Indian Economy

Transfer of Surplus from RBI

- 27 Aug 2019

- 3 min read

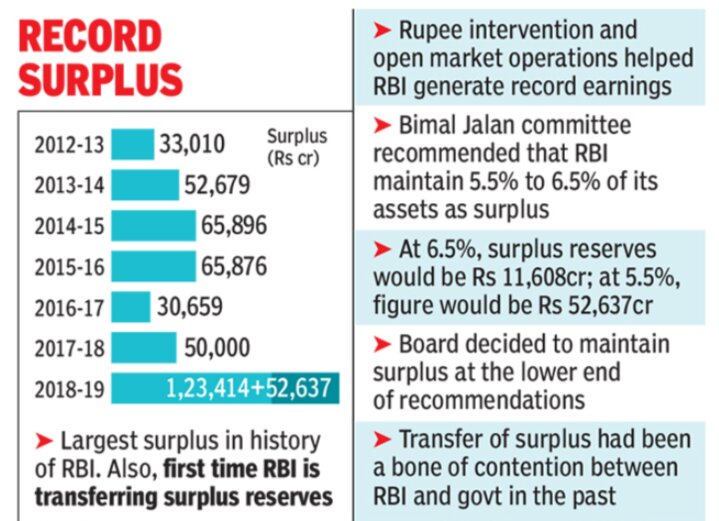

Recently, the Reserve Bank of India (RBI) has decided to transfer Rs 1.76 lakh crore to the Central government, which may help the government in dealing with the economic slowdown.

- The Rs 1.76 lakh crore includes the central bank’s 2018-19 surplus of ₹1.23 lakh crore and Rs 52,637 crore of excess provisions identified as per the revised Economic Capital Framework (recommended by Bimal Jalan Committee).

- The government already had revised downward the fiscal deficit target to 3.4% from 3.3% and initiated a slew of measures that are being dubbed as mini-budget.

- Economic Capital Framework

- The RBI had formed a committee chaired by former Governor Bimal Jalan to review its economic capital framework and suggest the quantum of excess provision to be transferred to the government.

- The panel recommended a clear distinction between the two components of the economic capital of RBI i.e. Realized equity and Revaluation balances.

- Revaluation reserves comprise of periodic marked-to-market unrealized/notional gains/losses in values of foreign currencies and gold, foreign securities and rupee securities, and a contingency fund.

- Realized equity, which is a form of a contingency fund for meeting all risks/losses primarily built up from retained earnings. It is also called the Contingent Risk Buffer (CBR).

- The Surplus Distribution Policy of RBI that was finalized is in line with the recommendations of the Bimal Jalan committee.

- The Jalan committee has given a range of 5.5-6.5% of RBI's balance sheet for Contingent Risk Buffer.

- Adhering to the recommendations, the RBI has decided to set the CBR level at 5.5% of the balance sheet, while transferring the remaining excess reserves worth ₹52,637 crore to the government.

- If CBR is below the lower bound of requirement, risk provisioning will be made to the extent necessary and only the residual net income (if any) transferred to the Government.

- However keeping CBR at a lower range of 5.5%, will reduce RBI's space to manoeuvre monetary policy.