RBI Reduces Risk Weights on NBFCs and MFIs Loans | 28 Feb 2025

Why in News?

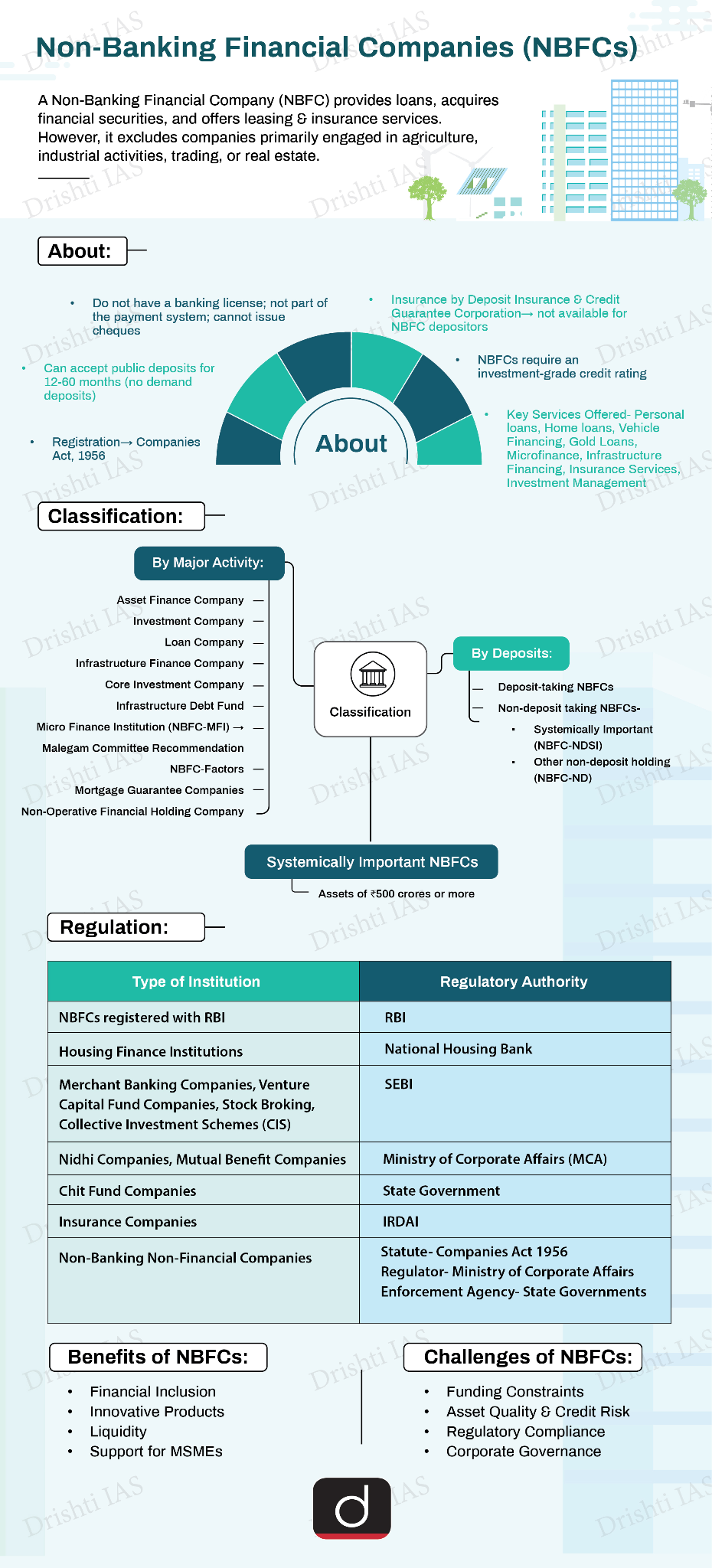

Reserve Bank of India (RBI) reduced the risk weights of bank loans to NBFCs and Microfinance Institutions to boost credit flow and enhance lending to the retail sector of the economy.

What is the Risk Weight on Loans and How Does It Impact NBFCs and Banks?

- About: Risk weight is a percentage factor assigned to a bank’s assets, including loans, to determine the amount of capital required to cover potential losses.

- Higher risk weight increases capital requirements, making loans costlier, while lower risk weight reduces capital needs, enabling more lending.

- Criteria: Risk weights depend on credit rating, asset type, and regulations. Highly rated borrowers get lower risk weights, while low-rated ones face higher risk weights.

- Impact of Lower Risk Weights:

- Encouraging Bank Lending to NBFCs: Banks need to hold less capital for loans, increasing their lending capacity to NBFCs.

- Positive Impact on Credit Growth: Enhanced liquidity will boost NBFC lending in housing, consumer finance, and MSMEs. The retail sector gains from improved access to credit.

- Enhancing Financial Stability: Boosting credit growth increases employment, income levels and financial resilience.

Capital Adequacy Ratio (CAR)

- About: It measures a bank's financial strength, ensuring a bank has enough capital to absorb potential losses and protect depositors.

- Components:

- Tier-1 Capital: Core capital (equity, share capital, retained earnings) used to absorb losses while the bank continues operating.

- Tier-2 Capital: Secondary capital (unaudited reserves, subordinated debt) used when the bank is winding down.

- Regulatory Requirement: It is set by the Basel Accords and enforced by central banks (e.g., RBI in India).

- As per Basel III norms, banks are required to maintain a minimum CAR of 8% globally, while RBI mandates 9% for Indian banks.

- Importance: A higher CAR indicates a bank is financially stable and capable of handling financial crises.

UPSC Civil Services Examination Previous Year Questions (PYQ)

Prelims

Q. Microfinance is the provision of financial services to people of low-income groups. This includes both the consumers and the self-employed. The service/services rendered under microfinance is/are (2011)

- Credit facilities

- Savings facilities

- Insurance facilities

- Fund Transfer facilities

Select the correct answer using the codes given below the lists:

(a) 1 only

(b) 1 and 4 only

(c) 2 and 3 only

(d) 1, 2, 3 and 4

Ans: (d)