2070.

- Enhancing Strategic Autonomy and Reducing Import Dependency: Critical minerals help reduce India’s over-reliance on imports, particularly from China, which dominates the global rare earth supply chain.

- However, currently, India sources 60% of its rare earth imports from China By expanding domestic mining, India can bolster its manufacturing capabilities in strategic sectors like semiconductors, aerospace, and defense.

- Accelerating India’s Electric Vehicle (EV) Ecosystem: India’s ambitious target of 30% EV penetration by 2030 hinges on access to critical minerals for battery manufacturing.

- Indigenous production can lower battery costs, making EVs more affordable and accessible.

- The Economic Survey 2023-24 predicts that India's electric vehicle market will see a 49% compound annual growth (CAGR) between 2022 and 2030.

- India’s collaboration with Australia under the Critical Minerals Investment Partnership (2022) and KABIL's recent efforts to secure lithium and cobalt abroad highlight the significance of global partnerships in securing supply chains.

- Supporting Semiconductor and High-Tech Manufacturing: Semiconductors, which are crucial for India’s digital and industrial revolution, rely on rare minerals like gallium and germanium.

- Developing a domestic critical mineral base would strengthen India’s $10 billion semiconductor initiative and position it as a global electronics hub.

- Driving Economic Growth and Employment: Domestic exploration and mining of critical minerals have the potential to create a new industrial ecosystem, generating jobs and boosting GDP.

- The government’s identification of 30 critical minerals and reforms like exploration licenses for private players are expected to de-risk investments and attract foreign players.

- Strengthening India’s Global Trade Position: Critical minerals can enhance India’s export basket, reducing trade deficits and creating new economic opportunities.

- For instance, the export of processed rare earth elements could mirror India’s success in pharmaceuticals and IT services.

- With China accounting for 90% of global rare earth processing, India can leverage its own reserves and KABIL partnerships to diversify supply chains and capture global markets.

- Fostering Technological Innovation: Critical minerals underpin advancements in cutting-edge sectors like AI, robotics, and space technology, directly supporting India’s vision for technological self-reliance under “Atmanirbhar Bharat.”

- India’s Chandrayaan-3 mission (2023) and the Gaganyaan mission (upcoming) highlight the strategic importance of beryllium, tungsten, and rare earths in aerospace and defense.

- Currently, India is import-dependent for beryllium, but domestic production can help reduce costs and ensure supply security.

- Securing India’s Energy Storage Needs: Energy storage solutions are critical for grid stability, especially as India scales up renewable energy installations to meet its target of 500 GW by 2030.

- Minerals like vanadium and graphite are integral to energy storage technologies like flow batteries and supercapacitors.

What are the Key Challenges India Faces Regarding Critical Minerals?

