Indian Polity

Fiscal Devolution in Panchayati Raj

- 21 Feb 2024

- 20 min read

This editorial is based on “Having panchayats as self-governing institutions” which was published in The Hindu on 21/02/2024. The article emphasises the need to educate elected representatives and the public on the importance of panchayats achieving self-sufficiency and relying on their own financial resources.

For Prelims: Local Governments, 73rd Constitutional Amendment, 74th Amendment Act (1992), Panchayati Raj Institutions, Local Self Governance, Reserve Bank of India, Rashtriya Gram Swaraj Abhiyan Scheme.

For Mains: Functioning of Panchayats in India, Government Policies & Interventions

Three decades have passed since the 73rd and 74th Constitutional Amendment Acts came into effect, which envisaged that local bodies in India would function as institutions of local self government. As a follow up, the Ministry of Panchayati Raj was constituted in 2004 to strengthen rural local governments.

The constitutional amendment has set forth specific details on fiscal devolution which includes the generation of own revenues. Emanating from the Central Act, various States Panchayati Raj Acts have made provisions for taxation and collection. Based on the provisions of these Acts, panchayats have made efforts to generate their own resources to the maximum extent.

What are the Salient Features of the 73rd and 74th Amendments?

- About:

- These amendments added two new parts to the Constitution, namely, Part IX titled “The Panchayats” (73rd Amendment) and Part IXA titled “The Municipalities” (74th Amendment).

- Basic units of democratic system-Gram Sabhas (villages) and Ward Committees (Municipalities) comprising all the adult members registered as voters.

- Three-tier system of panchayats at village, intermediate block/taluk/mandal and district levels except in States with population is below 20 lakhs (Article 243B).

- Seats at all levels to be filled by direct elections Article 243C (2).

- Reservation Provisions:

- Seats reserved for Scheduled Castes (SCs) and Scheduled Tribes (STs) and the chairpersons of the Panchayats at all levels also shall be reserved for SCs and STs in proportion to their population.

- 1/3rd of the total number of seats to be reserved for women.

- 1/3rd of the seats reserved for SCs and STs are also reserved for women.

- 1/3rd offices of chairpersons at all levels reserved for women (Article 243D).

- Tenure:

- Uniform five year term and elections to constitute new bodies to be completed before the expiry of the term.

- In the event of dissolution, elections compulsorily within six months (Article 243E).

- Independent Election Commission in each State for superintendence, direction and control of the electoral rolls (Article 243K).

- Developmental Planning:

- Panchayats to prepare plans for economic development and social justice in respect of subjects as devolved by law to the various levels of Panchayats including the subjects as illustrated in Eleventh Schedule (Article 243G).

- The 74th Amendment provides for a District Planning Committee to consolidate the plans prepared by Panchayats and Municipalities (Article 243ZD).

- The Eleventh Schedule of the Constitution places as many as 29 functions within the purview of the Panchayati Raj bodies.

- Revenue and Finances:

- Budgetary allocation from State Governments, share of revenue of certain taxes, collection and retention of the revenue it raises, Central Government programmes and grants, Union Finance Commission grants (Article 243H).

- Establish a Finance Commission in each State to determine the principles on the basis of which adequate financial resources would be ensured for panchayats and municipalities (Article 243I).

What is the Current Status of Finances of PRIs?

- Revenue Statistics:

