Indian Economy

Privatisation of Power DISCOMs

- 15 Jan 2025

- 10 min read

For Prelims: Supreme Court, High Court's , Power Distribution Companies (DISCOMs), Aggregate Technical and Commercial (AT&C) losses, UDAY scheme, Integrated Power Development Scheme (IPDS).

For Mains: Significance of Reforming Power Distribution Companies (DISCOMs) for Fiscal Prudence.

Why in News?

In December 2024, the Supreme Court upheld the Punjab and Haryana High Court's decision, supporting the government's intent to privatize the power distribution companies (DISCOMs), in Chandigarh.

What is the Need for Privatisation of Power DISCOMs?

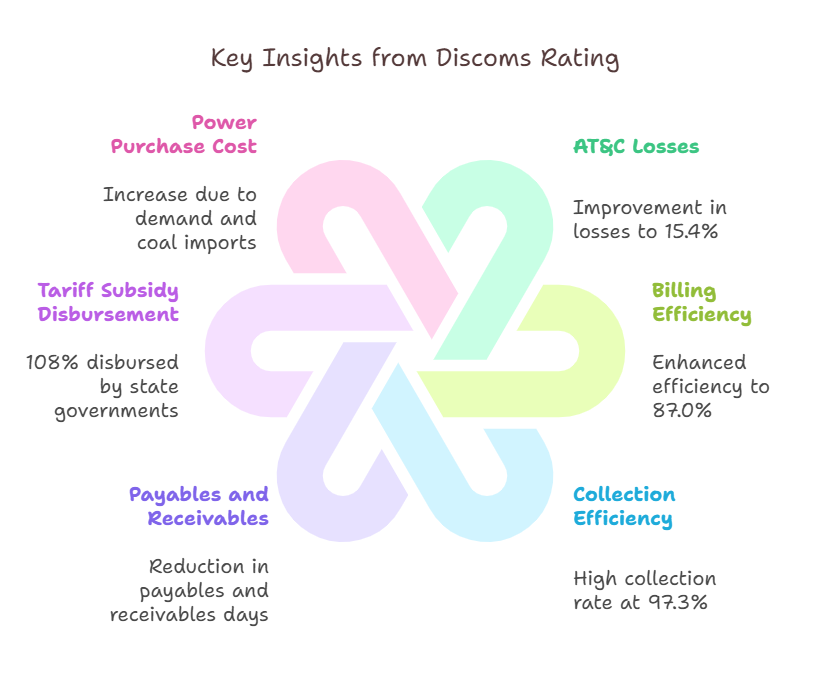

- High AT&C Losses: Despite improvements, India’s Aggregate technical and commercial (AT&C) losses remain high at 17.6% in FY24, showing persistent issues of electricity theft and unbilled supply.

- These losses undermine the financial health of DISCOMs and limit their ability to invest in infrastructure.

- Systemic Inefficiencies: Billing efficiency at 87% and collection efficiency at 97.3% reflect persistent operational inefficiencies.

- These gaps reduce revenue generation, aggravating the financial strain on DISCOMs.

- Escalating Financial Strain: The average cost of supply (ACS) and the average realizable revenue (ARR) gap widened to from 33 paise per unit in FY22 to 55 paise per unit in FY23.

- This gap exacerbates their debt, making them reliant on state subsidies.

- Subsidy Burden on States: The financial deficit in India's power distribution sector widened to at least Rs 79,000 crore in FY23 from Rs. 44,000 crores in FY22.

- This dependency reflects unsustainable financial management in the power sector.

- Rising Power Demand and Costs: A sharp 8% rise in power demand in FY23, coupled with dependence on costly coal imports and high exchange prices, pushed the average power purchase cost up by 71 paise/kWh.

- Without structural changes, these rising costs may lead to further financial instability for public-sector DISCOMs.

- Demonstrated Success in Private Models: In Delhi, privatisation led to a dramatic reduction in AT&C losses from over 50% in 2002 to single-digit levels, demonstrating the potential for operational turnaround.

- Due to privatization, the Delhi government saved approximately Rs. 1,200 crores annually, which was previously spent on the Delhi Vidyut Board.

- Ineffectiveness of Current Public-Sector Reforms: Government initiatives like the UDAY scheme have shown limited success in curbing losses or improving operational efficiency.

- Private-sector involvement is seen as necessary to introduce professional management, modern technologies, and accountability.

What are Challenges of Privatisation of DISCOMs?

- Employee Resistance to Privatisation: Employees of public-sector DISCOMs often oppose privatisation, fearing job losses, adverse service conditions, and retrenchment.

- Experiences like Delhi’s voluntary retirement scheme highlights employee concerns over job security and finances.

