Raising of Asset Monetisation Target | 14 Oct 2024

For Prelims: NITI Aayog, National Monetisation Pipeline, Brownfield Assets, National Infrastructure Pipeline, Public-Private Partnership, Infrastructure Investment Trusts, Disinvestment, monopoly.

For Mains: Infrastructure financing, Performance of National Monetisation Pipeline (NMP).

Why in News?

Recently, the NITI Aayog has increased the asset monetisation target for 2024-25 (FY25) by Rs 23,000 crore to Rs 1.9 trillion.

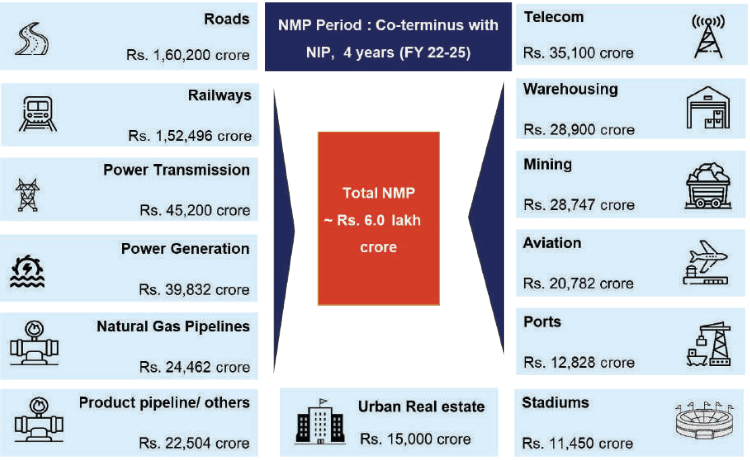

- With this, NITI Aayog moved closer to the overall Rs 6 trillion (Rs 6 lakh crore) target set under the National Monetisation Pipeline (NMP) for a four-year period (FY 2022-25).

What is Asset Monetisation?

- About Asset Monetisation: Monetising an asset means converting it into a form that can generate revenue or currency.

- Monetising involves using something of value to generate profit or convert it into cash. For example, a government may monetise its national debt by acquiring treasury securities, thereby increasing the money supply.

- Need of Asset Monetisation: It unlocks the economic value of underutilised or unutilised public assets to create new revenue streams for governments and public entities.

- It aims to identify and leverage these assets to generate financial returns without necessarily selling them outright.

- Focus on Public Assets: Public assets that can be monetised include properties owned by public bodies, such as infrastructure like roads, airports, railways, pipelines, and mobile towers.

- The focus is on brownfield assets, which are existing assets that can be improved or put to better use.

- Brownfield assets are those which a private company or investor purchases or leases an existing infrastructure project or production facility to carry out new production activity.

- Monetisation vs. Privatisation: Privatisation entails complete ownership transfer to the private sector, while asset monetisation involves structured partnerships with private entities, allowing public authorities to retain ownership while benefiting from private sector efficiency and investment.

What is the National Monetisation Pipeline (NMP)?

- About NMP: The NMP is a key initiative to promote sustainable infrastructure financing through the monetisation of operating public infrastructure assets.

- It envisages an aggregate monetisation potential of Rs 6 lakh crore through the leasing of core assets of the Central government and public sector entities.

- Preparation of NMP: The pipeline has been prepared by NITI Aayog in consultation with infrastructure line ministries.

- These include ministries responsible for Roads, Transport, Highways, Railways, Power, Civil Aviation, Telecommunications, and others.

- The NMP targets brownfield infrastructure assets, offering public asset owners a roadmap and providing the private sector with visibility on monetisation opportunities.

- Sectors and Asset Classes Covered: The NMP covers a wide array of sectors including roads, ports, airports, railways, gas & product pipelines, power generation and transmission, mining, telecom, warehousing, and more.

- The top 5 sectors include roads (27% of the total pipeline value) followed by railways (25%), power (15%), oil & gas pipelines (8%) and telecom (6%).

- Monetisation Framework: The framework for monetisation of core asset monetisation has three key mandates.

- Monetization of 'Rights' NOT ‘Ownership': The government retains primary ownership of the assets and assets are returned to public authority after the transaction period ends.

- Stable Revenue: It involves selecting de-risked brownfield assets with stable revenue.

- Defined Partnership: Structured partnerships are established under well-defined contractual frameworks, with strict key performance indicators (KPIs) and performance standards.

- Link with NIP: The NMP is aligned with the National Infrastructure Pipeline (NIP), ensuring that the monetisation period is co-terminus with the NIP, which runs through FY 2022 to FY 2025.