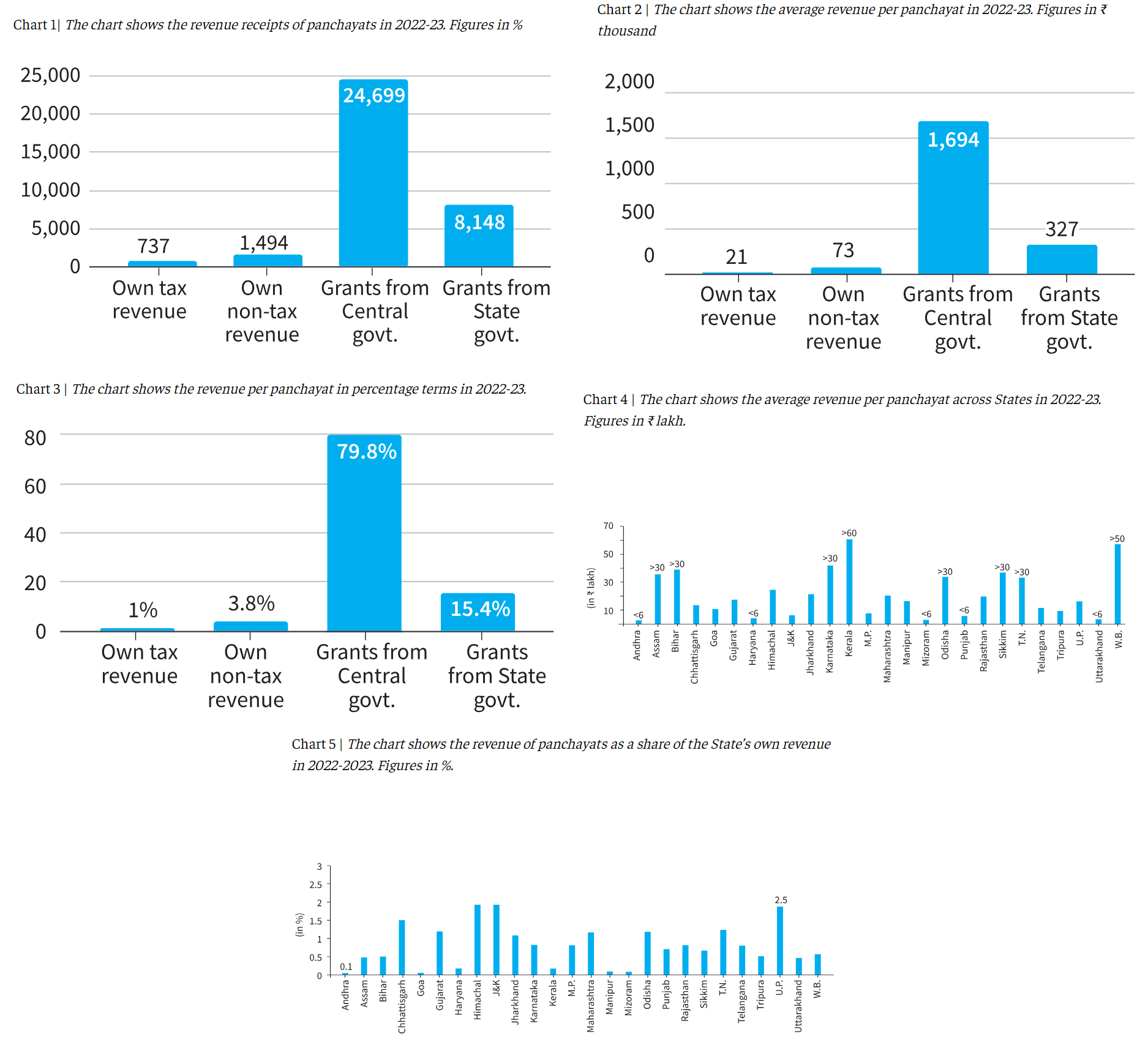

- As per RBI, in FY 2022-23, panchayats recorded a total revenue of Rs 35,354 crore.

- However only Rs 737 crore was generated through their own tax revenue which can be earned through taxes on profession and trades, land revenue, stamps and registration fees, taxes on property, and service tax.

- Non-tax revenue amounted to Rs 1,494 crore, primarily from interest payments and Panchayati Raj programs.

- Significantly, panchayats received Rs 24,699 crore in grants from the Central government and Rs 8,148 crore from State governments.

- As per RBI, in FY 2022-23, panchayats recorded a total revenue of Rs 35,354 crore.

- Revenue Per Panchayat:

- On an average each panchayat earned just Rs 21,000 from its own tax revenue and Rs 73,000 from non-tax revenue.

- Conversely, grants from the Central government amounted to approximately Rs 17 lakh per panchayat, with State government grants totaling over Rs 3.25 lakh per panchayat.

- State Revenue Share and Inter-State Disparities:

- Panchayats' share in their respective State's own revenue remains minimal.

- For example, in Andhra Pradesh, revenue receipts of panchayats form just 0.1% of the State’s own revenue, while in Uttar Pradesh, it forms 2.5%, the highest among states.

- There are wide variations among states regarding average revenue earned per panchayat.

- Kerala and West Bengal lead with average revenues of over Rs 60 lakh and Rs 57 lakh per panchayat, respectively.

- The revenue was over Rs 30 lakh per panchayat in Assam, Bihar, Karnataka, Odisha, Sikkim, and Tamil Nadu.

- States like Andhra Pradesh, Haryana, Mizoram, Punjab, and Uttarakhand have significantly lower average revenues, less than Rs 6 lakh per panchayat.

- Panchayats' share in their respective State's own revenue remains minimal.

Why is There a Need for Panchayats to Achieve Self Sufficiency?

The recently released report titled 'Finances of Panchayati Raj Institutions' by the RBI for the FY 22-23 sheds light on the financial dynamics of Panchayati Raj Institutions (PRIs) in India.

