SEBI Board Approves Regulatory Framework | 01 Dec 2023

For Prelims: Securities & Exchange Board of India (SEBI), Alternative Investment Funds (AIFs), IOSCO Principles for Financial Benchmarks, SEBI (Mutual Funds) Regulations, 1996, SEBI (Real Estate Investment Trusts) Regulations, 2014, Small & Medium REITs (SM REITs), Social Stock Exchange (SSE), Zero Coupon Zero Principal Instruments (ZCZP).

For Mains: Need for and significance of robust regulatory framework for capital markets by SEBI as per international standards and principles.

Why in News?

Securities & Exchange Board of India’s (SEBI's) board approved a framework for Index Providers to enhance transparency and accountability in governing and administering financial benchmarks in the securities market.

What are the New Regulations Framed by SEBI?

- Framework for Registration of Index Providers:

- SEBI announced the approval of regulations establishing a framework for the registration of Index Providers. This framework will be applicable specifically to 'Significant Indices,' which SEBI will identify based on objective criteria.

- The regulatory structure aligns with the International Organization of Securities Commissions (IOSCO) Principles for Financial Benchmarks.

- SEBI announced the approval of regulations establishing a framework for the registration of Index Providers. This framework will be applicable specifically to 'Significant Indices,' which SEBI will identify based on objective criteria.

- Dematerialization Requirement for AIF Investments:

- SEBI introduced a requirement for Alternative Investment Funds (AIFs) to hold fresh investments made after September 2024 in dematerialized form.

- However, existing investments are exempt, except in cases mandated by applicable law or when the AIF, alone or with other SEBI-registered entities, has control in the investee company.

- The mandate for the appointment of custodians, previously applicable to specific AIF categories, will now extend to all AIFs.

- SEBI introduced a requirement for Alternative Investment Funds (AIFs) to hold fresh investments made after September 2024 in dematerialized form.

- Amendments to SEBI (Real Estate Investment Trusts) Regulations:

- The SEBI board approved amendments to the Real Estate Investment Trusts (REITs) Regulations, creating a regulatory framework for Small & Medium REITs (SM REITs) with an asset value of at least ₹50 crore.

- SM REITs will be able to establish separate schemes for owning real estate assets through special purpose vehicles (SPVs).

- Flexibility in Social Stock Exchange (SSE) Framework:

- SEBI provided flexibility in the framework for the Social Stock Exchange (SSE) to boost fundraising by Not-for-Profit Organizations (NPOs).

- This includes a reduction in the minimum issue size and application size for public issuance of Zero Coupon Zero Principal Instruments (ZCZP) by NPOs on SSE, encouraging wider participation, including retail investors.

- Nomenclature Change and Comfort Measures for NPOs:

- SEBI approved a change in the nomenclature from "Social Auditor" to "Social Impact Assessor" to convey a positive approach toward the social sector.

- This measure is intended to provide comfort to NPOs involved in the SSE and reinforce SEBI's support for social impact initiatives.

Key Terminologies

- Index Providers: These are entities responsible for creating, maintaining, and calculating the values of financial indices. A financial index is a statistical measure of the performance of a specific segment of the financial markets.

- Alternative Investment Fund (AIF): AIF means any fund established in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors.

- Categories

- Category I AIFs: These generally invest in start-ups or early stage ventures which the government or regulators consider as socially or economically desirable.

- e.g. venture capital funds, infrastructure funds.

- Category II AIFs: These are AIFs which do not fall in Category I and III and which do not undertake leverage or borrowing other than to meet day-to-day operational requirements and as permitted in the SEBI (Alternative Investment Funds) Regulations, 2012.

- e.g. real estate funds, private equity funds.

- Categories III AIFs: AIFs which employ diverse or complex trading strategies and may employ leverage including through investment in listed or unlisted derivatives.

- e.g. hedge funds, private investment in Public Equity Funds.

- Category I AIFs: These generally invest in start-ups or early stage ventures which the government or regulators consider as socially or economically desirable.

