State of Sugar Industry in India | 28 Sep 2024

For Prelims: FRP, SAP, CACP, Rangarajan Committee, WTO, Sugarcane Industry, EBP Program

For Mains: State of Sugar Industry in India, Sugarcane Production in India, its Potential and Challenges.

Why in News?

The sugar sector in India is experiencing a notable recovery after a prolonged period of uncertainty.

- Recent revisions in production estimates for the current season, coupled with a positive outlook for the upcoming season beginning in October, have contributed to a more favourable supply situation in the industry.

What is the State of the Sugar Industry in India?

- Production and Consumption Data:

- Production: Indian Sugar Mills Association (ISMA) projects gross sugar production at 34.0 million MT, with net production at 32.3 million MT for Sugar Year (SY) 2024 after ethanol diversion and a ban on exports.

- According to the US Department of Agriculture, Brazil is the world’s top sugar producer for 2023-24, with a production of 45.54 million MT, accounting for about 25% of global output.

- India is the largest consumer and the second-largest producer of sugar in the world contributing around 19% of global sugar production.

- Consumption and Stocks: Domestic consumption is estimated at 28.5 million MT, leading to a closing stock of 9.4 million MT by September 2024, up from 5.6 million MT last year.

- Ethanol Production: A target of 320 crore liters for the first half of Ethanol Supply Year (ESY) 2024 was set, with 224 crore liters supplied by March 2024, achieving an 11.96% blending ratio.

- Production: Indian Sugar Mills Association (ISMA) projects gross sugar production at 34.0 million MT, with net production at 32.3 million MT for Sugar Year (SY) 2024 after ethanol diversion and a ban on exports.

- Distribution of Sugar Industries: The sugar industry is broadly distributed over two major areas of production:

- Uttar Pradesh, Bihar, Haryana and Punjab in the north and Maharashtra, Karnataka, Tamil Nadu and Andhra Pradesh in the south.

- South India has tropical climate which is suitable for higher sucrose content giving higher yield per unit area as compared to north India.

- Geographical Conditions for the Growth of Sugar:

- Temperature: Between 21-27°C with hot and humid climate.

- Rainfall: Around 75-100 cm.

- Soil Type: Deep rich loamy soil.

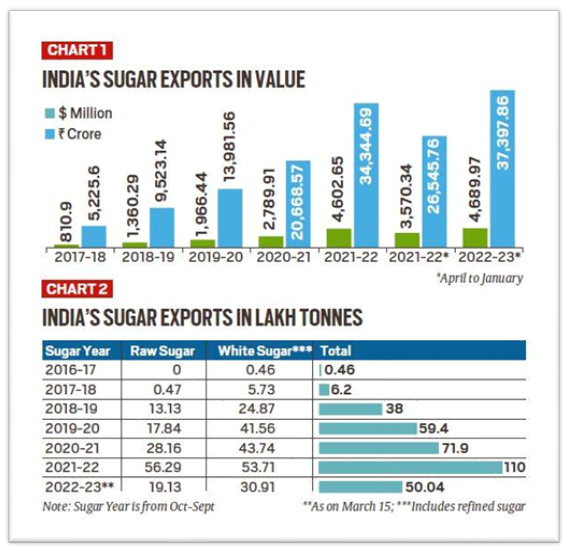

- Sugar Exports:

What is the Significance of the Sugar Industry in India?

- Employment Generation: The sugar sector is highly labor-intensive, providing livelihoods for approximately 50 million farmers and their families.

- It offers direct employment to over 500,000 skilled workers, along with numerous semi-skilled laborers engaged in sugar mills and related industries, particularly in states like Uttar Pradesh, Maharashtra, Tamil Nadu, and Karnataka.

- Value-Chain Linkages: The industry spans the entire value chain, from sugarcane cultivation to the production of sugar and alcohol which supports various sectors and promotes economic development at the local and national levels.

- Economic Contributions from Byproducts: The sugar industry generates several byproducts, including ethanol, molasses, and bagasse, which further enhance economic growth.

- It has emerged as a multi-product crop, serving as a raw material for not only sugar and ethanol but also for paper and electricity generation.

- Livestock Feeding and Nutrition: Molasses, a byproduct of sugar production, is highly nutritious and used for both livestock feeding and alcohol production, contributing to the agricultural economy.

- Biofuel Production: The majority of ethanol in India is produced from sugarcane molasses, which plays a crucial role in reducing reliance on crude oil imports through ethanol-blended fuels.

- Utilisation of Bagasse: Bagasse, the fibrous residue after sugar extraction, serves as a fuel source and is an essential raw material for the paper industry. It contributes about 30% of the cellulose requirements from agricultural residues.

What are the Challenges Associated With the Sugar Industry in India?