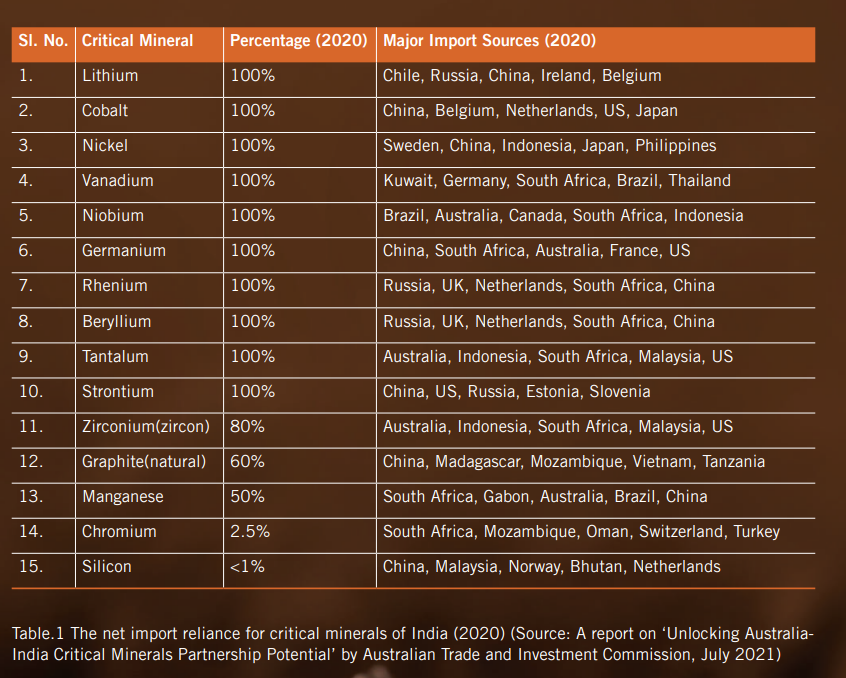

- Overdependence on Imports: India relies heavily on imports for critical minerals, making its strategic industries vulnerable to global supply chain disruptions and geopolitical tensions.

- Minerals like lithium, cobalt, gallium, and rare earth elements are crucial for green energy, semiconductors, and defense sectors, yet China dominates 80-90% of their global supply and processing.

- For instance, India imports 100% of its germanium needs, leaving it exposed to China’s 2023 tightened export policies on these minerals (though primarily aimed at the United States, it has global implications).

- Limited Domestic Exploration and Mining: India’s domestic exploration of critical minerals remains inadequate, hampering its ability to reduce dependency and capitalize on indigenous reserves.

- The absence of detailed geological surveys and outdated exploration techniques discourages private investment.

- For example, only 48% of mineral blocks auctioned between 2020 and 2023 were sold, and many auctioned blocks lack G1 or G2-level exploration data, making them commercially unattractive.

- Underdeveloped Processing and Refining Capacity: While India has reserves of some critical minerals, it lacks the infrastructure for value-added processing, forcing it to rely on external players for downstream industries.

- For instance, India has discovered lithium in Jammu & Kashmir but lacks the refining capacity to process it domestically.

- China, by contrast, processes over 90% of global rare earths, enabling it to dominate the global supply chain of advanced technologies

- Also, India lacks a skilled workforce and advanced technology for mining and processing critical minerals, reducing the efficiency and competitiveness of its industry.

- Policy and Regulatory Gaps: India’s policy framework for critical minerals, though improving, suffers from inconsistencies and a lack of investor confidence.

- While the 2023 Mines and Minerals Act introduced exploration licenses, its execution has been slow, with only a few licenses cleared and most going to public sector firms.

- Moreover, the absence of fiscal incentives for private players has resulted in tepid interest, with India attracting limited foreign participation in exploration and mining activities.

- Geopolitical Risks and Global Competition: Global competition for critical minerals has intensified due to the green energy transition, limiting India’s access to overseas mineral reserves.

- Countries like the U.S., China, and Australia are entering into exclusive agreements with other countries for mineral supplies, leaving India lagging behind.

- For instance, China’s Belt and Road Initiative secures mineral resources from Africa and Latin America, while India’s Khanij Bidesh India Ltd. (KABIL) has only made modest progress in securing lithium and cobalt from Argentina and Australia.

- Environmental and Social Concerns: Critical mineral mining is often associated with environmental degradation and social displacement, leading to opposition from local communities.

- India’s lithium reserves in Jammu & Kashmir, for instance, are located in ecologically sensitive areas, raising concerns about water contamination and biodiversity loss.

- Additionally, India’s poorly managed mining sector has caused significant damage, as seen in the Bellary mining scam which reflects broader governance challenges in mineral extraction.

- High Upfront Costs and Delayed Returns: The mining of critical minerals requires substantial upfront investments, often with a long gestation period before realizing returns.

- For instance, it can take 10-15 years to transition from exploration to production, making it financially risky for private players.

- India’s decision to reimburse exploration costs only after production begins, rather than upfront, has deterred investors, as seen in the limited success of the exploration license introduced under the 2023 reforms.

- Weak Recycling and Circular Economy Framework: India’s recycling industry for critical minerals is underdeveloped, resulting in lost opportunities for extracting resources from e-waste and industrial scrap.

- India's electronic waste (e-waste) generation has significantly increased over the last five years, growing from 1.01 million metric tonnes (MT) in 2019-20 to 1.751 million MT in 2023-24.