- Excessive Reliance on Grants:

- That “Panchayats earn only 1% of the revenue through taxes”, with the rest being raised as grants from the State and Centre. It specifically points out that 80% of the revenue is from the Centre and 15% from the States.

- This is an eye-opener for the proponents of decentralisation as the net result is that the revenue raised by panchayats is meagre even after 30 years of devolution initiatives.

- Disparities Across States:

- When it comes to analysing the status of devolution, it is evident that some States have forged ahead while many lag behind. The commitment of State governments towards decentralisation has been vital in making PRIs an effective local governance mechanism at the grass-roots level.

- In several States, gram panchayats lack the authority to collect taxes, while in numerous others, intermediate and district panchayats are not delegated the responsibility of tax collection.

- When gram panchayats collect 89% of their own taxes, the intermediate panchayats collect 7% and the district panchayats a nominal 5%. There is a need to demarcate Own Source of Revenue (OSR) for the entire three-tier panchayats to ensure equitable sharing.

- When it comes to analysing the status of devolution, it is evident that some States have forged ahead while many lag behind. The commitment of State governments towards decentralisation has been vital in making PRIs an effective local governance mechanism at the grass-roots level.

- General Aversion Towards Generating Own Income:

- With the increase in the allocation of Central Finance Commission (CFC) grants, panchayats are evincing less interest in the collection of OSR. The allocation for rural local bodies from the 10th and 11th CFC was Rs 4,380 crore and Rs 8,000 crore, respectively.

- But in the 14th and 15th CFCs there was a huge increase by way of allocating Rs 2,00,202 and Rs 2,80,733 crore, respectively.

- The tax collected in 2018-19 was Rs 3,12,075 lakh which diminished in 2021-2022 to Rs 2,71,386 lakh. The non-tax revenue collected for the same period was Rs 2,33,863 lakh and Rs 2,09,864 lakh.

- With the increase in the allocation of Central Finance Commission (CFC) grants, panchayats are evincing less interest in the collection of OSR. The allocation for rural local bodies from the 10th and 11th CFC was Rs 4,380 crore and Rs 8,000 crore, respectively.

- Incentivisation by State Governments:

- At one time, panchayats were in competition to raise OSR for their commitment to fulfil basic needs. This has now given place to dependency on allocations and reimbursements through different finance commissions.

- Some States have the policy of incentivisation by providing matching grants but which were sparingly implemented. Panchayats also have no need of penalising defaulters as they believe that OSR has not been regarded as an income that is linked with panchayat finance.

- Impediments Due to Freebie Culture:

- Despite every enabling factor to raise revenue, panchayats confront several impediments in resource mobilisation: the ‘freebie culture’ rampant in society is the cause for the antipathy in paying taxes. Elected representatives feel that imposing taxes would alter their popularity adversely.

What are the Suggestions Required for Boosting Financial Resources of PRIs?

- Expert Committee Report:

- The report of the expert committee constituted by the Ministry of Panchayati Raj on OSR of rural local bodies elaborates on the details of State Acts that have incorporated tax and non-tax revenue that can be collected and utilised by panchayats.

- Property tax, cess on land revenue, surcharge on additional stamp duty, tolls, tax on profession, advertisement, user charges for water and sanitation and lighting are the major OSRs where panchayats can earn maximum income.

- The report of the expert committee constituted by the Ministry of Panchayati Raj on OSR of rural local bodies elaborates on the details of State Acts that have incorporated tax and non-tax revenue that can be collected and utilised by panchayats.

- Establishing Conducive Environment:

- Panchayats are expected to establish a conducive environment for taxation by implementing appropriate financial regulations. This includes making decisions regarding the tax and non-tax bases, determining their rates, establishing provisions for periodic revisions, defining exemption areas, and enacting effective tax management and enforcement laws for collection.

- Diversifying Sources for Non-Tax Revenues:

- The huge potential for non-tax revenue includes fees, rent, and income from investment sales and hires charges and receipts. There are also innovative projects that can generate OSR. This covers income from rural business hubs, innovative commercial ventures, renewable energy projects, carbon credits. Corporate Social Responsibility (CSR) funds and donations.

- Leveraging Local Resources:

- Gram sabhas have a significant role in fostering self-sufficiency and sustainable development at the grass-roots level by leveraging local resources for revenue generation.

- They can be engaged in planning, decision-making, and implementation of revenue-generating initiatives that range from agriculture and tourism to small-scale industries.

- They have the authority to impose taxes, fees, and levies, directing the funds towards local development projects, public services, and social welfare programmes.