- Complex Legal and Regulatory Environment: Challenges arise from complying with the Electricity Act, 2003, uncertainty over full privatization, and unclear reform options.

- For example, in Chandigarh, legal challenges raised concerns about whether the private bidder met all statutory requirements, delaying the process.

- Tariff Concerns for Consumers: Post-privatisation, tariff increases are often necessary to cover operational costs and infrastructure investments, raising fears of consumer backlash.

- Balancing the need for cost recovery with affordability is a critical challenge for regulators and private players.

- Lack of Transitional Support: Odisha’s privatisation failure in the 1990s is an example where the absence of adequate financial and operational transitional support led to poor outcomes.

- Unlike Odisha, Delhi’s success was bolstered by transitional funds of Rs. 3,450 crores, which helped DISCOMs manage initial operational hurdles.

What are Government Steps to Support State DISCOMs?

- Schemes:

- Ujwal DISCOM Assurance Yojana (UDAY): Launched in 2015 to rescue financially strained DISCOMs, UDAY reduced their debt by allowing states to take over 75% of liabilities as low-interest bonds.

- It targeted improved AT&C losses and billing efficiency through measures like smart metering and theft reduction.

- Revamped Distribution Sector Scheme (RDSS): Introduced with a budget of Rs. 3,03,758 crore for a 5-year period (FY 2021-22 to FY 2025-26).

- The scheme aims to reduce AT&C losses to 12-15% nationwide and eliminate the gap between ACS and ARR by 2024-25.

- Integrated Power Development Scheme (IPDS): Launched to strengthen the urban power distribution infrastructure, IPDS focuses on improving reliability, reducing technical losses, and ensuring better customer service in urban areas.

- Ujwal DISCOM Assurance Yojana (UDAY): Launched in 2015 to rescue financially strained DISCOMs, UDAY reduced their debt by allowing states to take over 75% of liabilities as low-interest bonds.

- Other Measures:

- Integrated Ratings: The Integrated Rating of DISCOMs, conducted annually, evaluates operational and financial parameters, helping to identify inefficiencies and encourage accountability.

- The 12th Edition of the Integrated Rating of Discoms highlighted improvements like reduced AT&C losses and better payment cycles.

- Integrated Ratings: The Integrated Rating of DISCOMs, conducted annually, evaluates operational and financial parameters, helping to identify inefficiencies and encourage accountability.

- Financial Assistance and Subsidies: During FY23, state governments disbursed 108% of tariff subsidies booked, ensuring that DISCOMs could maintain operations despite losses.

- In cases like Delhi, transitional funding of Rs. 3,450 crores was instrumental in stabilizing operations post-privatisation.

- Regulatory Reforms: Late Payment Surcharge Rules have significantly reduced days payable to 126 days and days receivable to 119 days, easing liquidity pressures on DISCOMs.

- These rules incentivize timely payments to generation and transmission companies.

- Privatisation in Union Territories (UTs): The central government initiated privatisation of UT DISCOMs, with Dadra and Nagar Haveli and Daman and Diu being the first success stories in 2022.

- Progress in Chandigarh and Puducherry demonstrates ongoing efforts, despite resistance and litigation.

Way Forward

- Collaborative Stakeholder Engagement: Governments must engage employees, consumers, and political groups to address concerns and build consensus, ensuring a smooth transition.

- Clear communication about safeguards, such as pension liability sharing, can reduce resistance.

- Focus on Regulatory Strengthening: State electricity regulatory commissions must be empowered to enforce transparent tariff determination, incentivize efficiency, and protect consumer interests.

- Gradual Tariff Rationalisation: Tariff adjustments should be phased and coupled with subsidies for vulnerable consumers to maintain affordability while ensuring cost recovery.

- Emphasis on Infrastructure Upgradation: Modernizing grids, introducing smart metering, and leveraging technology must be prioritized to improve service delivery and reduce losses.

- Encouraging Retail Competition in Phases: While full privatisation is effective, exploring retail competition in a phased manner can offer consumers choice and improve service quality over time.

- Learning from Best Practices: Applying best practices based on learnings from both successful (Delhi) and unsuccessful (Odisha) models can help design effective policies and frameworks for privatisation.

|

Drishti Mains Question: What are the key needs and challenges driving DISCOM privatization in India, and how can systemic reforms address them? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. Which one of the following is the purpose of ‘UDAY’, a scheme of the Government? (2016)

(a) Providing technical and financial assistance to start-up entrepreneurs in the field of renewable sources of energy

(b) Providing electricity to every household in the country by 2018

(c) Replacing the coal-based power plants with natural gas, nuclear, solar, wind and tidal power plants over a period of time

(d) Providing for financial turnaround and revival of power distribution