SVB Financial Group Collapse | 16 Mar 2023

Why in News?

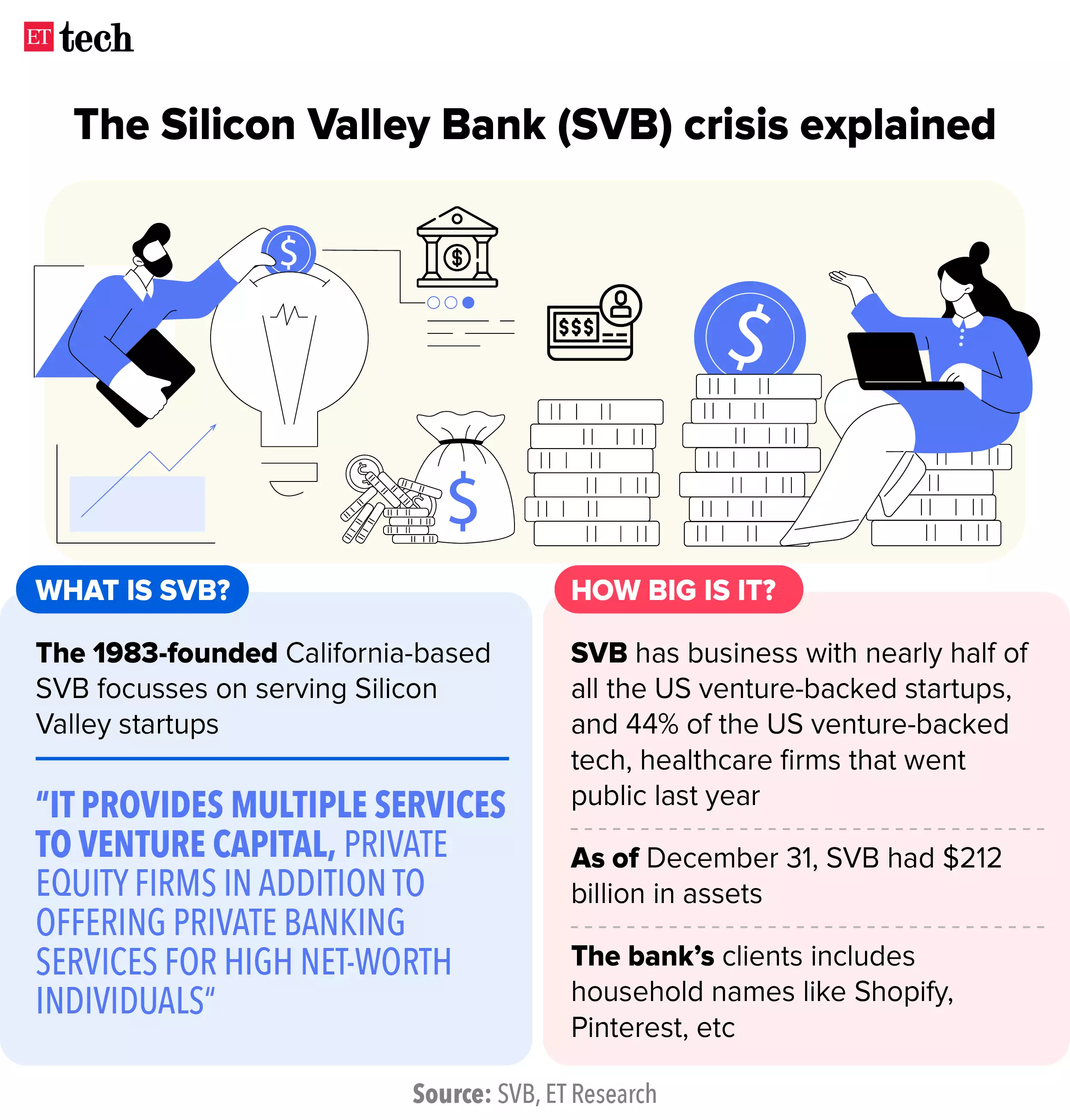

Recently, the U.S. banking regulators shut down the Silicon Valley Bank (SVP) Financial Group, causing shockwaves in the startup community.

- The collapse of Silicon Valley Bank was caused by the US Federal Reserve's decision to raise interest rates, leading to less appetite for risk and resulting in investors pulling out their money to meet their liquidity needs.

What led to the Decline of SVP Financial Group?

- Sequence of Event of Failure:

- Federal Reserve raises rates;

- Some SVB clients face cash crunch;

- SVB sells Bond portfolio at a loss;

- SVB Announces Stock Sale;

- Stock Sale Collapses;

- SVB goes into Receivership.

- Causes of SVB's Failure:

- SVB sold substantially all of its available-for-sale securities at a USD 1.8-billion loss, mostly in the form of US Treasury securities.

- It received a massive volume of deposits during the tech boom of 2020-2021, and invested the proceeds into long-term Treasury bonds while interest rates were low.

- However, with interest rates rising, the market value of these Treasuries became substantially lower than SVB paid, triggering withdrawal requests from depositors.

What are the Effects of SVB Failure?

- Bank Runs:

- The bank’s failure is raising concerns about other banks. Bank runs can happen when customers or investors panic and start pulling their deposits. Perhaps the most immediate concern is that the failure of Silicon Valley Bank would scare off customers of other banks.

- Indian Startup:

- SVB was an important lender to several Indian start-ups, and its failure will affect the withdrawal of money from their accounts.

- SVB offered an easy way for start-ups in India to park their cash as firms could set up their bank accounts without needing a United States Social Security Number or Income Tax Identification Number.