Indian Economy

Ensuring Mineral Availability for EVs

- 18 May 2022

- 10 min read

This editorial is based on “EV Plan Hinges on Securing Rare Resources” which was published in The Hindu BusinessLine on 17/05/2022. It talks about the measures that India can take to ensure mineral availability for giving impetus to India’s EV industry.

For Prelims: Electric vehicles, Net-zero emissions, IEA, Lithium-ion battery cells, Quad, Rare Earth Elements, Lithium

For Mains: Challenges to boosting India’s EV industry, Leveraging Quad and other multilateral institutions and bilateral relations for ensuring mineral availability

The Indian automotive industry is experiencing a paradigm shift as it tries to switch to alternative and less energy demanding options like electric vehicles (EV). The transition from petrol to EV is a significant step in the move to a net-zero future.

However, at the same time it also impacts India’s import dependency for the minerals used for EV manufacturing. EVs, like various low carbon technologies, use several exotic metals in their design, many of which are considered critical for effective functioning of the EVs.

While the government has set a high target for EV sales, India is not endowed with many of the rare minerals such as lithium, cobalt, and nickel, which are used to make lithium-ion (Li-ion) battery cells, which then is utilised to generate electric car batteries.

What is the Scenario of Production of these Elements?

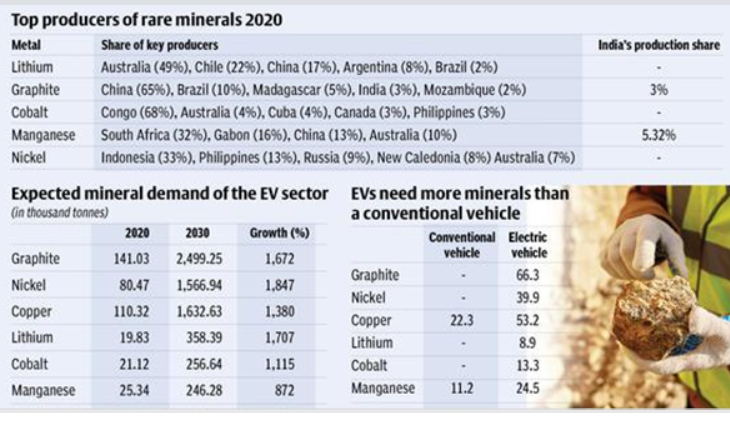

- In 2020, Australia was responsible for 49% of global lithium production, while 65% of graphite was produced in China, 68% of cobalt in Congo, and 33% of Nickel in Indonesia.

- Apart from graphite and nickel where India has 3% and 5.32% share globally (respectively) and is amongst the top five, in rest there is a huge deficiency.

What is their Significance in EV Manufacturing?

- According to the International Energy Agency (IEA)’s Sustainable Development Scenario, the demand for graphite, nickel, copper, cobalt and manganese is expected to see phenomenal growth in the EV industry, with lithium being the most sought after.

- A typical Lithium-ion battery used in an electric passenger vehicle contains 8 kg of Lithium, 35 kg of nickel, 20 kg of manganese and 14 kg of cobalt.

- The anode in Li-ion batteries requires graphite and, apparently, there are no substitutes for it.

- The cathodes, which also require Li-on, contain nickel and deliver high energy density, allowing the vehicle to travel further.

- Cobalt is important for EV as it prevents the cathode from overheating while extending the life of batteries.

- Manganese, on the other hand, contributes 61% of the cathode needs of the batteries.

- As per IEA, the amount of minerals required by an electric car would be at least six times more than a conventional petrol and diesel vehicle.

- This in essence would increase the demand for specific commodities required for electric vehicles.

What are the Underlying Issues?

- This rising demand could also become a cause of concern given the dependency on select rare minerals for inputs towards manufacturing of EV, which in the process may lead to economic-cost escalation.

- Also, as India does not have much reserves of lithium, nickel or cobalt, it has to obtain them from somewhere else where they are mined. It comes at a high social and environmental cost.

- For instance, it is estimated that two million litres of water are needed to produce a tonne of Lithium. This deprives indigenous farmers of badly needed water.

- The semiconductor shortage which began at the end of 2021 has still not been resolved completely and has hindered multiple industries. A similar challenge can adversely impact India’s upcoming EV industry in terms of high price volatility and supply disruptions of these elements

What Possible Measures can be Taken?

- Collaboration for Securing Minerals: Some of the state-run companies can form a joint venture to secure mineral assets which would be of demand for mass adoption of EVs by 2030.

- Multiple Japanese companies are engaging with firms in Australia and Kazakhstan to develop mining projects, in order to reduce dependence on China.

- Indian exploring companies may look for similar international collaborations in this space and also in areas of joint exploration, and refining, and trading of critical minerals.

- Mechanism for Regular Monitoring: A dedicated cell could be created by the government of India towards regular monitoring of availability of rare earths and other critical minerals under the Ministry of Mines.

- In this context, it is observed that countries like Japan have earmarked a $1.5-billion fund for developing alternative sources of rare earths, notching up the push for joint venture partnerships.

- Similarly, USA too in 2019 developed ‘A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals’ given the trade tensions between US and China.

- Leveraging Quad: A few years ago, the Australian and the US mineral agencies signed a deal to jointly develop a better understanding of their critical minerals’ reserves and in the process explore their existence in other parts.

- India may like to have bilateral engagements under the Quad platform to secure its needs in the years to come.

- Cooperation with Japan, Australia and the US can also help India to bridge the technology and financial viability gap to boost its Rare Earth Elements (REE) industry.

- South-South Cooperation: India could explore the possibility of formation of an intergovernmental body amongst the Developing South, something akin to OPEC of 1960, to ensure cooperation for the development of its EV industry.

- This could include Chile, Argentina, Brazil, Cuba in Latin America; Congo, Gabon, Madagascar, Mozambique, and South Africa in Africa; Indonesia, the Philippines, and Russia, apart from India.

- Need for Efficient Batteries: Work is also needed to ensure that Lithium-ion batteries work efficiently and last longer in India’s hot/humid conditions. The government should also mandate recycling 100% of the batteries; battery designs should be re-cycle friendly.

- This measure is critical because by not extending the life of a battery and not recycling it aggressively, India’s energy dependence will shift from West Asia to China (which controls much of the rare earth metals that a battery needs).

- Also, a bigger step will be to encourage research in India for developing batteries that replace cobalt and nickel with other metals.

|

Drishti Mains Question “In the process of reducing its import reliance on crude, India may find itself dependent on other minerals jeopardising its EV ambition. If India wants to shift to EV, it is imperative to secure its mineral resources which would be quintessential for its growth”. Discuss. |

UPSC Civil Services Examination, Previous Year Questions (PYQs):

Q. Which one of the following pairs of metals constitutes the lightest metal and the heaviest metal, respectively? (2008)

(a) Lithium and mercury

(b) Lithium and osmium

(c) Aluminium and osmium

(d) Aluminium and mercury

Ans: (b)

Q. With reference to the mineral resources of India, consider the following pairs: (2010)

| Mineral | 90% Natural sources in |

| Copper | Jharkhand |

| Nickel | Orissa |

| Tungsten | Kerala |

Which of the pairs given above is/are correctly matched?

(1) 1 and 2 only

(2) 2 only

(3) 1 and 3 only

(4) 1, 2 and 3

Ans: (b)