Governance

Rise in Donation Through Electoral Trust

- 20 Jan 2025

- 13 min read

For Prelims: Electoral Bonds, Supreme Court (SC), Association for Democratic Reforms v Union of India case, 2024, Electoral bonds scheme, Representation of the People Act, 1951, Election Commission of India (ECI), Finance Act 2017, Articles 19, 14, and 21.

For Mains: Effects of Electoral Bonds on the election process, Issues Arising Out of Design & Implementation of Electoral Bonds.

Why in News?

The Electoral Trust Contribution reports released by the Election Commission of India (ECI) for the FY 2023-24, indicate a significant increase in donations to political parties through electoral trusts.

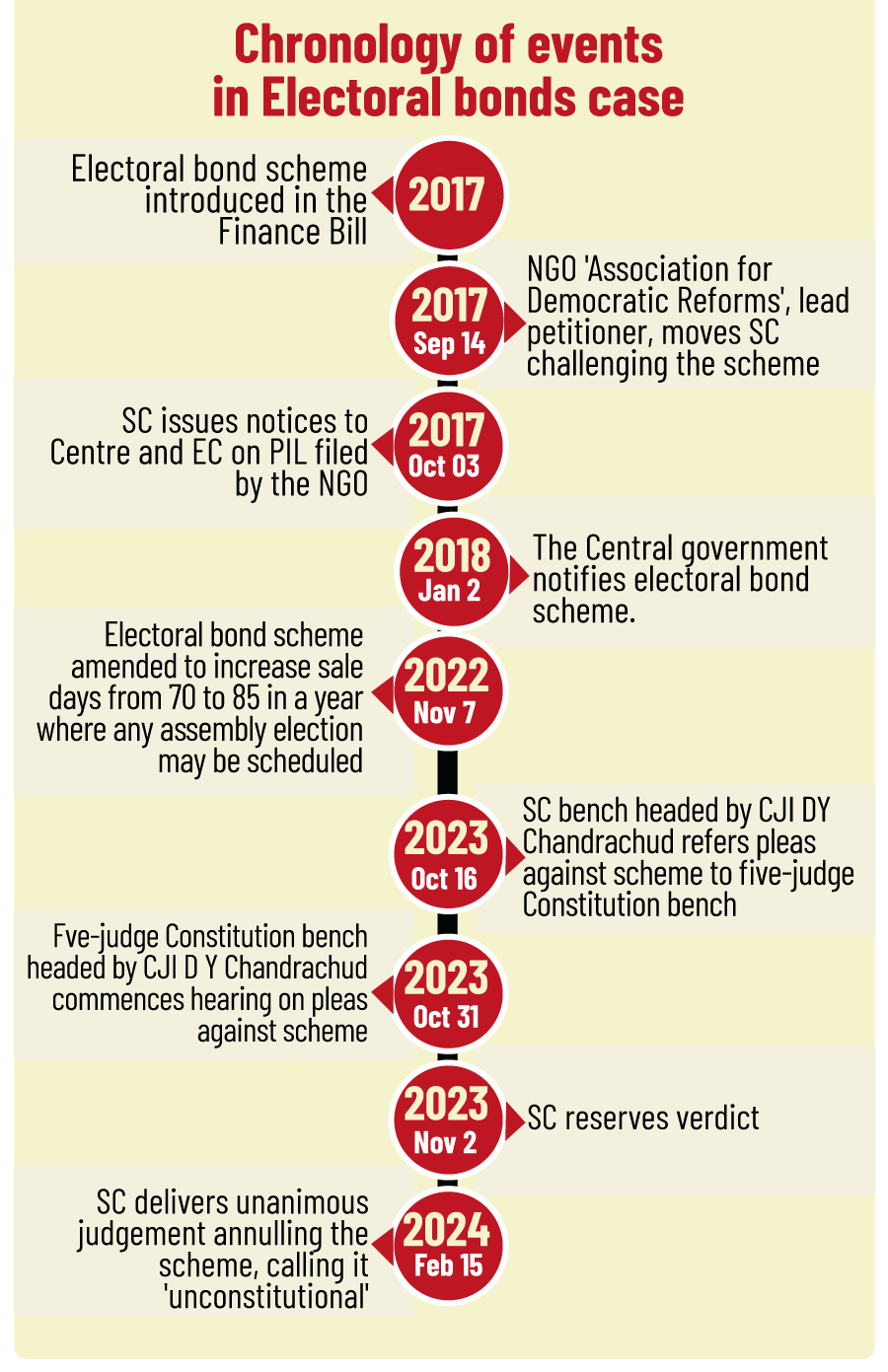

- This increase followed the Association for Democratic Reforms vs Union of India case, 2024, in which SC declared the electoral bonds scheme unconstitutional and directed banks to cease issuing bonds immediately.

