Oil and Food Prices | 08 Nov 2021

Why in News

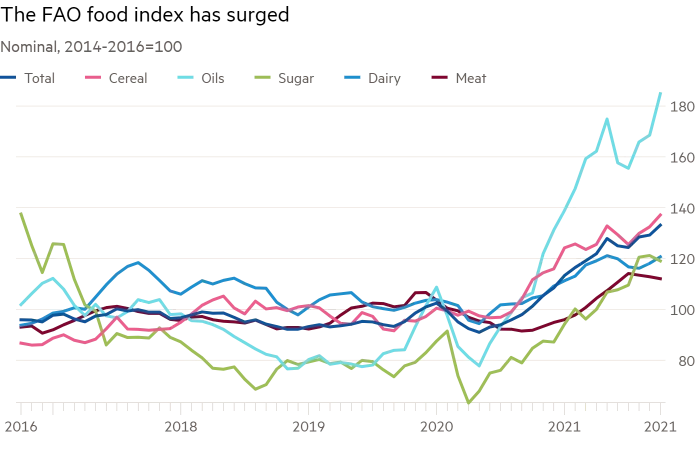

Recently, the United Nations Food and Agriculture Organisation (FAO) released data showing its world Food Price Index (FPI) the highest since July 2011.

- Food supplies and prices are under pressure from extreme weather, disturbed supply chains, worker shortages and rising costs.

Key Points

- Food & Fuel Move Intandem:

- One reason why petroleum and agri-commodity prices move in tandem is the bio-fuels link.

- When crude prices rise, blending ethanol from sugarcane and corn (maize) with petrol or diverting palm and soybean oil for biodiesel production becomes that much more attractive.

- Cotton, likewise, turns relatively affordable vis-à-vis petrochemicals-based synthetic fibres.

- Also, since corn is primarily an animal feed, its diversion to ethanol leads to substitution by other grains, including wheat, for livestock use.

- That, then, pushes up prices of foodgrains as well.

- The same happens to sugar, as mills step up the proportion of cane crushed for fermenting into alcohol.

- But it is not only the bio-fuels effect alone, large price increases also tend to have an effect on other farm produce through creation of positive sentiment.

- Economic Activity and Stimuli:

- The positive sentiment of the market is connected with two things:

- The first is the demand returning with revival of economic activity worldwide amid receding pandemic cases and rising vaccination rates.

- The second is the liquidity infused by the US Federal Reserve and other global central banks, to limit the economic damage wreaked by Covid-19.

- All this money, combined with the policy-induced ultra-low global interest rates, has found its way into stock markets, start-up investments and also commodities.

- However, since restoration of supply chains hasn’t kept pace with the demand recovery — manifested in congestion at ports, shortage of shipping containers/vessels and labourers yet to fully return to plantations — the overall result has been inflation.

- The positive sentiment of the market is connected with two things:

- Impact on Farmers:

- Some products like Kapas (raw unginned cotton) and Soyabean are selling at prices well above the government’s Minimum Support Price (MSP).

- On the flip side, however, farmers are being forced to pay much more for fuel and fertilisers, as their international prices have shot up.

- Fertilizers:

- The situation is worse in fertilisers, Di-ammonium phosphate (DAP) is currently being imported into India at USD 800 per tonne, including cost and ocean freight. Muriate of potash (MOP) is available for no less than USD 450 a tonne.

- These are close to the prices that prevailed during the world food crisis of 2007-08.

- DAP and MOP are non-urea fertilisers.

- Together with fertilisers, the prices of their intermediates and raw materials such as rock phosphate, sulphur, phosphoric acid and ammonia have also skyrocketed due to a combination of demand-pull (from higher crop plantings) and cost-push (from oil and gas).

- The situation is worse in fertilisers, Di-ammonium phosphate (DAP) is currently being imported into India at USD 800 per tonne, including cost and ocean freight. Muriate of potash (MOP) is available for no less than USD 450 a tonne.

Food Price Index

- It was introduced in 1996 as a public good to help in monitoring developments in the global agricultural commodity markets.

- The FAO Food Price Index (FFPI) is a measure of the monthly change in international prices of a basket of food commodities.

- It measures changes for a basket of cereals, oilseeds, dairy products, meat and sugar.

- Base Period:2014-16.