Indian Economy

Supreme Court Verdict on Adani-Hindenburg Case

- 09 Jan 2024

- 6 min read

For Prelims: Supreme Court of India, Securities and Exchange Board of India, Short-selling, Naked Short selling, Tax havens, Justice Sapre Committee, Futures and Options.

For Mains: Regulation of Short-selling in India, Supreme Court’s Recent Verdicts Related to Capital Market.

Why in News?

The Supreme Court of India recently concluded its judgment on a series of petitions pertaining to allegations made by the US-based firm, Hindenburg Research, against the Adani group.

- The apex court refused to transfer the investigation from the Securities and Exchange Board of India (SEBI) to other bodies, affirming its confidence in SEBI's handling of the case.

- Also, SC instructed SEBI to utilize its investigative authority to determine if the Hindenburg report's short-selling actions violated laws, resulting in investor harm.

What is the Supreme Court's Position Regarding the Adani-Hindenburg Dispute and SEBI's Inquiry?

- Background:

- Hindenburg's Allegations: In January 2023, Hindenburg Research accused the Adani group of stock manipulation, accounting fraud, and using improper tax havens and shell companies to manage funds, significantly impacting the stock market.

- Petitions and Arguments:

- Petitions Filed: Various petitions were filed seeking a court-monitored investigation, citing implications for national security and the economy.

- They also alleged that SEBI, the market regulator, was not competent or independent enough to conduct a fair and impartial probe.

- Counter Arguments: The Adani group refuted the allegations, attributing them to false information and vested interests.

- SEBI defended its competence and independence in handling the investigation.

- Petitions Filed: Various petitions were filed seeking a court-monitored investigation, citing implications for national security and the economy.

- Recent Judgment:

- The Supreme Court ruled in favor of the Adani group and SEBI, rejecting the transfer of the probe to other investigative bodies.

- The court held that the power to transfer investigation must be exercised in exceptional circumstances and not in the absence of cogent justifications.

- The Court deemed the Hindenburg report unreliable and aimed at influencing the market through selective and distorted information.

- While upholding SEBI's integrity, the Court directed an expedited completion of SEBI's investigation within three months.

- The Supreme Court ruled in favor of the Adani group and SEBI, rejecting the transfer of the probe to other investigative bodies.

Note

The Supreme Court formed the Justice Sapre Committee in March 2023 to probe potential regulatory failures after investors suffered significant losses due to market volatility following Hindenburg Research's allegations against the Adani Group for share price manipulation and accounting fraud.

What is Short Selling?

- About:

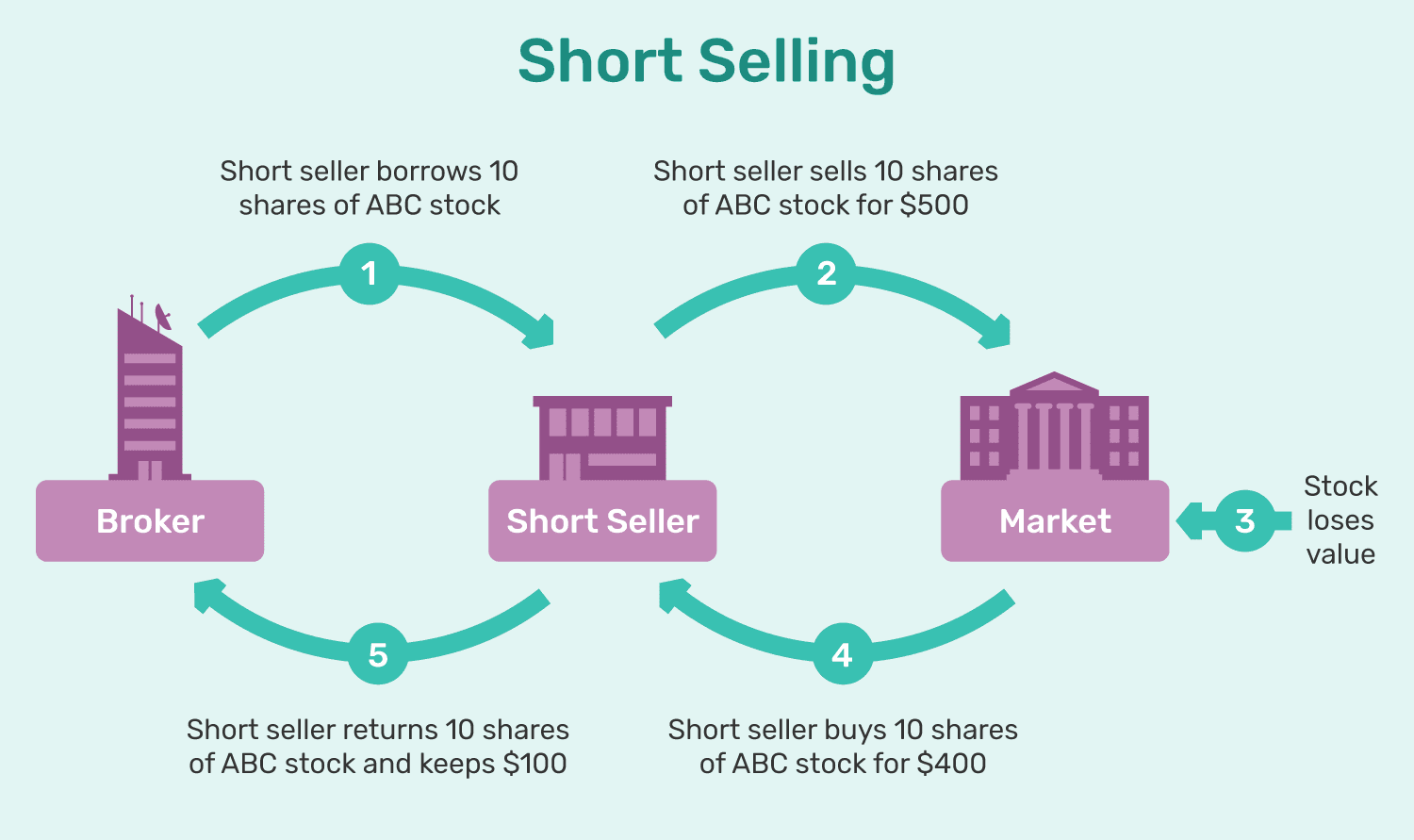

- Short selling is the practice wherein an investor borrows a stock or security, sells it in the open market, foreseeing a potential future price decline, aiming to repurchase the same asset at a lower price point later on.

- SEBI defines short selling as selling a stock that the seller does not own at the time of trade.

- Short selling is the practice wherein an investor borrows a stock or security, sells it in the open market, foreseeing a potential future price decline, aiming to repurchase the same asset at a lower price point later on.

- Regulation of Short-selling in India:

- SEBI has recently stated that investors across all categories will be allowed for short-selling, but naked short-selling will not be permitted.

- Consequently, all investors are required to fulfill their duty of delivering securities during the settlement period

- Naked short selling occurs when an investor sells stocks or securities without first arranging to borrow them or ensuring they can be borrowed.

- Institutional investors must disclose upfront whether a transaction is a short sale, while retail investors can make a similar disclosure by the trading day's end.

- Also, short selling is permitted for securities traded in the F&O (Futures & Options) segment, subject to SEBI's periodic review of eligible stocks.

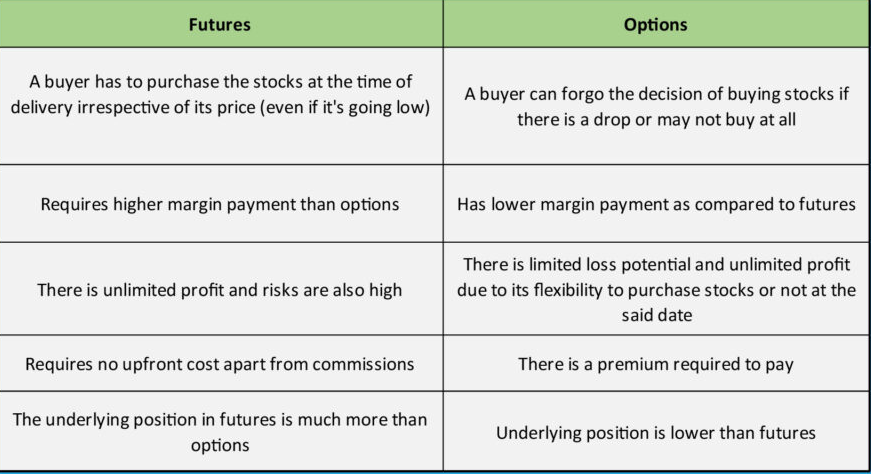

- Futures and Options (F&O) are derivative instruments. Futures involve an obligation to buy/sell assets at an agreed price on a set date, carrying unlimited risk.

- Options grant the right (but not obligation) to buy/sell assets by a certain date, with a premium paid upfront limiting potential losses.

- Futures and Options (F&O) are derivative instruments. Futures involve an obligation to buy/sell assets at an agreed price on a set date, carrying unlimited risk.

- SEBI has recently stated that investors across all categories will be allowed for short-selling, but naked short-selling will not be permitted.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. In the parlance of financial investments, the term ‘bear’ denotes (2010)

(a) An investor who feels that the price of a particular security is going to fall

(b) An investor who expects the price of particular shares to rise

(c) A shareholder or a bondholder who has an interest in a company, financial or otherwise

(d) Any lender whether by making a loan or buying a bond

Ans: (a)