What are the Key Highlights of the ECI’s Report and its Implications?

- Highlights of the Report:

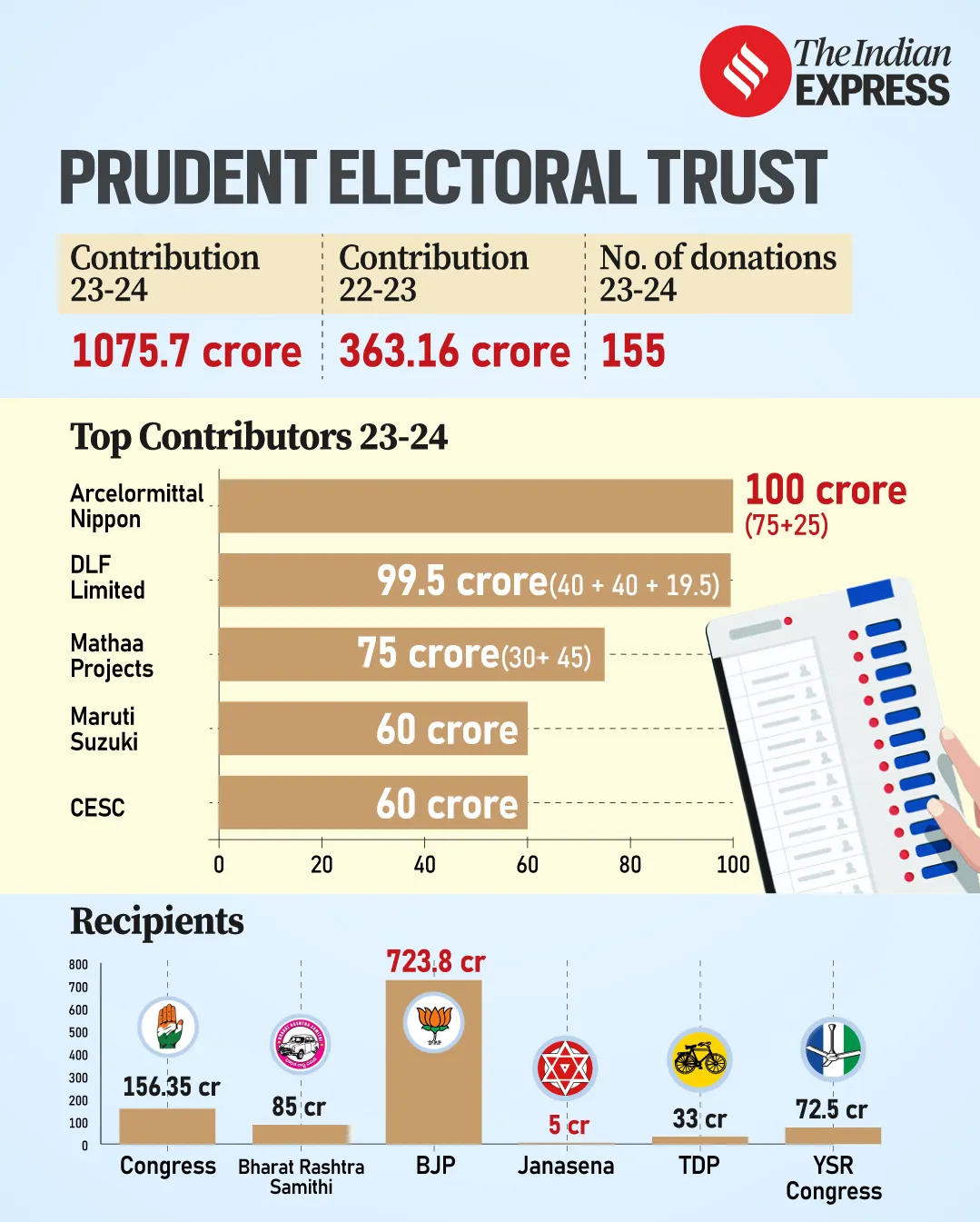

- Surge in Donations: The contribution to the Prudent Electoral Trust (PET) increased almost three-fold from 2022-23 to 2023-24.

