Indian Economy

Rising GST Revenues

- 02 Nov 2020

- 5 min read

Why in News

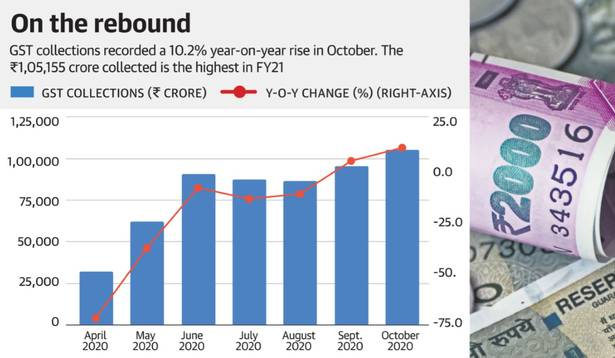

According to the recent data released by the Finance Ministry, the gross Goods and Services Tax (GST) revenue collected in October 2020 was Rs. 1.05 lakh crore.

- It is 10.25% higher than in 2019 and 10.1% more than the revenue garnered in September 2020.

Key Points

- The total revenue earned in October by the Central and State governments stood at Rs. 44,285 crore and Rs. 44,839 crore, respectively.

- GST cess collections, used to compensate the States for switching to the GST regime, rose to Rs. 8,011 crore, which is over 5% more than in 2019 and 12.5% higher than September 2020.

- October’s revenues from import of goods were 9% higher, while domestic transactions (including import of services) yielded 11% higher revenues, on a year-on-year basis.

- Status of the States:

- Andhra Pradesh and Chhattisgarh recorded the highest 26% growth in GST collections in October year-on-year, followed by Jharkhand (23%) and Rajasthan (22%).

- The trend in the more industrially developed States was mixed, with 15% growth in Gujarat, 13% in Tamil Nadu and just 5% in Maharashtra.

- Reasons:

- The surge in October's GST inflows could be attributed to the festive demand and input tax credits as well as other reconciliations that were due for businesses in September.

- Many companies raised sale invoices in September by pushing out their finished products which they had planned in March itself.

- Input Tax Credit: The GST that a merchant pays to procure goods or services (i.e. on inputs) can be set off later against the tax applicable on supply of final goods and services. The set-off tax is called an input tax credit.

- India’s manufacturing sector activities started to show signs of growth in August and September, driven mainly by a pick-up in production along with improvement in customer demand.

- The surge in October's GST inflows could be attributed to the festive demand and input tax credits as well as other reconciliations that were due for businesses in September.

- Implications:

- GST inflows crossing the Rs. 1 lakh crore mark for the first time in the financial year (FY) 2020-21 is a clear sign of a recovery in the economy after its 23.9% contraction in the first quarter of 2020.

- The expected shortfall in GST compensation for the States could be lower than the current estimate of Rs. 2.35 lakh crore if this revenue momentum is maintained through the rest of 2020-21.

- According to the Consortium of Indian Associations, October’s GST inflows must not be considered a return to normalcy for businesses as these revenues normally relate to sales that occurred in September, when a majority of the economy, including public transport, was unlocked.

- The consortium of Indian Associations is an umbrella body of Micro, Small and Medium Enterprises (MSME).

- November and December data has to be awaited before confidently saying that the economy has rebounded to pre-Covid-19 times.

Goods and Services Tax

- It is a comprehensive, multi-stage, destination-based indirect tax that is levied on every value addition.

- The Goods and Service Tax Act was passed in the Parliament on 29th March 2017 and came into effect on 1st July 2017.

- Under the GST Council and 101st constitutional amendment 2017, the tax is levied at every point of sale.

- GST is categorised into Central GST (CGST), State GST (SGST) and Integrated GST (IGST) depending on whether the transaction is intra-State or inter-State.

- Central GST: CGST is a tax levied on intra-State supplies of both goods and services by the Central Government and is governed by the CGST Act.

- State GST: SGST is also levied on the same intra-State supply but will be governed by the State Governments.

- This implies that both the Central and the State governments agree on combining their levies with an appropriate proportion for revenue sharing between them.

- However, it is clearly mentioned in Section 8 of the GST Act that the taxes be levied on all intra-State supplies of goods and/or services but the rate of tax shall not be exceeding 14%, each.

- Integrated GST: IGST is a tax levied on all inter-State supplies of goods and/or services and is governed by the IGST Act.

- It is applicable to any supply of goods and/or services in both cases of import into and export from India.