Co-operative Banking in India | 04 Oct 2019

This article is based on “Co-operative banks: Is dual regulation the problem?” which was published in The Hindu on 04/10/2019. It talks about the reasons for recent liquidity issues of PMC bank and suggests policy measures for effective regulation.

Recently, the Reserve Bank of India (RBI) imposed restrictions on withdrawals from Punjab and Maharashtra Cooperative (PMC) Bank, which triggered a panic among bank customers. It has brought to the fore the issue of riskiness of banks, especially co-operative banks and the need to restore confidence among customers.

Cooperative Banking

- A Co-operative bank is a financial entity which belongs to its members, who are at the same time the owners and the customers of their bank.

- Co-operative banks in India are registered under the States Cooperative Societies Act. The Co-operative banks are also regulated by the Reserve Bank of India (RBI) and governed by the

- Banking Regulations Act 1949

- Banking Laws (Co-operative Societies) Act, 1955.

- Features of Cooperative Banks:

- Customer Owned Entities: Co-operative bank members are both customer and owner of the bank.

- Democratic Member Control:Co-operative banks are owned and controlled by the members, who democratically elect a board of directors. Members usually have equal voting rights, according to the cooperative principle of “one person, one vote”.

- Profit Allocation: A significant part of the yearly profit, benefits or surplus is usually allocated to constitute reserves and a part of this profit can also be distributed to the co-operative members, with legal and statutory limitations.

- Financial Inclusion: They have played a significant role in the financial inclusion of unbanked rural masses.

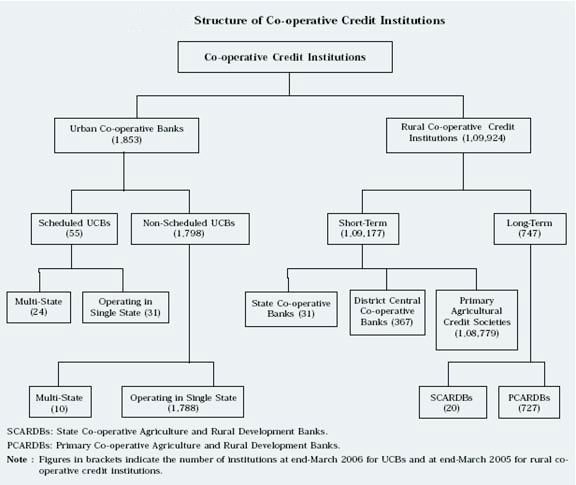

- Structure of Cooperative Banking:

- Advantage of Cooperative Banking

- Cooperative Banking provides effective alternative to the traditional defective credit system of the village money lender.

- It provides cheap credit to masses in rural areas.

- Cooperative Banks have discouraged unproductive borrowing personal consumption and have established the culture of productive borrowing.

- Cooperative credit movement has encouraged saving and investment, instead of hoarding money the rural people tend to deposit their savings in the cooperative or other banking institutions.

- Cooperative societies have also greatly helped in the introduction of better agricultural methods. Cooperative credit is available for purchasing improved seeds, chemical fertilizers, modern implements, etc

- Cooperatives Banks offers higher interest rate on deposits.

- Problems with Cooperative Banking in India

- Organisational and financial limitations of the primary credit societies considerably reduce their ability to provide adequate credit to the rural population.

- Needs of tenants and small farmers are not fully met.

- Primary credit societies are financially weak and are unable to meet the production-oriented credit needs

- Overdues are increasing alarmingly at all levels.

- Primary credit societies have not been able to provide adequate and timely credit to the borrowing farmers.

- The cooperatives have resource constraints as their owned funds hardly make a sizeable portfolio of the working capital. Raising working capital has been a major hurdle in their effective functioning.

- A serious problem of the cooperative credit is the overdue loans of the cooperative banks which have been continuously increasing over the years.

- Large amounts of overdues restrict the recycling of the funds and adversely affect the lending and borrowing capacity of the cooperative.

- Most of the benefits from the cooperatives have been covered by the big land owners because of their strong socio-economic position.

- Cooperative Banks are losing their lustre due to expansion of Scheduled Commercial Bank and adoption of technology. They are also facing stiff competition from payment banks and small-finance banks.

- Long-term credit extended by them is declining.

- Regional Disparities: The cooperatives in northeast states and in states like West Bengal, Bihar, Odisha are not as well developed as the ones in Maharashtra and Gujarat. There is a lot of friction due to competition between different states, this friction affects the working of cooperatives.

- Political Interference: Politicians use them to increase their vote bank and usually get their representatives elected over the board of director in order to gain undue advantages.

- Organisational and financial limitations of the primary credit societies considerably reduce their ability to provide adequate credit to the rural population.

Dual Regulation of Urban Cooperative Bank

- Urban Co-operative Banks are regulated and supervised by State Registrars of Co-operative Societies (RCS) in case of single-State co-operative banks and Central Registrar of Co-operative Societies (CRCS) in case of multi-State co-operative banks and by the RBI.

- The RCS exercises powers under the respective Co-operative Societies Act of the States with regard to incorporation, registration, management, amalgamation, reconstruction or liquidation and in case of UCBs that have multi-State presence, are exercised by the CRCS.

- The banking related functions such as issue of license to start new banks/branches, matters relating to interest rates, loan policies, investments and prudential exposure norms are regulated and supervised by the Reserve Bank under the provisions of the Banking Regulation Act, 1949.

Case of Punjab and Maharashtra Cooperative (PMC) Bank

- Restrictions imposed by RBI on withdrawals of money from PMC bank highlighted the strong case of malfunctioning in dual regulatory system in urban cooperative banking system.

- In above PMC case, there are three major problems- financial irregularities, failure of internal control and system, and underreporting of exposures.

- PMC Bank has extended 73% of its assets to HDIL which created a panicky situation for depositors.

- Since, PMC has deposits from other smaller cooperatives banks, the financial irregularities which includes governance and transparency issues will likely to have multi-dimensional impact.

Countering Dual Regulation Problem

- A high powered committee chaired by former Deputy Governor of RBI, R. Gandhi has recommended the merging and converting some of the cooperatives banks to small finance banks and the same has been implemented by RBI in form of scheme for voluntary transition of urban cooperative banks into small finance banks.

- Setting up of an independent regulator for Urban Cooperative Banks.

- H Malegam committee recommended a board of management of eligible and proper persons as opposed to elected Directors.

Way Forward

- An umbrella organisation should be promoted by the banks themselves to raise the capital as a joint stock company from the market to adequately tackle capital issues.

- RBI should be empowered to implement resolution techniques such as winding-up and liquidating banks, without involving other regulators under the cooperative societies’ laws.

- Audit plays an important supervisory role in ensuring the best performance of the cooperatives, but, it is observed that lots of irregularity & negligence take place while conducting audit. Hence, an appropriate mechanism of checks & balances may be evolved & made mandatory for all the Cooperative Bank.

- Accountability for erroneous audit along with penal action should also be ensured through appropriate statue. Further, the state government should also conduct a forensic Audit of the loan portfolios & purchases of a representative sample of cooperative banks.

- The RBI must ensure that Cooperative Banks adopt more professionalism in order to retain people’s confidence in the banking sector.