- PET is the largest electoral trust in India, receiving Rs 1,075.71 crore in FY24. Represents a significant concentration of corporate donations within a single trust.

- Major Recipient: The ruling party at centre (BJP) was the largest beneficiary, followed by the Congress, Bharat Rashtra Samithi (BRS), and YSR Congress.

- Status of Electoral Trusts: With more than 15 electoral trusts recognized by the ECI, only five trusts, including PET, received donations during this period.

- Surge in Donations: The contribution to the Prudent Electoral Trust (PET) increased almost three-fold from 2022-23 to 2023-24.

- Implications:

- Comparative Analysis: Unlike electoral bonds, which enabled Rs 12,000 crore in anonymous donations between 2018 and 2023, the SC ruling in Association for Democratic Reforms vs Union of India case 2024, declaring them unconstitutional has significantly shifted political funding towards electoral trusts.

- This shift has enhanced transparency by disclosing donor identities, amounts, and recipient parties, with trusts like Prudent Electoral Trust receiving 74% of their FY24 donations (Rs 797.1 crore out of Rs 1,075.7 crore) post-ruling.

- Economic Dimensions: Electoral trusts channel large-scale corporate funds into political systems, reinforcing corporate influence on party finances.

- The dominance of a few trusts like Prudent and Triumph highlights the centralization of political funding among top donors.

- Comparative Analysis: Unlike electoral bonds, which enabled Rs 12,000 crore in anonymous donations between 2018 and 2023, the SC ruling in Association for Democratic Reforms vs Union of India case 2024, declaring them unconstitutional has significantly shifted political funding towards electoral trusts.

What are Electoral Trusts?

- About; The Electoral Trusts, introduced in 2013, are non-profit entities established to collect funds from donors and distribute them to political parties.

- Legal Framework: These trusts are regulated under the Companies Act, 1956. Section 25 of this act (now section 8 in new Companies Act, 2013) allows any company to establish an electoral trust under this scheme.

- Eligibility for Donations: Section 17CA of the Income Tax Act, 1961 permits donations to electoral trusts from:

- Indian citizens, Companies registered in India, Firms, Hindu Undivided Families (HUF), or associations of persons residing in India.

- Donors are required to provide their PAN (for residents) or passport number (for NRIs) at the time of making contributions.

- Donations to Political Parties: Electoral trusts must donate at least 95% of the funds they receive in a financial year to eligible political parties that are registered under the Representation of the People Act, 1951.

- Registration and Renewal: Electoral trusts are required to apply for renewal every three financial years in order to continue their registration and operations.

- Key Differences Between Electoral Bonds and Electoral Trusts:

|

Feature |

Electoral Bonds |

Electoral Trusts |

|

Regulation |

Primarily regulated by the RBI, SBI, and Election Commission. |

Regulated by the Companies Act, monitored by the Election Commission and Income Tax Department. |

|

Purpose |

Aims to streamline donations while maintaining donor anonymity. |

Focuses on aggregating donations and ensuring transparency. |

|

Tax Benefits |

Donors can avail deductions under Section 80GGC. |

Donors receive tax deductions for donations through the Trust. |

|

Operational Mechanism |

Donations are made directly to political parties via bonds. |

Trusts collect funds and distribute them to political parties. |

|

Donor Disclosure |

Donors’ identities remain undisclosed. |

Donors’ identities are publicly disclosed. |

|

Transparency |

Anonymity of donors and recipients; concerns over undisclosed corporate influence. |

Full disclosure of donors and recipients details to the public. |

What is the Electoral Bond Scheme?

- About:The Electoral Bonds Scheme, introduced in 2018, is a money instrument similar to promissory notes, available for purchase by individuals and companies from the State Bank of India (SBI).

- The bonds can only be redeemed by registered political parties in a designated account.

- The person purchasing the bonds can either buy them singly or jointly with others.

- Objective: The primary goal was to ensure transparency in electoral funding, with the government presenting it as a reform for a nation progressing towards a digital economy.