- Gram sabhas have a significant role in fostering self-sufficiency and sustainable development at the grass-roots level by leveraging local resources for revenue generation.

- Fostering Partnerships:

- Through transparent financial management and inclusive participation, gram sabhas ensure accountability and foster community trust, ultimately empowering villages to become economically independent and resilient.

- Thus, gram sabhas need to promote entrepreneurship, and foster partnerships with external stakeholders to enhance the effectiveness of revenue generation efforts.

- Recommendations of RBI:

- The RBI suggests promoting greater decentralisation and empowering local leaders and officials. It advocates for measures to enhance financial autonomy and sustainability of Panchayati Raj.

- The report emphasised that PRIs can enhance resource utilisation by adopting transparent budgeting, fiscal discipline, community involvement in development prioritisation, staff training, and rigorous monitoring and evaluation.

- Additionally, it highlighted the necessity of raising public awareness about PRI functions and encouraging citizen participation for effective local governance.

- Educating Elected Representatives and Public:

- There is a need to educate elected representatives and the public on the significance of raising revenue to develop panchayats as self-governing institutions.

- Ultimately, the dependency syndrome for grants has to be minimised and in due course, panchayats will be able to survive on their own resources. Panchayats can only achieve such a state of affairs when there are dedicated efforts at all tiers of governance, which includes even the State and central level.

- There is a need to educate elected representatives and the public on the significance of raising revenue to develop panchayats as self-governing institutions.

What are the Related Initiatives?

- SVAMITVA Scheme:

- Survey of Villages and Mapping with Improvised Technology in Village Areas (SVAMITVA) scheme was launched on National Panchayati Raj Day 2020 to enable economic progress of Rural India by providing “Record of Rights” to every rural household owner.

- e-Gram Swaraj e-Financial Management System:

- e-Gram Swaraj is a Simplified Work Based Accounting Application for Panchayati Raj.

- Geo-Tagging of Assets:

- The Ministry of Panchayati Raj (MoPR) has developed “mActionSoft”, a mobile based solution to help in capturing photos with Geo-Tags (i.e., GPS Coordinates) for the works which have assets as an output.

- Citizen Charter:

- In order to focus on the commitment of the PRIs towards its Citizens in respect of Standard of Services, the MoPR has provided a platform to upload Citizen Charter documents with the slogan “Meri Panchayat Mera Adhikaar – Jan Sevaayein Hamaare Dwaar”.

- Revamped Rashtriya Gram Swaraj Abhiyan (2022-23 to 2025-26):

- The focus of the scheme of Revamped RGSA is on re-imagining PRIs as vibrant centres of local self-governance with special focus on Localisation of Sustainable Development Goals (LSDGs) at grassroot level adopting thematic approach through concerted and collaborative efforts of Central Ministries and State Line departments and other Stakeholders with ‘Whole of Government and Whole of Society’ approach.

Conclusion

Fiscal devolution, as outlined in the constitutional amendments, includes generating own revenues, with panchayats making efforts to maximise their resources. However, the recent data suggests that panchayats only earn 1% of revenue through taxes, highlighting a continued dependency on grants from the State and Centre. The report on OSR emphasizes the potential for panchayats to earn income through various avenues like property tax, user charges, and innovative projects. Despite challenges like the 'freebie culture' and reluctance to impose taxes, educating elected representatives and the public on the importance of revenue generation can help panchayats become financially independent and self-sustaining.

|

Drishti Mains Question: Discuss the challenges faced by Panchayati Raj Institutions in generating their own revenue and suggest measures to enhance their financial autonomy. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q1. Local self-government can be best explained as an exercise in (2017)

(a) Federalism

(b) Democratic decentralisation

(c) Administrative delegation

(d) Direct democracy

Ans: (b)

Q. The fundamental object of Panchayati Raj system is to ensure which among the following? (2015)

- People’s participation in development

- Political accountability

- Democratic decentralisation

- Financial mobilisation

Select the correct answer using the code given below

(a) 1, 2 and 3 only

(b) 2 and 4 only

(c) 1 and 3 only

(d) 1, 2, 3 and 4

Ans: (c)

Mains

Q1. Assess the importance of the Panchayat system in India as a part of local government. Apart from government grants, what sources can the Panchayats look out for financing developmental projects? (2018)

Q2. To what extent, in your opinion, has the decentralisation of power in India changed the governance landscape at the grassroots? (2022)

Q3. In absence of a well-educated and organised local level government system,`Panchayats’ and ‘Samitis’ have remained mainly political institutions and not effective instruments of governance. Critically discuss. (2015)