Accelerating Renewable Energy Adoption | 29 Apr 2025

This editorial is based on “Why India’s renewable energy targets are insufficient” which was published in Hindustan Times on 23/05/2025. The article brings into picture the challenges in meeting India’s 2030 renewable energy targets, highlighting issues like supply-demand mismatch, solar-heavy dependence, and the need for diversified energy sources and dynamic pricing mechanisms.

For Prelims: India's renewable energy targets, Solar power, National Green Hydrogen Mission, battery energy storage systems, India’s Renewable Energy Mix, PM-KUSUM, PM JI-VAN scheme, Bioethanol

For Mains: Key Developments in India's Renewable Energy Sector, Key Issues Associated with India's Renewable Energy Sector.

India's ambitious target of 500 GW non-fossil capacity by 2030 faces significant challenges, with renewable growth likely falling short by nearly 12% in meeting incremental energy demand. The mismatch between renewable generation timing and actual demand creates periods of both surplus and deficit, particularly as solar dominates the renewable mix. Addressing these challenges requires a more balanced solar-wind portfolio, accelerated renewable installations with better capacity utilization, and time-of-day electricity pricing to shift demand patterns.

What are the Key Developments in India's Renewable Energy Sector?

- Expansion of Solar Power Capacity: India's solar power capacity is experiencing significant growth, driven by aggressive government policies and favorable investment conditions.

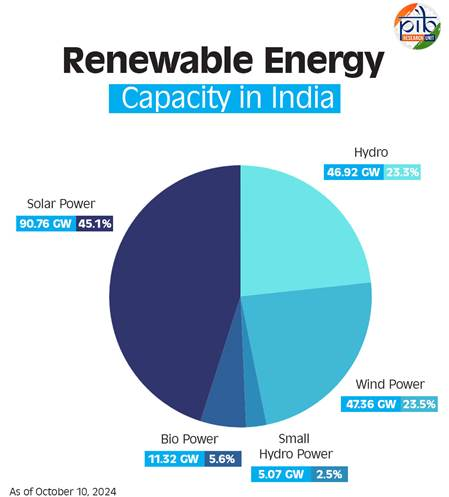

- With a target of 500 GW renewable energy capacity by 2030, solar energy plays a crucial role, constituting 44% of India's renewable energy.

- As of October 2024, India has installed 90.76 GW of solar capacity, which is 26 times its capacity in 2014.

- The solar capacity is projected to reach 170 GW by March 2025, reinforcing India’s leadership in solar energy.

- Driving Towards Green Hydrogen: India is betting on green hydrogen as a critical component of its energy transition. The National Green Hydrogen Mission, launched with Rs. 600 crores funding in 2024, aims to make India a global leader in green hydrogen production.

- This aligns with India’s net-zero target by 2070. For instance, Bharat Petroleum Corporation Limited plans to invest around $1 billion in green hydrogen projects to produce 2 GW by 2025, positioning green hydrogen as a sustainable fuel.

- Renewable Energy Investment Surge: India’s renewable energy sector has attracted substantial foreign investments, reinforcing the viability of its clean energy transition.

- FDI inflows in the non-conventional energy space amounted to US$ 15.36 billion between 2000-2023, showing growing global confidence.

- In 2024 alone, investments are expected to increase by 83%, with over US$ 16.5 billion projected in renewable energy.

- The commitment from global players, including Brookfield Asset Management, highlights India's role as a global renewable investment hub.

- Pumped Storage and Battery Energy Storage Systems (BESS): To enhance grid reliability and support renewable integration, India is focusing on pumped storage and battery energy storage systems (BESS).

- The government’s approval for 13,000 MW of renewable energy projects with a 12,000 MWh BESS in Ladakh is a notable step in strengthening storage capacity.

- The introduction of pumped storage projects in Tamil Nadu and Andhra Pradesh, aimed at adding 4-6 GW by 2030, demonstrates India's shift towards long-duration storage.

- Renewable Energy Parks: India's Renewable Energy Parks are instrumental in scaling up capacity, with 59 solar parks totaling 40 GW approved as of 2024.

- These parks provide the necessary infrastructure for large-scale solar and wind installations.

- The 30 GW hybrid solar-wind project in Gujarat, set to be the world’s largest, is an example of such large-scale initiatives.

- By consolidating renewable energy projects in these parks, India aims to reduce land acquisition issues and streamline power generation.

- Rural Electrification and Decentralized Renewable Energy (DRE): India’s decentralized renewable energy (DRE) initiatives are crucial for rural electrification, where grid access remains limited.

