Startup India Seed Fund Scheme | 06 Feb 2023

Prelims: Startup India Seed Fund Scheme, Startup India Initiative, DPIIT, Ranking of States on Support to Startup Ecosystems, Make in India, Invest India.

Mains: Startup India Seed Fund Scheme and the Need for early-stage Seed Fund.

Why in News?

Recently, the Ministry of Commerce and Industry has approved Rs. 477.25 crore under the Startup India Seed Fund Scheme (SISFS), which is a flagship Scheme under Startup India Initiative.

- Seed Funding is an early stage of investment in a start-up or a new business idea. The goal of seed funding is to help the company reach a point where it can secure additional rounds of funding or generate revenue to become self-sustaining.

What is the Startup India Initiative?

- The Startup India initiative envisages building a robust Start-up ecosystem in the country for nurturing innovation and providing opportunities to budding entrepreneurs.

- Under the Initiative, an Action Plan of 19 Action Points was unveiled by the Prime Minister in January, 2016.

- This Action Plan laid down a roadmap for the creation of a conducive ecosystem for Startups in India.

- The flagship schemes under Startup India initiative namely, Fund of Funds for Startups (FFS), SISFS and Credit Guarantee Scheme for Startups (CGSS) extend support to startups at various stages of their business cycle.

What is SISFS?

- About:

- The scheme was announced at Startup India International Summit on 16th January 2021.

- Department for Promotion of Industry and Internal Trade (DPIIT) approved an outlay of Rs. 945 Crore for the period of 4 years starting from 2021-22 to provide financial assistance to startups for Proof of Concept, prototype development, product trials, market entry, and commercialization.

- Execution and Monitoring:

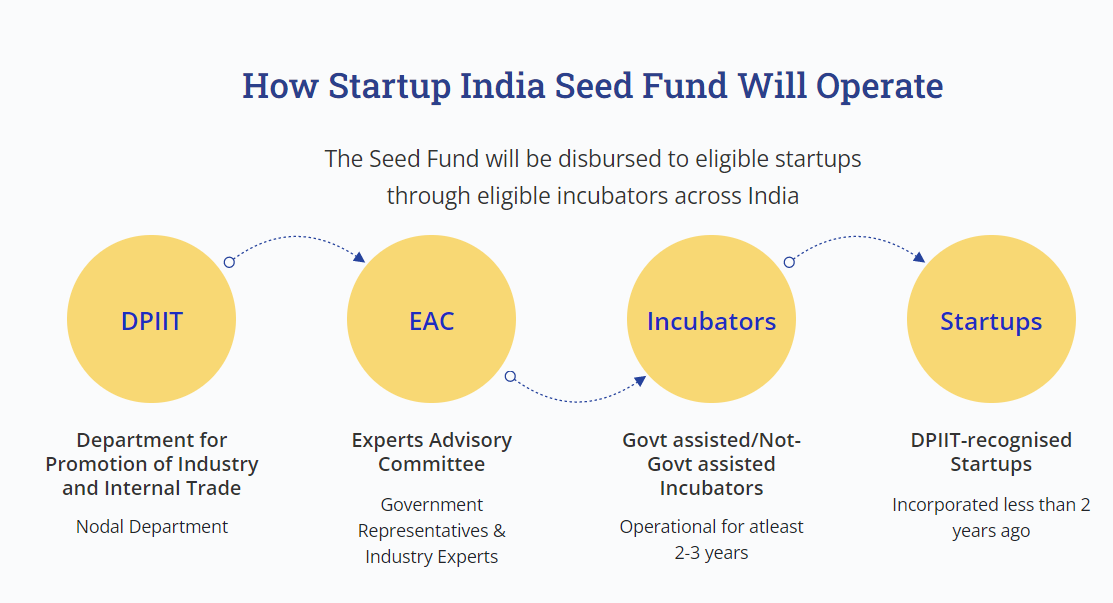

- An Experts Advisory Committee (EAC) has been constituted by DPIIT, which will be responsible for the overall execution and monitoring of the Startup India Seed Fund Scheme.

- The EAC will evaluate and select incubators for allotment of Seed Funds, monitor progress, and take all necessary measures for efficient utilization of funds towards fulfilment of objectives of Startup India Seed Fund Scheme.

- Eligibility:

- A startup, recognized by DPIIT (Ministry of Commerce and Industry), incorporated not more than 2 years ago at the time of application.

- Startups should not have received more than Rs. 10 lakhs of monetary support under any other Central or State Government scheme.

- Preference would be given to startups creating innovative solutions in sectors such as social impact, waste management, water management, financial inclusion, education, agriculture, food processing, biotechnology, healthcare, energy, mobility, defence, space, railways, oil and gas, textiles, etc.

- Grants and Support:

- It will support an estimated 3,600 entrepreneurs through 300 incubators in the next 4 years.

- Grants of upto Rs. 5 crores will be provided to the eligible incubators selected by the committee.

- The selected incubators will provide grants of up to Rs. 20 lakhs for validation of proof of concept, or prototype development, or product trials to startups.

- Investments of up to Rs. 50 lakhs will be provided to the startups for market entry, commercialization, or scaling up through convertible debentures or debt-linked instruments.

What is the Need for Seed Fund?

- Easy availability of capital is essential for entrepreneurs at the early stages of growth of an enterprise.

- The Indian startup ecosystem suffers from capital inadequacy in the seed and ‘Proof of Concept’ development stage.

- The capital required at this stage often presents a make-or-break situation for startups with good business ideas.

- Many innovative business ideas fail to take off due to the absence of this critical capital required at an early stage for proof of concept, prototype development, product trials, market entry and commercialization.

- Seed Fund offered to such promising cases can have a multiplier effect in validation of business ideas of many startups, leading to employment generation.

What are the other Initiatives Pertaining to Startups?

- Startup Innovation Challenges: It is a fantastic opportunity for any startup to leverage their networking and fund-raising efforts.

- National Startup Awards: It seeks to recognize and reward outstanding startups and ecosystem enablers that are contributing to economic dynamism by spurring innovation and injecting competition.

- Ranking of States on Support to Startup Ecosystems: It is an evolved evaluation tool aimed to strengthen the support of States and UTs to holistically build their startup ecosystems.

- SCO Startup Forum: The first-ever Shanghai Cooperation Organisation (SCO) Startup Forum was launched in October 2020 to develop and improve startup ecosystems collectively.

- Prarambh: The ‘Prarambh’ Summit aims to provide a platform to the startups and young minds from around the world to come with new ideas, innovation and invention.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. What does venture capital mean? (2014)

(a) A short-term capital provided to industries

(b) A long-term start-up capital provided to new entrepreneurs

(c) Funds provided to industries at times of incurring losses

(d) Funds provided for replacement and renovation of industries

Ans: (b)

Exp:

- Venture capital is a form of fund for a new or growing business. It usually comes from venture capital firms that specialize in building high risk financial portfolios.

- With venture capital, the venture capital firm gives funding to the startup company in exchange for equity in the startup.

- The people who invest this money are called venture capitalists (VCs). Venture capital investment is also referred as risk capital or patient risk capital, as it includes the risk of losing the money if the venture does not succeed and takes a medium to long term period for the investments to fructify.

- Therefore, option (b) is the correct answer.