Economy

Special Drawing Rights

- 17 May 2022

- 6 min read

For Prelims: Special Drawing Rights, International Monetary Fund

For Mains: Important International Institutions

Why in News?

Recently, the International Monetary Fund lifted the yuan’s weighting in the Special Drawing Rights currency basket, prompting the Chinese central bank to pledge to push for a further opening of its financial markets.

What are the Key Points?

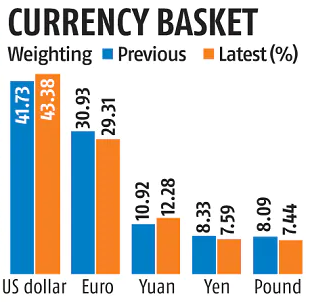

- The IMF raised the yuan’s weighting to 12.28% from 10.92 % in its first regular review of the SDR evaluation since the Chinese currency was included in the basket in 2016.

- The weighting of the US dollar rose to 43.38 % from 41.73 %, while those of euro, Japanese yen and British pound declined.

- The ranking of the currencies’ weighting remains the same after the review, with the yuan continuing to be in third place.

- The change came amid a sharp depreciation of the yuan since late April, as it faces a double whammy of slowing domestic growth because of Covid-induced lockdowns and capital outflows due to its widening monetary policy divergence with the US.

What is Special Drawing Right?

- About:

- The SDR is neither a currency nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members. SDRs can be exchanged for these currencies.

- The SDR serves as the unit of account of the IMF and some other international organizations.

- The currency value of the SDR is determined by summing the values in US dollars, based on market exchange rates, of a SDR basket of currencies.

- The SDR basket of currencies includes the US dollar, Euro, Japanese yen, pound sterling and the Chinese renminbi (included in 2016).

- The SDR currency value is calculated daily (except on IMF holidays or whenever the IMF is closed for business) and the valuation basket is reviewed and adjusted every five years.

- Quota (the amount contributed to the IMF) of a country is denominated in SDRs.

- Members’ voting power is related directly to their quotas.

- IMF makes the general SDR allocation to its members in proportion to their existing quotas in the IMF.

- India’s quota in IMF:

- In 2016, IMF’s quota and governance reforms took place.

- According to which, India’s voting rights increased by 0.3% from then 2.3% to 2.6% and China’s voting rights increased by 2.2% from then 3.8% to 6%.

- Presently, India holds 2.75% of SDR quota, and 2.63% of votes in the IMF.

- India's foreign exchange reserves also incorporate SDR other than gold reserves, foreign currency assets and Reserve Tranche in the IMF.

What is the International Monetary Fund?

- About:

- The IMF was set up along with the World Bank after the Second World War to assist in the reconstruction of war-ravaged countries.

- The two organizations were agreed to be set up at a conference in Bretton Woods in the US. Hence, they are known as the Bretton Woods twins.

- Created in 1945, the IMF is governed by and accountable to the 190 countries that make up its near-global membership. India joined in December 1945.

- The IMF's primary purpose is to ensure the stability of the international monetary system — the system of exchange rates and international payments that enable countries (and their citizens) to transact with each other.

- Its mandate was updated in 2012 to include all macroeconomic and financial sector issues that bear on global stability.

- The IMF was set up along with the World Bank after the Second World War to assist in the reconstruction of war-ravaged countries.

- Reports by IMF:

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. Recently, which one of the following currencies has been proposed to be added to the basket of IMF’s SDR? (2016)

(a) Rouble

(b) Rand

(c) Indian Rupee

(d) Renminbi

Ans: (d)

Q. Which one of the following groups of items is included in India’s foreign-exchange reserves? (2013)

(a) Foreign-currency assets, Special Drawing Rights (SDRs) and loans from foreign countries

(b) Foreign-currency assets, gold holdings of the RBI and SDRs

(c) Foreign-currency assets, loans from the World Bank and SDRs

(d) Foreign-currency assets, gold holdings of the RBI and loans from the World Bank

Ans: (b)