Surety Bonds | 05 Feb 2022

For Prelims: Surety bonds, IRDAI.

For Mains: Surety bonds and its role in boosting infrastructure development.

Why in News?

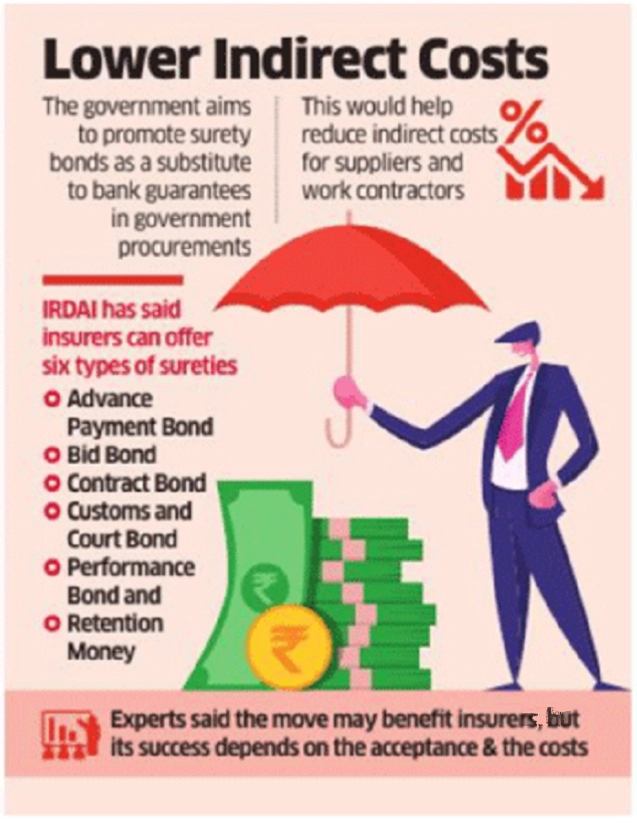

In the Budget 2022-23, the government has allowed the use of surety insurance bonds as a substitute for bank guarantees in case of government procurement and also for gold imports.

- Insurance Regulatory and Development Authority of India (IRDAI) has also released final guidelines to ensure orderly development of surety insurance business in India.

- The IRDAI (Surety Insurance Contracts) Guidelines, 2022 will come into effect from 1st April , 2022.

What is a Surety Bond?

- A surety bond is a legally binding contract entered into by three parties—the principal, the obligee, and the surety.

- The obligee, usually a government entity, requires the principal, typically a business owner or contractor, to obtain a surety bond as a guarantee against future work performance.

- Surety bonds are mainly aimed at infrastructure development, mainly to reduce indirect cost for suppliers and work-contractors thereby diversifying their options and acting as a substitute for bank guarantee.

- Surety bond is provided by the insurance company on behalf of the contractor to the entity which is awarding the project.

- Surety bonds protect the beneficiary against acts or events that impair the underlying obligations of the principal. They guarantee the performance of a variety of obligations, from construction or service contracts to licensing and commercial undertakings.

What are the issues with the Decision taken in the Budget?

- Surety bonds, a new concept, are risky and insurance companies in India are yet to achieve expertise in risk assessment in such business.

- Also, there’s no clarity on pricing, the recourse available against defaulting contractors and reinsurance options.

- These are critical and may impede the creation of surety-related expertise and capacities and eventually deter insurers from writing this class of business.

How can it boost the Infra Project?

- The move to frame rules for surety contracts will help address the large liquidity and funding requirements of the infrastructure sector.

- It will create a level-playing field for large, mid and small contractors.

- The Surety insurance business will assist in developing an alternative to bank guarantees for construction projects.

- This shall enable the efficient use of working capital and reduce the requirement of collateral to be provided by construction companies.

- Insurers shall work together with financial institutions to share risk information.

- Hence, this shall assist in releasing liquidity in infrastructure space without compromising on risk aspects.

What are the IRDAI Guidelines on Surety Bonds?

- According to new guidelines Insurance companies can launch the much-anticipated surety bonds now.

- The regulator has said the premium charged for all surety insurance policies underwritten in a financial year, including all installments due in subsequent years for those policies, should not exceed 10% of the total gross written premium of that year, subject to a maximum of Rs 500 crore.

- As per Insurance Regulatory and Development Authority of India (IRDAI), Insurers can issue contract bonds, which provide assurance to the public entity, developers, subcontractors and suppliers that the contractor will fulfil its contractual obligation when undertaking the project.

- Contract bonds may include: Bid Bonds, Performance Bonds, Advance Payment Bonds and Retention Money.

- Bid Bonds: It provides financial protection to an obligee if a bidder is awarded a contract pursuant to the bid documents, but fails to sign the contract and provide any required performance and payment bonds.

- Performance Bond: It provides assurance that the obligee will be protected if the principal or contractor fails to perform the bonded contract. If the obligee declares the principal or contractor as being in default and terminates the contract, it can call on the Surety to meet the Surety’s obligations under the bond.

- Advance Payment Bond: It is a promise by the Surety provider to pay the outstanding balance of the advance payment in case the contractor fails to complete the contract as per specifications or fails to adhere to the scope of the contract.

- Retention Money: It is a part of the amount payable to the contractor, which is retained and payable at the end after successful completion of the contrac.

- Contract bonds may include: Bid Bonds, Performance Bonds, Advance Payment Bonds and Retention Money.

- The limit of guarantee should not exceed 30% of the contract value.

- Surety Insurance contracts should be issued only to specific projects and not clubbed for multiple projects.