T+0 Settlement Cycle | 01 Apr 2024

Why in News?

Recently, the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) introduced trading in the T+0 beta version of the settlement cycle in the equity segment on an optional basis.

- This came after the Securities and Exchange Board of India (SEBI) issued operational guidelines for the launch of the shorter tenure settlement cycle.

Note

The term "Beta Version" refers to a pre-release version of software or a product that is still in the testing phase.

- Beta versions may contain some features that are still in development or may not yet be fully functional, and they are often subject to further refinement based on user feedback before the final release.

What is the T+0 Trading Settlement Cycle?

- About:

- In December 2023, the SEBI proposed to introduce a facility for clearing and settlement of funds and securities on T+0 (same day) on an optional basis, in addition to the existing T+1 settlement cycle.

- Under the T+0 trade cycle, the settlement of trades would occur on the same day after the closure of the T+0 market.

- This means that if investors sell a share, they would receive the money credited to their account on the very same day, and the buyer would also get the shares in their demat account on the day of the transaction itself.

- This is the world's fastest stock settlement system.

- In comparison, the current T+1 system involves a delay of one business day between the trade execution date and the settlement date.

- In this system, sellers only receive 80% of their cash on the day of sale, with the remaining 20% available the following day.

- However, with the introduction of the new T+0 settlement system, sellers would have instant access to 100% of their cash on the day of the transaction, eliminating the need to wait for the following day for the remaining amount.

- In comparison, the current T+1 system involves a delay of one business day between the trade execution date and the settlement date.

- Benefits:

- A shortened settlement cycle will bring cost and time efficiency, transparency in charges to investors, and strengthen risk management at clearing corporations and the overall securities market ecosystem.

- The T+0 trade cycle is expected to provide flexibility in terms of faster pay-out of the funds against the securities to the sellers and faster pay-out of securities against the funds to the buyers.

- It will allow better control over funds and securities by the investors.

- For the securities market ecosystem, a shorter settlement cycle will further free up capital in the securities market, thereby enhancing the overall market efficiency.

- It will enhance the overall risk management of Clearing Corporations (CCs) as the trades are backed by upfront funds and securities.

- Stages of Settlement:

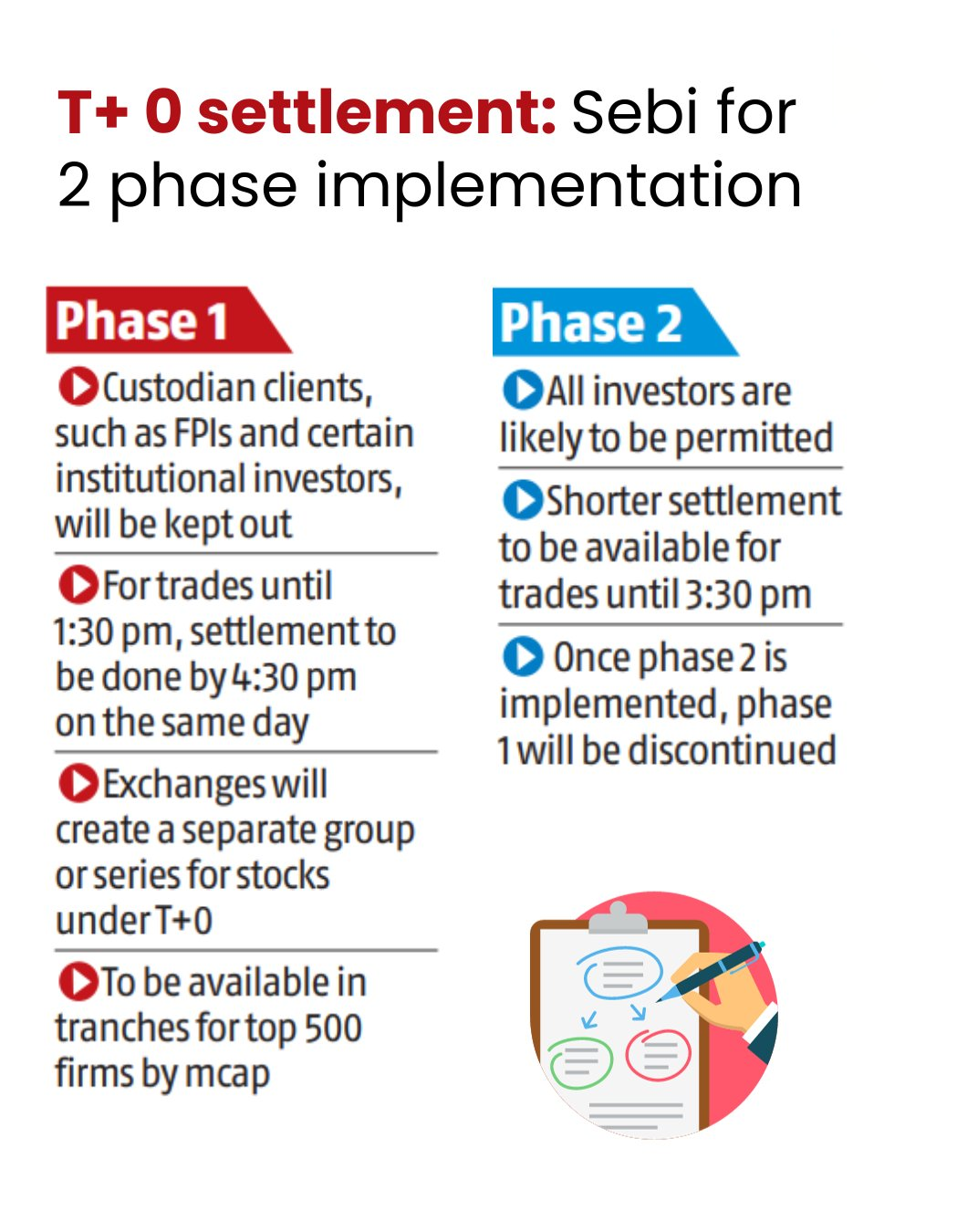

- There will be two stages to the T+0 settlement cycle.

- Phase 1 deals made up to 1:30 pm will be taken into account for the settlement, which must be finished by 4:30 pm.

- Trading will begin at 1:30 pm and last until 3:30 pm in the second phase and the first phase will be discontinued.

- SEBI has proposed the initial rollout of the T+0 settlement for the top 500 listed equity shares in three tranches (200, 200,100) based on market capitalization.

- This initiative corresponds to the changing Indian securities market, marked by surging volumes, values, and participants.

- SEBI has proposed the initial rollout of the T+0 settlement for the top 500 listed equity shares in three tranches (200, 200,100) based on market capitalization.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. With reference to India, consider the following: (2010)

- Nationalisation of Banks

- Formation of Regional Rural Banks

- Adoption of village by Bank Branches

Which of the above can be considered as steps taken to achieve the “financial inclusion” in India?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Mains:

Q. Justify the need for FDI for the development of the Indian economy. Why is there a gap between MoUs signed and actual FDIs? Suggest remedial steps to be taken for increasing actual FDIs in India. (2016)

.png)