Economy

World Economic Outlook: IMF

- 13 Oct 2022

- 9 min read

For Prelims: World Economic Outlook, IMF, Global Financial Stability Report, World Economic Outlook.

For Mains: Important International Institutions, Effect of Policies & Politics of Countries on India's Interests, Growth & Development, World Economic Outlook, International Monetary Fund.

Why in News?

Recently, the International Monetary Fund (IMF) released the latest edition of World Economic Outlook 2022.

What are the Highlights of the World Economic Outlook?

- Indian Scenario:

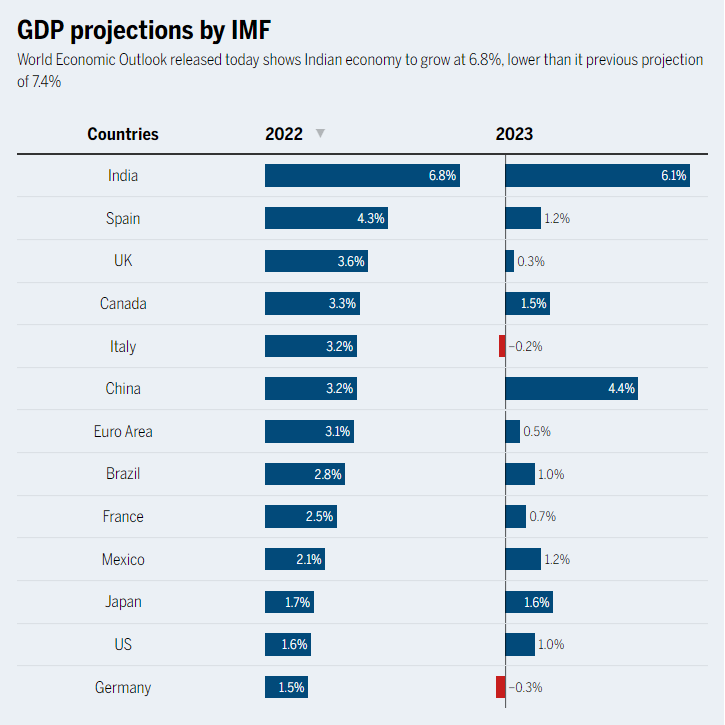

- It cut its forecast for India’s Gross Domestic Product (GDP) growth in 2022 to 6.8%, from 7.4% for India in the fiscal year that started in April 2022.

- For 2023, India has been projected to grow at 6.1%.

- Global Scenario:

- Global growth is forecast to slow from 6% in 2021 to 3.2% in 2022 and 2.7% in 2023. This is the weakest growth profile since 2001, except for the global financial crisis and the acute phase of the Covid-19 pandemic.

- The global growth is expected to slow further in 2023. The worst is yet to come and, for many people 2023 will feel like a recession.

- A slowdown in the Euro area is expected to deepen in 2023, and growth in China is projected to hit its lowest rate in decades apart from during the initial coronavirus outbreak.

- Inflation:

- Global inflation is forecast to rise from 4.7% in 2021 to 8.8% in 2022 but to decline to 6.5% in 2023 and to 4.1% by 2024.

- The slowdown in global economic activity is broad-based and sharper-than-expected, with inflation higher than seen in decades. The economic outlook depends on a successful calibration of monetary and fiscal policies, the course of the war in Ukraine, and growth prospects in China.

What are IMF’s Recommendations?

- Fighting Inflation:

- The priority must be to tackle inflation, normalize central bank balance sheets, and raise real policy rates above their neutral level fast enough and for long enough to keep inflation and inflation expectations under control.

- Monetary and Fiscal Policy Coordination:

- Fiscal policy also needs to support monetary policy in softening demand in economies with excess aggregate demand and overheating labor markets.

- Without price stability, any gains from future growth are at risk of being eaten up by a renewed cost-of-living squeeze.

