Important Facts For Prelims

Project Nexus of BIS

- 02 Jul 2024

- 5 min read

Why in News?

Recently, the Reserve Bank of India (RBI) has joined Project Nexus, a multilateral international initiative to enable instant cross-border retail payments by interlinking domestic Fast Payments Systems (FPSs).

What is Project Nexus?

- About:

- Project Nexus is conceptualised by the Innovation Hub of the Bank for International Settlements (BIS).

- It seeks to enhance cross-border payments by connecting multiple global domestic instant payment systems (IPS).

- It is the first BIS Innovation Hub project in the payments area to move towards live implementation.

- Members:

- Project Nexus aims to connect the FPSs of four Association of Southeast Asian Nations (ASEAN) namely, Malaysia, Philippines, Singapore, Thailand, and India, who would be the founding members and first mover countries of this platform.

- Indonesia will also join the platform in the future.

- An agreement on this was signed by the BIS and the central banks of the founding countries in Basel, Switzerland.

- Project Nexus aims to connect the FPSs of four Association of Southeast Asian Nations (ASEAN) namely, Malaysia, Philippines, Singapore, Thailand, and India, who would be the founding members and first mover countries of this platform.

- Benefits:

- Project Nexus aims to streamline how IPS connect globally, eliminating the need for custom connections with each new country by centralising connections through a single platform.

- This single connection allows a fast payment system to reach all other countries on the network.

- According to BIS, connecting IPS can enable cross-border payments from sender to recipient within 60 seconds (in most cases).

- While India and its partner countries continue to benefit through bilateral connectivity of FPS, a multilateral approach will provide further impetus to the RBI’s efforts in expanding the international reach of Indian payment systems.

- The Reserve Bank of India has been collaborating bilaterally with various countries to link India’s Fast Payments System (FPS) UPI, with their respective FPSs for cross-border Person to Person (P2P) and Person to Merchant (P2M) payments. For example, Bhutan , UAE, France, Sri Lanka, Mauritius.

Bank for International Settlements (BIS)

- Established in 1930, the BIS is owned by 63 central banks, representing countries from around the world that together account for about 95% of world GDP.

- Its head office is in Basel, Switzerland and it has two representative offices (Hong Kong SAR and Mexico City), as well as Innovation Hub Centres around the world.

- Innovation BIS 2025, is its medium-term strategy that leverages technology and new collaboration channels to serve the central banking community in the fast-changing world.

- The Basel Banking Accords are global rules set by the Basel Committee on Banking Supervision (BCBS), operating under the Bank for International Settlements (BIS) in Basel, Switzerland, providing guidelines for best practices in banking.

- It provides central banks with:

- a forum for dialogue and broad international cooperation

- a platform for responsible innovation and knowledge-sharing

- in-depth analysis and insights on core policy issues

- sound and competitive financial services

Read More: UPI Goes Global from Eiffel Tower, UPI Services in Sri Lanka and Mauritius,

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

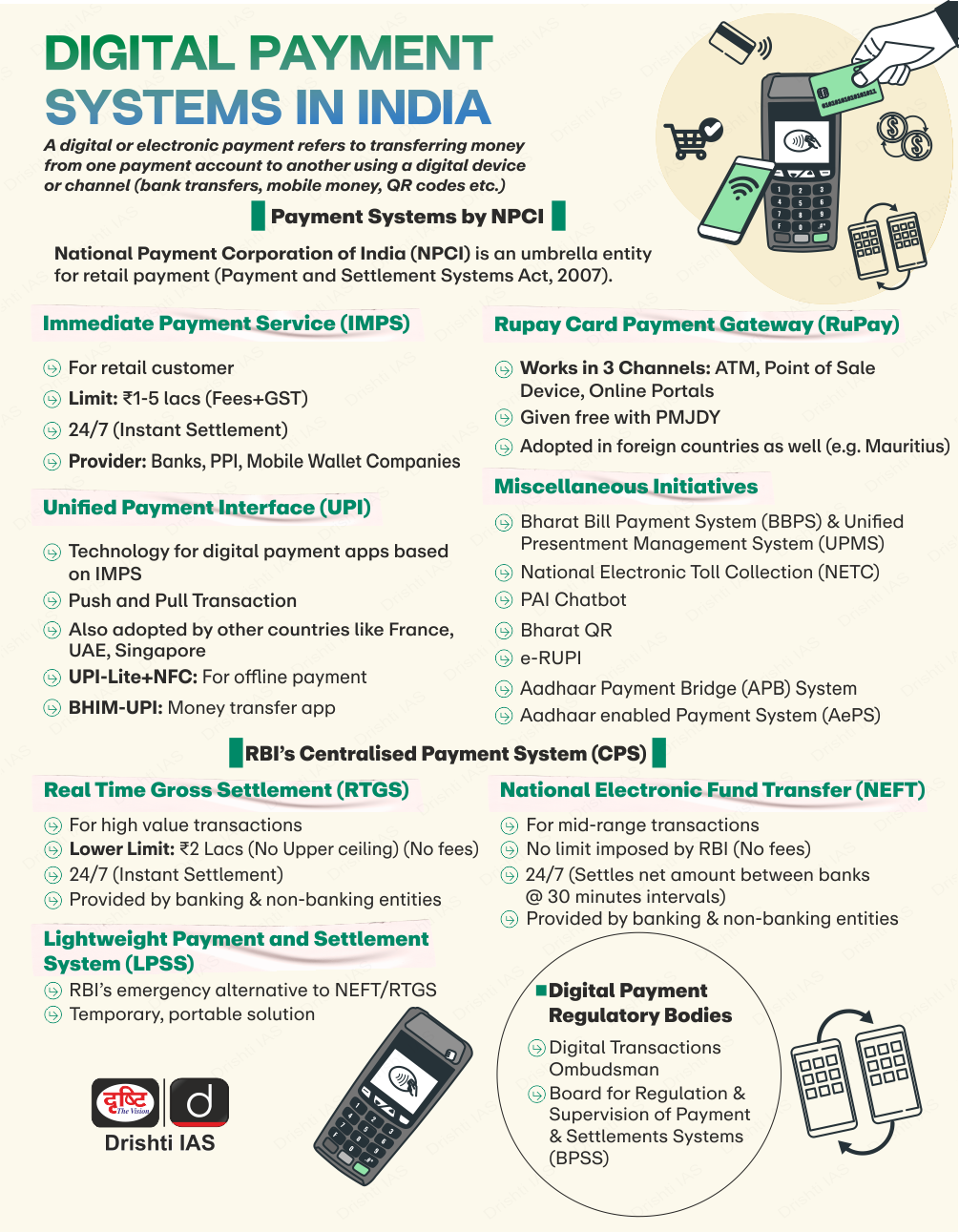

Q1. With reference to digital payments, consider the following statements: (2018)

- BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account.

- While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Q2. Which of the following is a most likely consequence of implementing the ‘Unified Payments Interface (UPI)’? (2017)

(a) Mobile wallets will not be necessary for online payments.

(b) Digital currency will totally replace the physical currency in about two decades.

(c) FDI inflows will drastically increase.

(d) Direct transfer of subsidies to poor people will become very effective.

Ans: (a)

Q3. Consider the following statements: (2017)

- National Payments Corporation of India (NPCI) helps in promoting the financial inclusion in the country.

- NPCI has launched RuPay, a card payment scheme.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)