Rapid Fire

Proposed Abolition of Equalisation Levy

- 26 Mar 2025

- 2 min read

The Union Government has proposed abolishing the Equalisation Levy which will benefit advertisers on digital platforms like Google, X (formerly Twitter), and Meta by reducing tax burdens.

Equalisation Levy (Digital services tax):

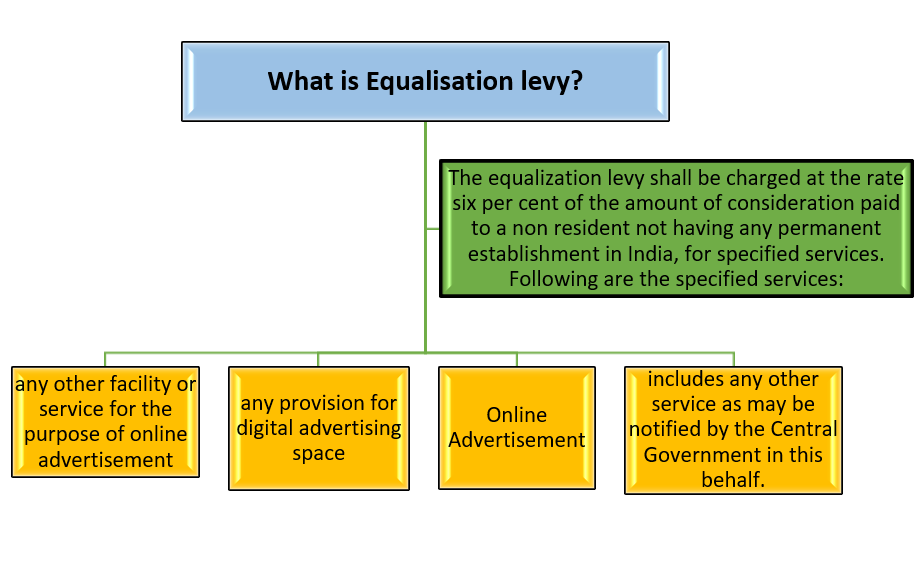

- About: Equalisation Levy, introduced in 2016, is a direct tax imposed on foreign digital service providers to tax income generated from digital transactions in India.

- Objective: It aims to ensure fair taxation of digital businesses that do not have a physical presence in India, aligning with the BEPS (Base Erosion and Profit Shifting) Action Plan to curb tax avoidance.

- Applicability: It is deducted at the time of payment by the service recipient if:

- The payment is made to a non-resident service provider.

- The annual payment to a single provider exceeds Rs. 1,00,000 in a financial year.

- Covered Services & Tax Rates: The Equalisation Levy initially applied to online ads (6%) and was expanded in 2020 to cover digital services and e-commerce (2%), with the latter abolished in August 2024.

- Exemptions: It does not apply if the non-resident has a permanent office in India, payments are below Rs.1 lakh, or the income is covered under Section 10(50) to prevent double taxation.

- Income taxed as royalties or fees for technical services is excluded.

| Read More: Key Economic Reforms in the Budget 2024-25 |