Indian Economy

Stimulus Package to Reverse Economic Slowdown

- 12 Aug 2019

- 3 min read

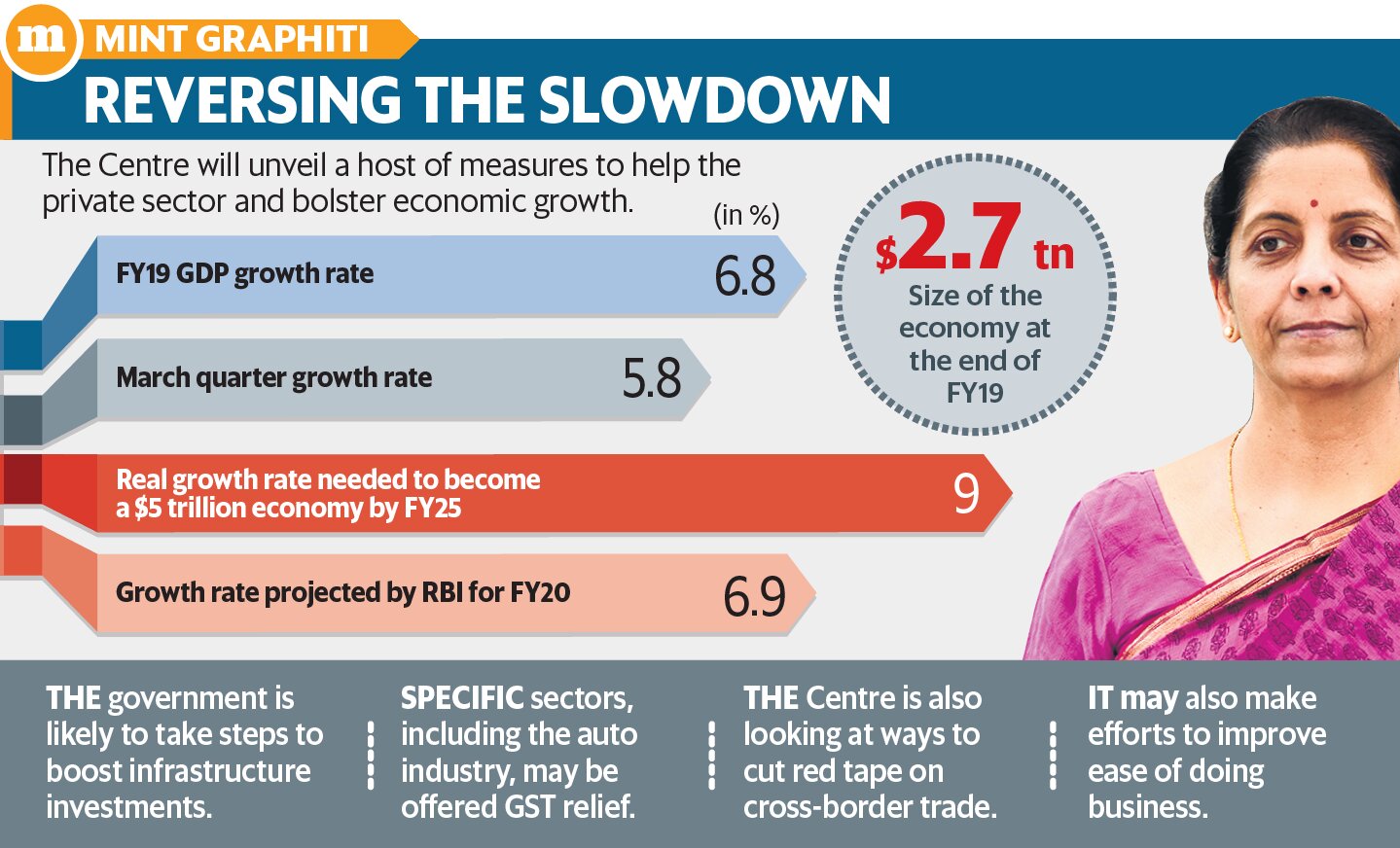

Recently, many economic indicators have pointed to a sharp slowdown in demand, both in rural and urban India.

- For instance, the automobile sector is facing a prolonged slump in demand, leading to massive job losses.

- In this context, the government looks to reverse economic slowdown with a stimulus package.

Reasons for the Slowdown

- India’s merchandise exports have contracted, signalling the impact of US-China trade war.

- Poor sentiment in the equity markets and in the banking sector have led to stalling the investment in India.

- With domestic economic activity remaining weak, while the global slowdown and trade tensions have intensified, there are further chances of intensification of this slowdown.

- In this scenario, the industry has demanded a stimulus package of ₹1 trillion to initiate an investment cycle amid slowing global and domestic slowdown.

- The government realized that the tight fiscal policy is proving to be counterproductive and that monetary policy alone is not enough to spur economic growth.

- Therefore, it has laid down a set of measures including tax cuts and targeted sops, to reverse an economic downturn.

Proposed Measures

- The measures being considered are:

- The stimulus package will include Rs 100 trillion infrastructure investment over the next five years

- Goods and services tax (GST) relief to specific sectors, including the automobile sector, that could boost demand.

- Reduce Red tape on cross-border trade and improve ease of doing business.

- The government also held that, in an effort to boost exports, it is working on a new World Trade Organization-compliant duty reimbursement scheme.

Significance

- Earlier Fiscal Responsibility and Budget Management (FRBM) Act constrained the government from providing a fiscal push in the Union budget.

- But the government is considering the use of escape clause (in the FRBM Act) for deviation in the fiscal deficit up to 50 basis points.

- It may give the government leeway to spend an additional ₹1.15 trillion in the current fiscal.

- Escape Clause: The panel led by N.K. Singh to review the FRBM Act had suggested an escape clause, allowing deviations up to 0.5 percentage points of Gross Domestic Product, based on triggers including far-reaching structural reforms in the economy with unanticipated fiscal implications, acts of war and farm distress.