- Programs like PM-KUSUM have provided over 140 MW of solar power plants and 2.73 lakh solar pumps, significantly boosting rural energy access.

- Moreover, the Green Energy Open Access Rules 2022 are designed to make renewable energy more accessible to farmers and rural communities.

- International Solar Alliance and Global Collaboration: India's leadership in global renewable energy has been strengthened by its role in the International Solar Alliance (ISA), which now includes over 120 countries.

- The ISA's efforts to scale up solar energy adoption worldwide align with India’s goal of increasing its solar capacity to 500 GW by 2030.

- India’s diplomatic engagement through the ISA ensures mutual benefits for member countries in achieving sustainable energy goals.

- Progress in Bioenergy and Waste-to-Energy Initiatives: India is tapping into bioenergy, with projects focusing on biomass and waste-to-energy solutions.

- The PM JI-VAN scheme, with Rs. 908 crore allocated for 2G bioethanol projects, is advancing bioenergy development in India.

- Bioenergy accounts for 11.32 GW of installed capacity, with projects like waste-to-energy plants in Delhi making significant strides.

- Wind Energy-Onshore and Offshore Developments: India is expanding its wind energy capacity, both onshore and offshore:

- In 2024, India reached 47.2 GW of wind energy capacity with key projects in states like Tamil Nadu, Gujarat, and Rajasthan.

- The Ministry of New And Renewable Energy has estimated the offshore wind potential in India around 70 GW, split between Gujarat (36 GW) and Tamil Nadu (35 GW).

What are the Key Issues Associated with India's Renewable Energy Sector?

- Intermittency and Grid Integration Challenge: The intermittent nature of renewable energy sources, especially solar and wind, poses significant challenges to grid stability.

- This intermittency requires robust energy storage solutions and improved grid infrastructure.

- For instance, the country’s solar and wind capacity accounted for 44% of total renewable capacity in FY24, but these sources still face grid integration issues.

- Land Acquisition and Infrastructure Bottlenecks: Land acquisition for large-scale renewable energy projects, such as solar parks and wind farms, remains a major issue, especially in land-scarce regions.

- Complicated land laws, delays in approvals, and local opposition hinder the timely execution of projects.

- For example, Rajasthan and Gujarat, which are pivotal for solar and wind energy, are seeing rising land-use conflicts.

- High Dependence on Imported Solar Components: India's renewable energy sector, particularly solar energy, is heavily dependent on imports for critical components such as solar cells and modules.

- This dependency not only impacts cost competitiveness but also exposes India to geopolitical risks.

- In 2023-24, India imported $7 billion worth of solar equipment, with China supplying 62.6% of it. (though declined recently)

- Financing and Investment Shortfalls: While India is seeing rising investments in renewable energy, the sector still faces significant financing challenges due to high capital expenditure and risks associated with long-term projects.

- Meeting India's renewable energy targets requires annual finance flows to grow to around USD 68 billion by 2032.

- Despite the projected $16.5 billion investment in 2024, many smaller projects in rural and remote areas struggle to secure financing.

- This issue affects the broader goal of 500 GW renewable energy by 2030.

- Regulatory and Policy Uncertainty: The renewable energy sector faces policy instability and inconsistent regulations across states, hindering the uniform growth of the industry.

- Frequent changes in solar tariffs, taxation policies, and grid codes create uncertainty, making it difficult for investors to plan long-term investments.

- For example, the Inter-State Transmission System (ISTS) charges waiver has been introduced to facilitate renewables, but its implementation is still inconsistent across regions.

- Environmental and Social Impacts: While renewable energy is crucial for reducing emissions, it also raises environmental and social concerns.

- Large-scale projects like hydropower and solar parks sometimes displace local communities or disrupt fragile ecosystems.

- The Sillahalla Hydro Project in Tamil Nadu, has raised concerns over biodiversity loss and community displacement.

- The challenge lies in balancing the need for clean energy with the rights of local communities and environmental sustainability.

- Water Usage in Renewable Energy Production: Water consumption in some renewable energy production processes, especially biomass and biofuels, raises concerns about the sector’s water footprint.

- India is already facing water scarcity issues in several states, and the expansion of water-intensive renewable projects could exacerbate these problems.

- For example, bioethanol production from crops uses significant water resources. Although initiatives like PM-JI-VAN support sustainable biofuel production, the need for water-efficient technologies in energy generation is becoming increasingly urgent.

- Slow Pace of Rooftop Solar Adoption: Although rooftop solar is a key strategy for decentralizing renewable energy, its adoption in India has been sluggish.

