Oil bonds | 16 Apr 2022

Why in News?

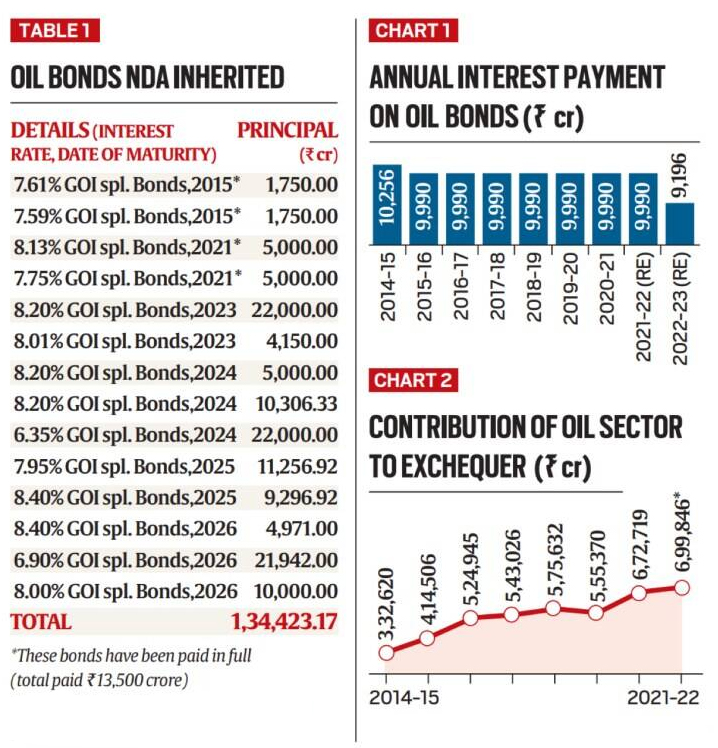

Recently, the Finance Minister has countered criticism of high oil prices by claiming that the government cannot bring down taxes - and thus oil prices because it has to pay for oil bonds issued by the Previous Government.

- However, critics claim that what the government has had to pay for oil bonds, the payout is not big compared to revenues earned in this sector.

What Percentage of Fuel Price is Tax?

- There are two components to the domestic retail price — the price of crude oil itself, and the taxes levied on this basic price.

- Together they make up the retail price. The taxes vary from one product to another. For instance, as of now, taxes account for 50% of the total retail price for a litre of petrol, and 44% for a litre of diesel.

What are Oil Bonds?

- When fuel prices were too high for domestic consumers, governments in the past often asked Oil Marketing Companies (OMCs) to avoid charging consumers the full price.

- But if oil companies don’t get paid, they would become unprofitable. To address this, the government said it would pay the difference.

- If the government paid that amount in cash, it would have been pointless, because then the government would have had to tax the same people to collect the money to pay the OMCs. This is where oil bonds come in.

- An oil bond is an IOU, or a promissory note issued by the government to the OMCs, in lieu of cash that the government would have given them so that these companies don’t charge the public the full price of fuel.

- An IOU, a phonetic acronym of the words "I owe you," is a document that acknowledges the existence of a debt.

- A promissory note is a debt instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on-demand or at a specified future date.

- An oil bond says the government will pay the OMC the sum of, say, Rs 1,000 crore in 10 years. And to compensate the OMC for not having this money straight away, the government will pay it, say, 8% (or Rs 80 crore) each year until the bond matures.

- Oil bonds do not qualify as Statutory Liquidity Ratio (SLR) securities, making them less liquid when compared to other government securities.

- SLR: The share of Net Demand and Time Liabilities that a bank is required to maintain safe and liquid assets, such as government securities, cash, and gold.

What is the Significance?

- By issuing such oil bonds, the government of the day is able to protect/ subsidise the consumers without either ruining the profitability of the OMC or running a huge budget deficit itself.

UPSC Civil Services Exam Previous Year Question

Q. In the context of global oil prices, “Brent crude oil” is frequently referred to in the news. What does this term imply? (2011)

- It is a major classification of crude oil.

- It is sourced from the North Sea.

- It does not contain sulphur.

Which of the statements given above is/are correct?

(a) 2 only

(b) 1 and 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

- Brent crude oil is one of the major classifications of crude oil done on the basis of geographical location of the source. Brent crude oil is sourced from the North Sea. Other major types of crude oil on the basis of geography are West Texas Intermediate (USA) and Dubai/Oman (Persian Gulf).