Rapid Fire

Price-to-Earnings Ratio and Hockey-Stick Effect

- 03 Apr 2024

- 1 min read

The Chairperson of SEBI noted that despite a high P/E ratio, overseas investors are attracted to the Indian capital markets due to the rapid economic growth, reflecting global optimism and trust in India, exemplified by the hockey stick effect.

- Price-to-Earnings (P/E) Ratio:

- The P/E ratio is the company's share price relative to its earnings per share (EPS).

- The P/E ratio helps assess a company's stock value compared to others and is also useful for comparing its valuation historically, against peers, or the market.

- A high P/E ratio may indicate overvaluation, while a low ratio could suggest undervaluation.

- Hockey Stick Effect:

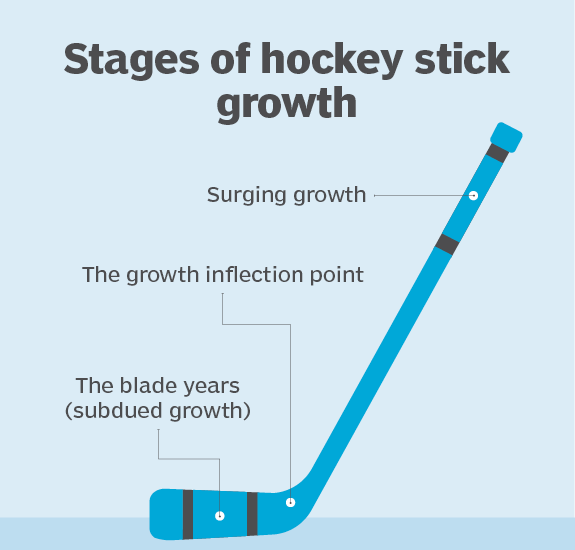

- The hockey stick effect is characterised by a sharp rise or fall of data points after a long flat period.

- Hockey stick charts visually depict notable changes or rapid growth, seen in areas like corporate earnings, global temperatures, and poverty statistics, with applications in business, economics, and policy.

- It indicates the need for urgent action due to a drastic shift in data points.

Read more: SEBI