NITI Aayog’s Strategies for Growth in Edible Oils | 30 Aug 2024

For Prelims: Oilseeds Sector, NITI Aayog, Edible oil, Crops

For Mains: Scenario of Edible Oil Sector in India, Challenges in the Edible Oil Sector in India, Recommendations of NITI Aayog

Why in News?

Recently, a report titled “Pathways and Strategies for Accelerating Growth in Edible Oils towards Goal of Atmanirbharta” was released by NITI Aayog.

- The report analyses the current edible oil sector, outlines its future potential, and provides a detailed roadmap to address challenges, aiming to close the demand-supply gap and achieve self-sufficiency.

What are the Key Highlights of the Report?

- Oilseed Production and Area: Nine major oilseed crops (groundnut, rapeseed-mustard, soybean, sunflower, sesame, safflower, niger seed, castor and linseed) cover 14.3% of the gross cropped area, contributing 12-13% to dietary energy and about 8% to agricultural exports.

- Soybean leads with 34% of total oilseed production, followed by rapeseed-mustard (31%) and groundnut (27%).

- Regional Production Distribution: Rajasthan and Madhya Pradesh are the top producers, each contributing about 21.42% of national production.

- Gujarat (17.24%) and Maharashtra (15.83%) also play major roles.

- Rising Consumption and Import Dependence: Per capita consumption (over the last decade) of edible oil has surged to 19.7 kg/year.

- Domestic production meets only 40-45% of the demand,overall consumption surged, leading to increased imports from 1.47 MT (million tonne) in 1986-87 to 16.5 MT in 2022-23, raising the import dependency ratio to 57%.

- Palm oil dominates these imports, accounting for 59%, followed by soybean (23%) and sunflower (16%).

- Growth Trends: From 1980-81 to 2022-23, oilseed area, production, and yield grew at rates of 0.90%, 2.84%, and 1.91%, respectively.

- In the recent decade, production and yield growth rates improved to 2.12% and 1.53%. The area under oilseeds increased in all decades except 1991-2000.

- The report projects that production of the nine major oilseeds will rise to 43 MT by 2030 and 55 MT by 2047, up from 37.96 MT in 2021-22 under the Business as Usual (BAU) scenario.

- Approaches for Demand Forecasting:

- Static/Household Approach:

- Uses population projections and baseline per capita consumption data.

- Assumes short-term static consumption behavior.

- Projects a demand-supply gap of 14.1 MT by 2030 and 5.9 MT by 2047.

- Normative Approach:

- Based on recommended intake levels by ICMR-NIN (Indian Council of Medical Research - National Institute of Nutrition).

- Indicates a potential surplus of 0.13 MT by 2030 and 9.35 MT by 2047.

- Behavioristic Approach:

- Considers behavioural shifts due to changing lifestyles and income levels.

- Scenario I: Consumption capped at 25.3 kg per capita.

- Demand-Supply Gap: 22.3 MT by 2030, 15.20 MT by 2047.

- Scenario II: Higher consumption at 40.3 kg per capita.

- Demand-Supply Gap: 29.5 MT by 2030, 40 MT by 2047.

- Scenario I: Consumption capped at 25.3 kg per capita.

- Considers behavioural shifts due to changing lifestyles and income levels.

- BAU Situation: Gap projected to be Scenario-I by 2028 and Scenario-II by 2038.

- High-Income Growth Scenario: Advanced demand to Scenario-I by 2025 and Scenario-II by 2031.

- Static/Household Approach:

What Steps are Needed to Achieve Self-sufficiency in Edible Oil?

- The Niti Aayog report suggested strategic interventions to bridge the gap and ensure long-term sustainability.

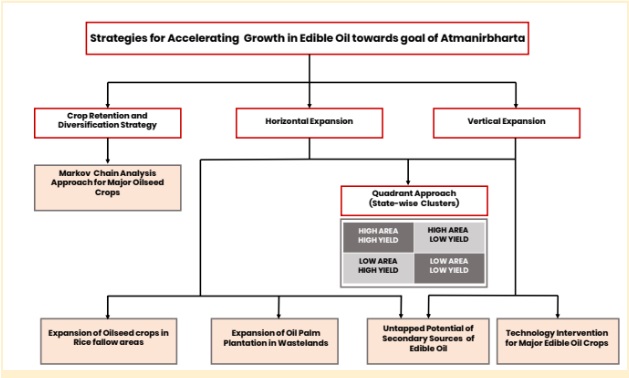

- The strategy centers on three pillars:

- Crop Retention and Diversification in Potential Regions:

- Retaining and diversifying oilseed crops could increase production by 20% adding 7.36 MT and cutting imports by 2.1 MT.

- Horizontal Expansion:

- Expand cultivation area, utilise rice fallow lands and wastelands for oilseed and palm cultivation.

- Utilising one-third of rice fallow areas for oilseeds could boost production by 3.12 MT and reduce imports by 1.03 MT.

- Expand cultivation area, utilise rice fallow lands and wastelands for oilseed and palm cultivation.

- Vertical Expansion:

- Enhance oilseed yields via improved farming practices, high-quality seeds, and advanced technologies.

- Crop Retention and Diversification in Potential Regions:

- The strategy centers on three pillars:

- The report’s ‘state-wise quadrant approach’ is a key strategy for achieving self-sufficiency in edible oils

- The report identifies state clusters using four quadrants:

- High Area-High Yield (HA-HY) States: Focus on efficiency and adopting global best practices.