- The purpose of NMP is to reinvest capital into the Rs 111 trillion National Infrastructure Pipeline.

- NIP aims to attract investments in key greenfield and brownfield projects across all economic and social infrastructure sub-sectors.

- Instruments for Monetisation: The NMP will utilise a variety of instruments for asset monetisation, including:

- Public-Private Partnership (PPP) concessions for direct contracts.

- Infrastructure Investment Trusts (InvITs) and other capital market instruments.

- InvITs enables direct investment of money from individual and institutional investors in infrastructure projects to earn a portion of the income as return.

What is the Current Status of the National Monetisation Pipeline?

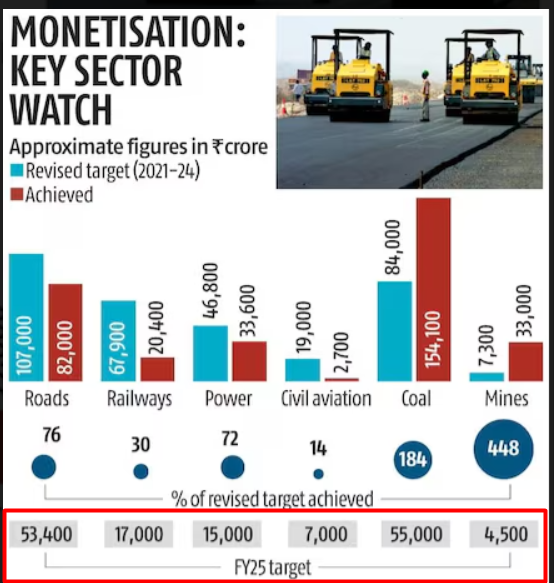

- Revenue Generation: The NMP has generated Rs 3.9 trillion in the first three years (up to FY24), achieving most of its adjusted targets. The original target for this period was Rs 4.3 trillion.

- Successful Monetisation: The Ministry of Coal has raised Rs 1.54 trillion against its four-year target of Rs 80,000 crore, far exceeding expectations.

- Additionally, mines have been monetised to the tune of Rs 32,000 crore, surpassing the revised target of Rs 7,300 crore.

- Lagging Sectors:

- Railways: Despite being a major focus area, the Ministry of Railways has only monetised assets worth Rs 20,417 crore over the past three years, meeting just 30% of its revised target.

- Warehousing: Achieved 38% of its target, amounting to Rs 8,000 crore.

- Civil Aviation: Lagging significantly, having monetised only 14% of its targeted Rs 2,600 crore asset base.

What are Challenges with NMP?

- Low Monetisation Potential: The NMP targets the monetisation of Rs 6 lakh crore which is only 5-6% of the overall capital expenditure under the National Infrastructure Pipeline (Rs 111 lakh crore).

- Missing Disinvestment: The 13 sectors chosen for monetization have consistently missed their disinvestment targets year after year in recent years. It raises doubt on achieving actual monetisation targets.

- Long-Term Rights: Monetisation could grant private players long-term rights (up to 60 years) to operate and profit from public assets. It can be viewed by many as privatisation raising suspicion about government motives.

- Budgeting and Proceeds Usage: The NMP lacks clarity on how proceeds from monetisation will be accounted for within the budget.

- There are no specific guidelines on whether these funds will finance infrastructure or be used for revenue expenditures, such as salaries or subsidies.

- Monopolisation: The consolidation of ownership may lead to monopolies, particularly in the case of highways and railway lines. It could lead to increased prices.

- Issue of Taxpayers’ Money: Taxpayers are concerned about potential double charges on public assets, as they first funded their creation and now face additional costs for using them through payments to private entities after monetization.

Way Forward

- Expedite Contract-Based Monetisation: The government should prioritise the acceleration of contract-based monetisation through Public-Private Partnership (PPP) concession agreements particularly in railways and airports, where investor interest is strong.

- Implement Land Monetisation Initiatives: Engaging real estate and infrastructure companies in developing multi-storey buildings can enhance housing amenities while generating revenue.

- Establish Clear Budgeting Guidelines: The NMP should establish clear guidelines on how monetization proceeds will be treated in the budget, specifying whether funds will be allocated for infrastructure development or operational expenses.

|

Drishti Mains Question: Examine the objectives of the National Monetisation Pipeline (NMP). How does the NMP plan to leverage public assets for economic development? |

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Mains

Q. Account for the failure of the manufacturing sector in achieving the goal of labour-intensive exports. Suggest measures for more labour-intensive rather than capital-intensive exports. (2017)

Q. The nature of economic growth in India in recent times is often described as jobless growth. Do you agree with this view? Give arguments in favour of your answer. (2015)