Windfall Tax | 04 Jul 2024

Recently, the Indian government has increased the windfall tax on domestically produced crude oil from Rs 3,250 per tonne to Rs 6,000 per tonne.

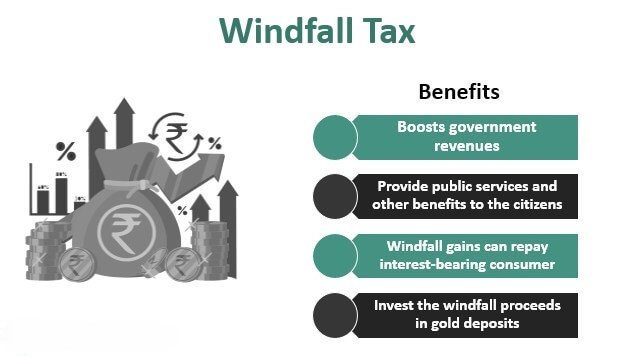

- A Windfall Tax is a type of tax that is levied on companies or individuals who have unexpectedly and/or dramatically gained large profits, often due to external factors beyond their control.

- It is commonly levied on industries such as oil, gas, and mining.

- The purpose is to capture a portion of the extraordinary profits that companies make and redistribute it for public good.

- It is a strategic measure to promote transparency and fairness and responsible economic practices in the energy industry.

- This hike will impact the profits of oil companies operating in India and reduce their earnings.

- India first implemented windfall profit taxes on 1st July 2022, aligning with other countries that tax excessive profits of energy companies.

- The tax rates are reassessed every 2 weeks, taking into account international crude prices from the preceding fortnight.

Read more: Windfall Tax