- Central banks need to act resolutely while communicating clearly the objectives and the steps to achieve them.

- Protecting the Vulnerable during the Adjustment:

- As the cost of living continues to rise, policymakers will need to protect the most vulnerable members of society from the impact of higher prices.

- Climate Policies:

- Without prompt remedial action, climate change will eventually have catastrophic impacts on health and economic outcomes the world over.

- Current global targets are not aligned with global temperature goals. Meeting these goals will require emission cuts of at least 25% by the end of the decade.

- The ongoing energy crisis has also sharpened the energy security benefits countries can derive from transitioning to clean and reliable energy sources to steadily replace their reliance on fossil fuels with renewables and low-carbon energy sources.

What is the International Monetary Fund?

- About:

- The IMF was set up along with the World Bank after the Second World War to assist in the reconstruction of war-ravaged countries.

- The two organizations agreed to be set up at a conference in Bretton Woods in the US. Hence, they are known as the Bretton Woods twins.

- Created in 1944, the IMF is governed by and accountable to the 190 countries that make up its near-global membership. India joined on 27th December 1945.

- The IMF came into formal existence in December 1945.

- The IMF's primary purpose is to ensure the stability of the international monetary system — the system of exchange rates and international payments that enables countries (and their citizens) to transact with each other.

- The Fund's mandate was updated in 2012 to include all macroeconomic and financial sector issues that bear on global stability.

- The IMF was set up along with the World Bank after the Second World War to assist in the reconstruction of war-ravaged countries.

- Reports by IMF:

- World Economic Outlook

- It is a survey by the IMF that is usually published twice a year in the months of April and October.

- It analyzes and predicts global economic developments during the near and medium term.

- In response to the growing demand for more frequent forecast updates, the WEO Update is published in January and July, between the two main WEO publications released usually in April and October.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q1. "Rapid Financing Instrument" and "Rapid Credit Facility" are related to the provisions of lending by which one of the following? (2022)

(a) Asian Development Bank

(b) International Monetary Fund

(c) United Nations Environment Programme Finance Initiative

(d) World Bank

Ans: (b)

Exp:

- Rapid Financing Instrument (RFI) provides quick financial assistance, which is available to all member countries facing urgent balance of payments requirements. The RFI was created as part of a broader reform to make IMF financial support more flexible to meet the diverse needs of member states. The RFI replaces the IMF's previous emergency assistance policy and can be used in a wide variety of circumstances.

- The Rapid Credit Facility (RCF) provides immediate balance of payments (BoP) requirements to low-income countries (LICs) with no ex-post condition, where a full economic program is neither necessary nor feasible. RCF was set up as part of a comprehensive reform to make the fund's financial support more flexible and better suited to suit the diverse needs of LIC including times of crisis.

- There are three areas under the RCF: (i) a "regular window" for immediate BoP needs due to a wide range of sources such as household instability, emergencies and fragility (ii) for immediate BoP needs due to sudden, exogenous shocks. an “exogenous shock window” and (iii) a “large natural disaster window” for immediate BoP needs due to natural disasters where the damage is estimated to be equal to or greater than 20% of the member's GDP.

Q2. “Gold Tranche” (Reserve Tranche) refers to (2020)

(a) a loan system of the World Bank

(b) one of the operations of a Central Bank

(c) a credit system granted by WTO to its members

(d) a credit system granted by IMF to its members

Ans: (d)

Q3. ‘Global Financial Stability Report’ is prepared by the (2016)

(a) European Central Bank

(b) International Monetary Fund

(c) International Bank for Reconstruction and Development

(d) Organization for Economic Cooperation and Development

Ans: (b)

Mains

Q. The World Bank and the IMF, collectively known as the Bretton Woods Institutions, are the two inter-governmental pillars supporting the structure of the world’s economic and financial order. Superficially, the World Bank and the IMF exhibit many common characteristics, yet their role, functions and mandate are distinctly different. Elucidate. (2013)