New Tax Regime | 03 Feb 2023

For Prelims: Union Budget 2023-24

For Mains: Main Points Associated with the Budget 2023-24, Changes in the Tax Regime, Finance Bill, 2023.

Why in News?

Recently, during the Union Budget 2023-24 speech, Union Finance Minister announced a change in income tax slabs and rebate limits under the new income tax regime.

- According to the proposed 2023 Finance Bill, startups that offer their shares to foreign investors may be subject to paying the "angel tax," which was previously only applicable to investments raised by Indian residents.

What are the Proposed Changes?

- Tax Rebate Limit Raised:

- The enhancement of this limit to ₹7 lakhs from ₹ 5 lakhs indicates that the person whose income is less than ₹7 lakhs need not invest anything to claim exemptions and the entire income would be tax-free irrespective of the quantum of investment made by such an individual.

- This will result in giving more consumption power to the middle-class income group as they could spend the entire amount of income without bothering too much about investment schemes to take the benefit of exemptions.

- The enhancement of this limit to ₹7 lakhs from ₹ 5 lakhs indicates that the person whose income is less than ₹7 lakhs need not invest anything to claim exemptions and the entire income would be tax-free irrespective of the quantum of investment made by such an individual.

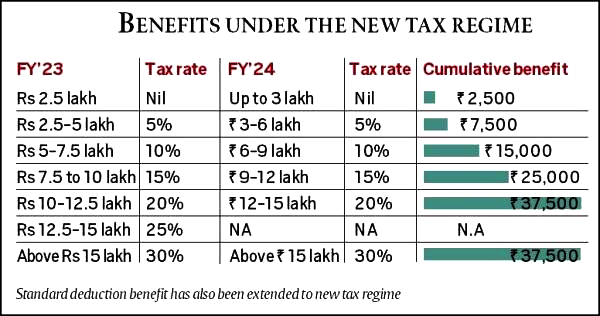

- Changes in Income Tax slabs:

- It was proposed to change the tax structure in the new regime by reducing the number of slabs to five from six income categories and increasing the tax exemption limit to ₹3 lakh.

- Tax assessors will still be able to choose from the prior regime.

- Salaried and Pensioners: The new system's standard deduction for taxable income exceeding Rs15.5 lakhs is ₹52,500.

- For Pensioners:

- The Finance Minister announced extending the benefit of the standard deduction to the new tax regime.

- Each salaried person with an income of ₹15.5 lakh or more will benefit by ₹52,500.

- The Finance Minister announced extending the benefit of the standard deduction to the new tax regime.

- Maximum Tax Along with Surcharge:

- It was proposed to reduce the highest surcharge rate from 37% to 25% in the new tax regime. This would result in the reduction of the maximum tax rate to 39%.

- The highest tax rate in India is 42.74%. This is among the highest in the world.

- Tax rates have been reduced under the new tax regime and the maximum marginal rate drops from 42.74% to 39%.

- It was proposed to reduce the highest surcharge rate from 37% to 25% in the new tax regime. This would result in the reduction of the maximum tax rate to 39%.

- Finance Bill, 2023:

- The Finance Bill, 2023 was also unveiled which has proposed to amend Section 56(2) VII B of the Income Tax Act.

- The provision states that when an unlisted company, such as start-ups receive equity investment for the issue of shares exceeding their face value, it will be considered income for the start-up and be subject to income tax under the heading "Income from other Sources".

- Section 56(2) VII B of the Income Tax Act, colloquially known as the ‘angel tax’ was first introduced in 2012 to deter the generation and use of unaccounted money through the subscription of shares of a closely held company at a value that is higher than the fair market value of the firm’s shares.

- The Finance Bill, 2023 was also unveiled which has proposed to amend Section 56(2) VII B of the Income Tax Act.

- It was also proposed to include foreign investors also, meaning that when a start-up raises funding from a foreign investor, that too will now be counted as income and be taxable.

Why are Startups Concerned?

- Foreign investors are a significant source of funding for startups and have contributed to their increased valuations and the proposed amendments can affect the amount of investment.

- According to a report by PwC India, the funding for India's startups decreased by 33% to $24 billion in 2022.

- The reintroduction of the tax on angel investors in India may cause startups to shift abroad, as foreign investors may not want to pay additional taxes associated with their investment in the startup.

What is Face Value?

- According to the face value definition, it is the dollar value of any stock (or any financial instrument) at the time of issuing. It is also termed as the nominal value or the dollar value.

- Face Value= Equity share capital/ number of outstanding shares.