- Amendments to Scheme: In 2022 amendment to the scheme introduced an extra 15-day period for the purchase of electoral bonds during years of state legislative assembly elections.

- Electoral bonds are valid for 15 days from issuance. If not deposited within that time, they cannot be used. If deposited by the political party within the validity period, the bond is credited to their account on the same day.

- Only political parties registered under Section 29A of the Representation of the People Act, 1951 (RPA) that secured at least 1% of the votes in the last general election (either Lok Sabha or State Legislative Assembly) are eligible to receive Electoral Bonds.

- Declared Unconstitutional: In Association for Democratic Reforms vs Union of India case, 2024, SC declared the scheme as Unconstitutional and found that the anonymity allowed in the scheme violates the fundamental right to information under Article 19(1)(a) of the Constitution,

What are the Recommendations Related to Electoral Funding in India?

- Indrajit Gupta Committee, 1998: Endorsed state funding of elections to establish a fair playing field for parties with less financial resources.

- Recommended limitations:

- State funds to be allocated only to national and state parties with allotted symbols, not independent candidates.

- Initially, state funding should be provided in kind, offering certain facilities to recognised political parties and their candidates.

- Acknowledged economic constraints, advocating partial rather than full state funding.

- Recommended limitations:

- Law Commission, 1999: Described total state funding of elections as desirable under the condition that political parties are prohibited from receiving funds from other sources.

- The Commission proposed amending the RPA, 1951, introducing section 78A for maintenance, audit, and publication of political party accounts, with penalties for non-compliance.

- Election Commission's Recommendations: The 2004 report of the Election Commission emphasised the necessity for political parties to publish their accounts annually, allowing scrutiny by the general public and concerned entities.

- Audited accounts, ensuring accuracy, should be made public, with auditing performed by Comptroller and Auditor General-approved firms.

What are the Issues Related to Electoral Funding in India?

- Transparency Issue: Electoral Bonds were meant to ensure transparency, but donor anonymity undermines it, especially for the public and opposition. Transparency issue in electoral bonds allows the ruling party to manipulate donor information, compromising elections.

- The ruling party may access donor details via SBI, potentially victimizing non-supportive companies.

- Impact on Democracy: Voters remain unaware of donation sources, limiting their ability to make informed choices. Electoral bonds restrict citizens' right to know about political donations, affecting participatory democracy.

- Crony Capitalism: The removal of donation caps (7.5% of their average net profits from the past 3 financial years) opens the door for corporate influence on politics, fostering crony capitalism.

- Crony Capitalism is an economic system characterized by close, mutually advantageous relationships between business leaders and government officials.

- Imbalance in Funding: Association for Democratic Reforms (ADR) Report, 2023 highlights that national parties, especially the ruling party, dominate electoral bond donations, creating an unequal funding landscape.

- As electoral bonds show disproportionate donations from the corporate sector, strengthening the power of the ruling party.

Way Forward

- Balancing Transparency and Anonymity: One of the most prominent responses is to balance legitimate public interests in transparency and anonymity. Many jurisdictions strike this balance by allowing anonymity for small donors, while requiring disclosures of large donations.

- In the UK, a party needs to report donations received from a single source amounting to a total of more than Pounds 7,500 in a calendar year.

- The analogous limit in Germany is Euros 10,000.

- Regulation of Donations: Countries should focus on limiting donations to avoid dominance by large donors. As limits prevent financial arms races in elections.

- Electoral Trusts can ensure donations stay within limits and are allocated properly.

- Public Funding for Parties: Public funding is based on party performance, with disclosure ensuring transparency while anonymity protects smaller donors.

- National Election Fund: A national fund could gather donations from all donors and distribute them to political parties based on their electoral performance.

- This approach would address concerns about potential reprisals against donors.

|

Drishti Mains Question Discuss the role of electoral trusts in promoting transparency, highlight the difference between electoral bond and electoral trust, and suggest measures to enhance electoral accountability and regulatory oversight. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. ‘Right to Privacy’ is protected under which Article of the Constitution of India?

(a) Article 15

(b) Article 19

(c) Article 21

(d) Article 29

Ans: (c)

Mains:

Q. The Right to Information Act is not all about citizens’ empowerment alone, it essentially redefines the concept of accountability.” Discuss. (2018)