- Categories

- Real Estate Investment Trusts (REITs): These are investment vehicles that allow individuals to invest in large-scale, income-producing real estate without having to directly manage or own the properties.

- REITs pool capital from multiple investors to invest in a diversified portfolio of real estate assets, which may include residential or commercial properties, shopping centers, office buildings, hotels etc.

- Social Stock Exchange (SSE): The SSE would function as a separate segment within the existing stock exchange and help social enterprises raise funds from the public through its mechanism.

- It would serve as a medium for enterprises to seek finance for their social initiatives, acquire visibility and provide increased transparency about fund mobilisation and utilisation.

What is SEBI?

- About:

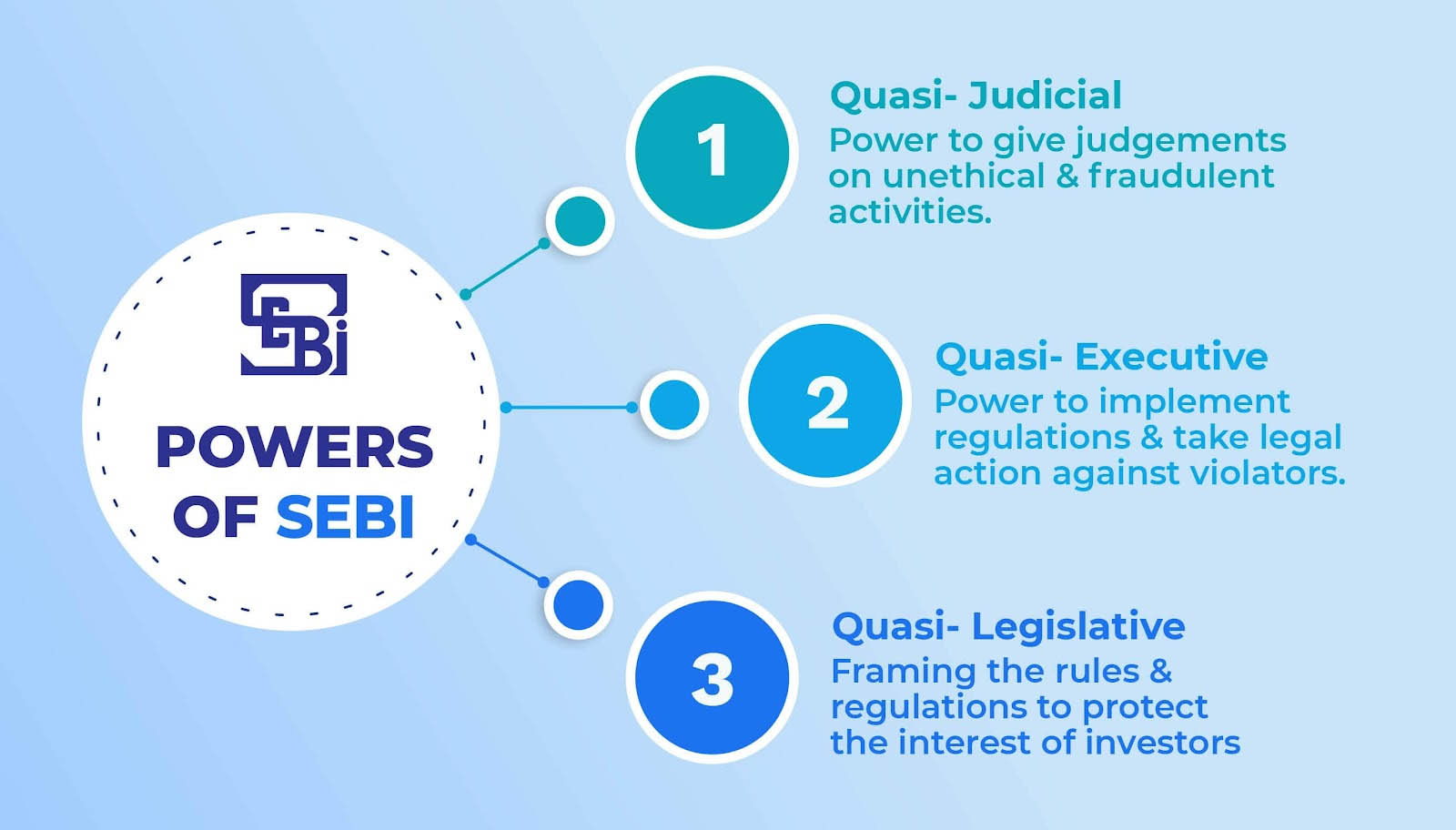

- SEBI is a Statutory Body (a Non-Constitutional body which is set up by a Parliament) established in 1992 in accordance with the provisions of the Securities and Exchange Board of India Act, 1992.

- The basic functions of SEBI is to protect the interests of investors in securities and to promote and regulate the securities market.

- The headquarters of SEBI is situated in Mumbai. The regional offices of SEBI are located in Ahmedabad, Kolkata, Chennai and Delhi.

- Background:

- Before SEBI came into existence, Controller of Capital Issues was the regulatory authority, it derived authority from the Capital Issues (Control) Act, 1947.

- In 1988, the SEBI was constituted as the regulator of capital markets in India under a resolution of the Government of India.

- Initially SEBI was a non statutory body without any statutory power but became autonomous and given statutory powers by SEBI Act 1992.

- Structure:

- SEBI Board consists of a Chairman and several other whole time and part time members.

- SEBI also appoints various committees, whenever required to look into the pressing issues of that time.

- Further, a Securities Appellate Tribunal (SAT) has been constituted to protect the interest of entities that feel aggrieved by SEBI’s decision.

- SAT consists of a Presiding Officer and two other Members.

- It has the same powers as vested in a civil court. Further, if any person feels aggrieved by SAT’s decision or order can appeal to the Supreme Court.

What is IOSCO?

- About:

- Founded: April 1983

- Headquarters: Madrid, Spain