- This e-waste contains valuable critical minerals like cobalt and rare earth elements, but recycling capacity remains limited to informal sectors.

- In contrast, countries like Japan solved its rare earth minerals dependency issue through enhanced recycling, significantly reducing their reliance on imports.

- India's electronic waste (e-waste) generation has significantly increased over the last five years, growing from 1.01 million metric tonnes (MT) in 2019-20 to 1.751 million MT in 2023-24.

- Export Restrictions and Trade Barriers: India faces challenges in accessing critical minerals due to protectionist policies of resource-rich nations, which prioritize their domestic needs.

- For instance, Indonesia’s export ban on nickel, a key material for EV batteries, has disrupted global supply chains, affecting India’s EV and battery production ambitions.

- Similarly, the growing trend of "resource nationalism" in countries like Argentina and Chile is complicating India’s efforts to secure stable mineral supplies through overseas partnerships.

What Measures can India Adopt to Secure its Critical Mineral Supply Chain and Boost Processing Capabilities?

- Centralized National Authority for Critical Minerals: India needs a unified body to oversee exploration, acquisition, processing, and recycling of critical minerals.

- This body should coordinate efforts across ministries, streamline decision-making, and align domestic and international policies to avoid duplication of efforts.

- Recommendations to establish the Center of Excellence for Critical Minerals (CECM) as recommended by a seven-member Committee established by the Ministry of Mines, is a step in the right direction.

- Develop Strategic Stockpiles of Critical Minerals: India should establish a strategic reserve of critical minerals to safeguard against supply shocks, price volatility, and geopolitical disruptions.

- This can be modeled on China’s stockpiling strategy for rare earths, with a focus on high-priority minerals like lithium, cobalt, and gallium.

- For example, India could prioritize minerals with the highest import dependence (e.g., 100% imports of germanium and gallium) and allocate budgetary support to maintain reserves for industries like EV manufacturing and semiconductors.

- Provide Upfront Fiscal Incentives for Exploration and Processing: To address the lack of private investment in exploration, the government should provide upfront fiscal incentives such as subsidies, tax rebates, or soft loans to de-risk early-stage exploration and processing ventures.

- For instance, instead of reimbursing exploration costs only after production (as per the 2023 Mines and Minerals Act), the government can provide direct capital support during the exploration phase.

- This approach has been successful in India’s semiconductor PLI scheme, where upfront incentives attracted major players like Micron Technology.

- Foster Public-Private Partnerships (PPPs) in Exploration and Refining: Collaborating with private players can bring advanced technologies, investments, and expertise into the mining and processing sectors.

- The government could develop a PPP framework for exploration licenses, offering equity participation and risk-sharing models to attract both Indian and foreign firms.

- For example, partnerships with global leaders like Australia’s Lynas Rare Earths or Tesla (battery materials) could help India boost its domestic refining capabilities and reduce import dependency.

- Leveraging Mineral Diplomacy: India should expand its participation in global alliances such as the Mineral Security Partnership (MSP) and the Quad’s Critical and Emerging Technology Forum.

- Bilateral agreements with resource-rich nations like Australia, Canada, and Chile can secure diversified and stable supplies of minerals like lithium, cobalt, and rare earths.

- For instance, India’s 2022 Critical Minerals Investment Partnership with Australia should be expanded to include joint ventures in refining and processing, ensuring value addition within India.

- Incentivize Domestic Manufacturing of Downstream Industries: India must promote domestic manufacturing of critical mineral-based products, such as lithium-ion batteries, solar panels, and EV components, to reduce reliance on imports.

- The government could extend PLI schemes to incentivize industries that create end-use products from critical minerals.

- For example, a dedicated PLI scheme for this, similar to the one for Advanced Chemistry Cell, could attract global companies like Panasonic or CATL to set up production units in India, supported by domestic mineral supplies.

- Accelerate Recycling and Circular Economy Initiatives: To reduce the demand for virgin critical minerals, India should invest in advanced recycling technologies and establish formal recycling ecosystems for e-waste and industrial scrap.

- Policies like mandatory take-back schemes for used electronics and batteries can boost the recovery of minerals like cobalt, nickel, and rare earths.