- The high initial cost, lack of awareness, and fragmented state-level policies are significant barriers.

- The initial target for India's Rooftop Solar Programme was 40 GW installed capacity by 2022, part of a larger 100 GW target by 2030.

- However, the 40 GW target was not met, and the deadline was extended to 2026.

- Limited Energy Storage Capacity: Energy storage, particularly battery storage, is crucial to mitigate the intermittent nature of renewable energy.

- Despite India’s renewable energy growth, battery storage capacity remains limited, making it difficult to store excess power generated during peak solar or wind periods.

- As per National Electricity Plan (NEP) 2023 of Central Electricity Authority (CEA), the energy storage capacity requirement is projected to be 82.37 GWh in 2026-27.

- Despite India’s renewable energy growth, battery storage capacity remains limited, making it difficult to store excess power generated during peak solar or wind periods.

How can India Accelerate Renewable Energy Adoption to Meet Rising Energy Demand?

- Strengthening Renewable Energy Infrastructure: To meet the rising energy demand, India must focus on building and modernizing its energy transmission and storage infrastructure.

- Expanding smart grids and investing in pumped storage systems will enhance grid flexibility and enable seamless integration of renewable energy into the grid.

- This includes ensuring inter-regional transmission capacity is upgraded to facilitate power distribution from renewable-rich regions to energy-deficient areas.

- Prioritizing energy storage solutions such as lithium-ion batteries will address the intermittency of solar and wind power, ensuring a stable supply.

- Streamlining Land Acquisition and Regulatory Processes: Simplifying land allocation procedures through single-window clearances and providing land banks dedicated to renewable energy projects can expedite development.

- Alongside this, fast-tracking environmental and regulatory approvals through digital platforms will reduce bureaucratic delays, enabling quicker deployment of projects while maintaining compliance with sustainability standards.

- Enhancing Financial Support Mechanisms: Providing accessible and affordable financing for renewable energy projects, particularly for smaller developers, is crucial.

- Expanding green bonds and renewable energy financing schemes will attract both domestic and international investments.

- Additionally, the government can provide subsidies or tax incentives for small and medium-sized enterprises (SMEs) involved in manufacturing solar panels and wind turbines, ensuring greater domestic manufacturing and reducing dependency on imports.

- Promoting Decentralized Energy Solutions: Encouraging decentralized renewable energy systems, such as rooftop solar and microgrids, will help distribute the energy load and reduce the strain on centralized grids.

- Localized solutions enable communities in remote and rural areas to generate and consume energy, making them more energy-resilient.

- Expanding Renewable Energy in the Transportation Sector: Integrating renewable energy into the transportation sector can significantly reduce carbon emissions and energy demand.

- Promoting electric vehicle (EV) adoption, coupled with the expansion of EV charging infrastructure powered by renewable sources, will help reduce fossil fuel consumption.

- Strengthening Public-Private Partnerships (PPPs): Encouraging public-private partnerships (PPPs) can drive renewable energy innovation and project execution.

- By collaborating with private sector players, the government can leverage private capital and expertise to scale up renewable energy projects.

- Offering clear policy frameworks, tax breaks, and guaranteed power purchase agreements (PPAs) will encourage long-term investments in both large-scale and off-grid renewable projects.

- Fostering Research and Development in Clean Energy: India must enhance its focus on research and development (R&D) in emerging renewable technologies, such as floating solar and offshore wind energy.

- Creating innovation hubs for clean energy startups and encouraging collaborations with international research institutes will foster new solutions to optimize energy production and consumption.

- Incentivizing private sector innovation through R&D grants and patent protections will ensure India stays at the forefront of clean energy advancements.

- Localizing Manufacturing and Supply Chains: To reduce reliance on imports, India must focus on localizing renewable energy manufacturing. This includes setting up domestic supply chains for critical components like solar panels, batteries, and wind turbines.

- The PLI scheme can be expanded to support large-scale manufacturing hubs, providing jobs and enhancing the country’s competitive edge in the global renewable energy market.

|

Drishti Mains Question: “India's target of achieving 500 GW of non-fossil fuel capacity by 2030 is ambitious but faces structural and technological hurdles”. Examine the key developments and associated challenges in India’s renewable energy sector. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. With reference to the Indian Renewable Energy Development Agency Limited (IREDA), which of the following statements is/are correct? (2015)

- It is a Public Limited Government Company.

- It is a Non-Banking Financial Company.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)

Mains

Q. “Access to affordable, reliable, sustainable and modern energy is the sine qua non to achieve Sustainable Development Goals (SDGs)”.Comment on the progress made in India in this regard. (2018)