- IOSCO Asia Pacific Hub is located in Kuala Lumpur, Malaysia.

- It is the international organization that brings together the world's securities regulators, covering more than 95% of the world’s securities markets, and is the global standard setter for the securities sector.

- It works closely with the G20 (Group of Twenty) and the Financial Stability Board (FSB) in setting up the standards for strengthening the securities markets.

- The FSB is an international body that monitors and makes recommendations about the global financial system.

- The IOSCO Objectives and Principles of Securities Regulation have been endorsed by FSB as one of the key standards for sound financial systems.

- IOSCO's enforcement role extends to matters of interpretation of International Financial Reporting Standards (IFRS), where IOSCO maintains a (confidential) database of enforcement actions taken by member agencies.

- IFRS is an accounting standard that has been issued by the International Accounting Standards Board (IASB) with the objective of providing a common accounting language to increase transparency in the presentation of financial information.

- Objectives:

- To cooperate in developing, implementing and promoting adherence to internationally recognized and consistent standards of regulation, oversight and enforcement in order to protect investors, maintain fair, efficient and transparent markets, and seek to address systemic risks;

- To enhance investor protection and promote investor confidence in the integrity of securities markets, through strengthened information exchange and cooperation in enforcement against misconduct and in supervision of markets and market intermediaries; and

- To exchange information at both global and regional levels on their respective experiences in order to assist the development of markets, strengthen market infrastructure and implement appropriate regulation.

- Membership:

- IOSCO provides members the platform to exchange information at the global level and regional level on areas of common interests.

- SEBI is an ordinary member of IOSCO.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Which of the following is issued by registered foreign portfolio investors to overseas investors who want to be part of the Indian stock market without registering themselves directly? (2019)

(a) Certificate of Deposit

(b) Commercial Paper

(c) Promissory Note

(d) Participatory Note

Ans: (d)