- Water-Intensive Crop: Sugarcane is a highly water-intensive crop, yet it is predominantly grown in monsoon-dependent states like Maharashtra and Karnataka which exacerbates water scarcity issues in these areas.

- Seasonal Nature of Sugarcane: The seasonal availability of sugarcane poses a challenge, as delays in crushing beyond 24 hours after harvest result in sucrose loss.

- Low Sugar Recovery Rate: The sugar recovery rate in Indian sugar mills has remained stagnant at 9.5-10%, much lower than the 13-14% seen in some other countries. This is largely due to a lack of major advancements in developing better sugarcane varieties and improving crop yields.

- Uncertain Production Output: Sugarcane cultivation competes with other food and cash crops like cotton, oilseeds, and rice, leading to supply fluctuations and price volatility, especially during surplus periods when prices fall.

- Low Investment and Outdated Technology: Many sugar mills, particularly in states like Uttar Pradesh and Bihar, are old and operate with outdated machinery which hampers productivity.

- Competition from Gur Production: While gur has higher nutritional value, it has a lower sugar recovery rate compared to sugar leading to a net loss for the country when sugarcane is diverted to gur production.

- Also, gur factories often procure sugarcane at a lower price than sugar mills, incentivising farmers to sell to them, further impacting sugar production.

What are the Government Initiatives for the Sugar Industry?

- Rangarajan Committee (2012): It was established to provide recommendations for reforming the sugar industry.

- Replacing quantitative controls on sugar imports and exports with appropriate tariffs and ending outright bans on sugar exports.

- Reviewing the 15 km minimum radial distance between sugar mills, which can create monopolies and give mills undue power over farmers.

- Allowing market-determined prices for by-products and encouraging states to reform policies, enabling mills to generate power from bagasse.

- Lifting restrictions on the sale of non-levy sugar to improve the financial health of mills, ensuring timely payments to farmers and reducing cane arrears.

- Fair and Remunerative Price (FRP): On the recommendations of Commission for Agricultural Costs and Prices (CACP) a hybrid approach for fixing sugarcane prices, incorporating the Fair and Remunerative Price (FRP) was suggested.

- Ethanol Blending with Petrol (EBP) Programme: Under EEP initiative, ethanol production capacity in molasses/sugar-based distilleries has expanded to 605 crore litres annually, with ongoing efforts to achieve the 20% ethanol blending target by 2025.

- Legislations Measures:

- Essential Commodities Act (ECA), 1955: ECA,1955 regulates sugar and sugarcane, giving powers to control the sugar sector.

- Sugarcane (Control) Order, 1966: Fixes the FRP for sugarcane and ensures timely payments to farmers.

- Sugar (Control) Order, 1966: Regulates the production, sale, packaging, and international trade of sugar.

- Sugar Price Control Order, 2018: Establishes the Minimum Selling Price (MSP) for sugar and allows inspections of sugar mills and storage facilities.

Note:

- Fair and Remunerative Price (FRP): FRP is the minimum price sugar mills are mandated to pay farmers for sugarcane. It is determined by the Central Government, based on the recommendations of the CACP, in consultation with state governments and other stakeholders.

- State Advised Price (SAP): While FRP is set by the central government, state governments can set their own SAP, which sugar mills must pay farmers if higher than the FRP.

Way Forward

- Research & Development in Sugarcane: Investment in R&D is crucial to address low yields and low sugar recovery rates. Developing high-yielding, drought-resistant varieties can improve productivity and sustainability in the long term.

- Implementation of Revenue Sharing Formula: The Rangarajan Committee's Revenue Sharing Formula should be adopted for fair cane pricing, factoring in sugar and by-product prices.

- Adoption of Remote Sensing Technologies: There is an urgent need to deploy advanced remote sensing technologies for accurate mapping of sugarcane cultivation areas with reliable data.

- Price Support Mechanism: In cases where the cane price determined by the formula falls below a reasonable level, the government can bridge the gap through a dedicated fund, built from a cess levied on sugar sales.

- Encouragement of Ethanol Production: The government should incentivise ethanol production to reduce dependence on oil imports and manage excess sugar production and stabilise both the sugar and energy markets.

|

Drishti Mains Question: Discuss the challenges faced by India's sugar industry and evaluate the government measures implemented to support it. |

UPSC Civil Services Examination, Previous Year’s Question (PYQs)

Q. With reference to the usefulness of the by-products of sugar industry, which of the following statements is/are correct? (2013)

- Bagasse can be used as biomass fuel for the generation of energy.

- Molasses can be used as one of the feedstocks for the production of synthetic chemical fertilizers.

- Molasses can be used for the production of ethanol.

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Mains

Q. Do you agree that there is a growing trend of opening new sugar mills in the Southern states of India? Discuss with justification. (2013)