- For example, setting up formal recycling hubs in cities like Bengaluru and Hyderabad (major e-waste generators) could reduce import dependency while fostering sustainability.

- Invest in R&D for Advanced Mining and Processing Technologies: India needs to focus on R&D for innovative technologies such as AI-based exploration, in-situ leaching, and solvent extraction to improve the efficiency of mining and processing operations.

- Establishing dedicated R&D centers for critical minerals under institutions like CSIR and IITs can fast-track technology adoption.

- For instance, advanced processing techniques could help India utilize low-grade ores in states like Odisha and Jharkhand, which remain underexploited due to inefficient recovery methods.

- Build Infrastructure in Resource-Rich Regions: To unlock the potential of critical mineral reserves in remote regions, India must prioritize investments in infrastructure, including roads, railways, power supply, and processing facilities.

- For instance, Arunachal Pradesh’s rich mineral reserves remain untapped due to poor connectivity; integrating these areas with the Bharatmala and Sagarmala projects could enable cost-effective transportation.

- Furthermore, setting up integrated mining and processing clusters in mineral-rich regions like Chhattisgarh and Karnataka could reduce logistical inefficiencies.

- Integrate Critical Minerals into India’s Energy Security Policy: India’s energy security goals (500 GW renewable energy capacity by 2030) must be aligned with its critical minerals strategy to ensure consistent supply for solar panels, wind turbines, and battery storage.

- For example, the National Solar Mission and the National Electric Mobility Mission Plan should have dedicated budgets for securing minerals like silicon, vanadium, and lithium.

- Creating a National Energy and Mineral Security Plan could holistically address the supply chain needs of India’s energy transition.

- Establish a Green Mining Policy: To address environmental and social concerns, India should implement a green mining policy with guidelines for sustainable practices, including water management, biodiversity conservation, and rehabilitation of displaced communities.

- Using renewable energy in mining operations and adopting clean technologies like carbon capture could minimize the environmental footprint.

- For example, India could mandate green certifications for projects in sensitive regions like Jammu & Kashmir’s lithium reserves to balance development with sustainability.

- Promote Skill Development in Critical Mineral Sectors: India must create a pipeline of skilled professionals for exploration, mining, and processing by integrating critical minerals into technical education and vocational training programs.

- Setting up centers of excellence in collaboration with global universities specializing in mining technologies (e.g., University of Western Australia) can provide India’s workforce with the expertise needed to operate cutting-edge equipment.

- For instance, training programs focused on rare earth processing could reduce India’s dependence on foreign experts.

Conclusion:

Critical minerals are vital for India's energy transition, economic growth, and strategic autonomy. Addressing gaps in exploration, processing, and recycling while leveraging global partnerships can reduce import dependency. Sustainable practices, infrastructure development, and R&D investments will strengthen supply chains. An integrated approach is key to securing India's future in high-tech and green industries.

|

Drishti Mains Question: “Critical minerals are essential for India's transition to a green economy and technological advancement”.Discuss the challenges associated with securing critical mineral supply chains and suggest measures to ensure their sustainable and strategic availability. (250 words) |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q. With reference to the management of minor minerals in India, consider the following statements: (2019)

- Sand is a ‘minor mineral’ according to the prevailing law in the country

- State Governments have the power to grant mining leases of minor minerals, but the pwers regarding the formation of rules related to the grant of minor minerals lie with the Coentral Government.

- State Governments have the power to frame rules to prevent illegal mining of minor minerals.

Which of the statements given above is/are correct?

(a) 1 and 3 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)

Q. What is/are the purpose/purposes of ‘District Mineral Foundations’ in India? (2016)

- Promoting mineral exploration activities in mineral-rich districts

- Protecting the interests of the persons affected by mining operations

- Authorizing State Governments to issue licenses for mineral exploration

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains

Q. Despite India being one of the countries of Gondwanaland, its mining industry contributes much less to its Gross Domestic Product (GDP) in percentage. Discuss. (2021)

Q. “In spite of adverse environmental impact, coal mining is still inevitable for development”. Discuss. (2017)