- High Area-Low Yield (HA-LY) States: Implement vertical expansion to boost yields.

- Low Area-High Yield (LA-HY) States: Prioritise horizontal expansion to increase cultivation.

- Low Area-Low Yield (LA-LY) States: Address both horizontal and vertical expansion to enhance area and yield.

- The report identifies state clusters using four quadrants:

- Strategic Interventions: This could achieve edible oil supplies of 36.2 MT by 2030 and 70.2 MT by 2047, potentially ensuring self-sufficiency in most scenarios.

- Technological Interventions: Optimising seed utilisation and processing could increase production by 15-20%, potentially up to 45% with improved management. The current Seed Replacement Ratio (SRR) is low, ranging from 25% (groundnut) to 62% (rapeseed mustard), impacting yield.

- Modernising mills and investing in processing infrastructure are essential, as current mills operate at only 30% of refining capacity, with many being small-scale and low-tech.

What are the Challenges in the Edible Oil Sector in India?

- Rainfed Production Dependence: 76% of oilseed cultivation is rainfed, contributing 80% of total production, making it vulnerable to erratic weather patterns.

- Irrigation coverage has only marginally increased by 4% over the past decade (from 23% to 27%).

- Demand-Supply Gap: India continues to face a substantial demand-supply gap, leading to heavy reliance on imports to meet domestic needs.

- Imports accounted for 60% of India’s edible oil requirements in 2022-23, with palm oil, soybean oil, and sunflower oil being the major contributors.

- Increased Consumption: Per capita consumption of edible oils has risen to around 19 kg annually (over the past decade).

- Impact on Farmers: Low import duties and high imports have negatively impacted the price realisation for domestic oilseeds farmers.

- The government’s reduced import duties aim to curb retail price spikes, but lower duties might result in India influx of cheaper oils, affecting local farmers and processors.

What are the Recommendations of the Niti Aayog Report?

- Enhance Oilseed Development in Bundelkhand and Indo-Gangetic Plain:

- Revitalise Bundelkhand for oilseeds, particularly sesame, to boost incomes.

- Introduce soybean, rapeseed-mustard, and sunflower in the Indo-Gangetic Plain to increase profitability and address soil and water issues.

- Prioritise Wasteland Utilisation for Oil Palm Expansion:

- Focus on expanding oil palm cultivation on suitable wastelands, with a potential increase in production by 24.7 MT.

- Leverage partnerships with FPOs (Farmers’ Producer Organisations), FPCs (Farmer Producer Company), and SHGs (Self help group) for effective large-scale cultivation.

- Cluster-Based Seed Village:

- Establish “One Block-One Seed Village” hubs at block levels for high-quality oilseed supply, enhancing SRR and VRR through FPOs.

- Promotion of Biofortified Oilseed Varieties:

- Integrate biofortification in national missions to improve oilseed nutrition and reduce anti-nutritional factors.

- Increase adoption of 14 released biofortified varieties by targeting a 10-12% annual adoption rate.

- State-Level Seed Rolling Plans and Quality Standards:

- Develop five-year rolling plans for breeder seed production and replace outdated varieties.

- Harmonise Indian seed standards with OECD (Organisation of Economic Cooperation and Development) and ISTA (International Seed Testing Association) to meet global quality requirements.

- Enhancing Yield through Improved Varieties:

- Scale up production of high-potential Indian oilseed varieties and adopt advanced breeding techniques to boost yield and quality.

- Harnessing Rice Bran Oil:

- Utilise rice bran oil for blending with cooking oils, aiming for large-scale production and standardization with international regulations.

- Enhancing Solvent Extraction Efficiency:

- Address low capacity utilisation (around 30%) in solvent extraction plants by modernising facilities and improving mill management to achieve at least 60% utilisation.

- Balancing Storage Profitability:

- Implement fair pricing structures to balance off-season storage costs with consumer affordability, ensuring market stability and incentivizing off-season sales.

- Enhancing Marketing Infrastructure:

- Ensure procurement at MSP through NAFED (National Agricultural Cooperative Marketing Federation of India) and state federations, and facilitate direct marketing to boost oilseed cultivation in non-traditional areas.

- Setting Up Testing Laboratories:

- Establish testing laboratories in mandis to standardise quality parameters and avoid subjective pricing, using PPP (Public Private Partnership) models with agricultural universities and ICAR ( Indian Council of Agricultural Research).

- Enhancing Oil Palm Sector Efficiency:

- Promote large-scale oil palm plantations and seed gardens, streamline regulations by declaring oil palm a plantation crop, and enforce zero-waste policies to utilise byproducts.

Conclusion

To achieve self-sufficiency in India's edible oil sector, strategic interventions must focus on enhancing oilseed production through crop diversification, horizontal and vertical expansion, and improved processing. By optimising seed quality, modernising infrastructure, and utilising wastelands effectively, India can significantly reduce import dependency and meet future demand projections. Embracing these measures will be crucial for ensuring sustainable growth and resilience in the edible oil sector by 2030 and beyond.

|

Drishti Mains Question Q. In the context of India's edible oil sector, evaluate the current challenges and propose a comprehensive strategy to achieve self-sufficiency by 2030. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. Consider the following statements: (2018)

- The quantity of imported edible oils is more than the domestic production of edible oils in the last five years.

- The Government does not impose any customs duty on all the imported edible oils as a special case.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)