National Green Financing Institution | 27 Feb 2025

For Prelims: NaBFID, NABARD, IREDA, InvITs, Panchamrit Strategy, Green Bonds, Clean Environment Cess, Priority Sector Lending (PSL), Green Masala Bonds, COP29 UNFCCC,Credit Ratings.

For Mains: Need of a dedicated green financing institution in India. Role of finance in climate change mitigation.

Why in News?

The Government is working to set up a National Green Financing Institution to aggregate green finance from different sources and lower the cost of capital to support its net-zero target by 2070.

- NITI Aayog is evaluating models like NaBFID/NABARD, IREDA, Green InvITs, and global Green Banks for a National Green Financing Institution.

What is the Need for Green Finance in India?

- Escalating Climate Change Risks: Climate change could lead to an estimated 10% loss in total economic value and up to 18% of global GDP wiped out by 2050.

- This economic threat is particularly severe for India, which aims to grow its economy to USD 10 trillion by 2030.

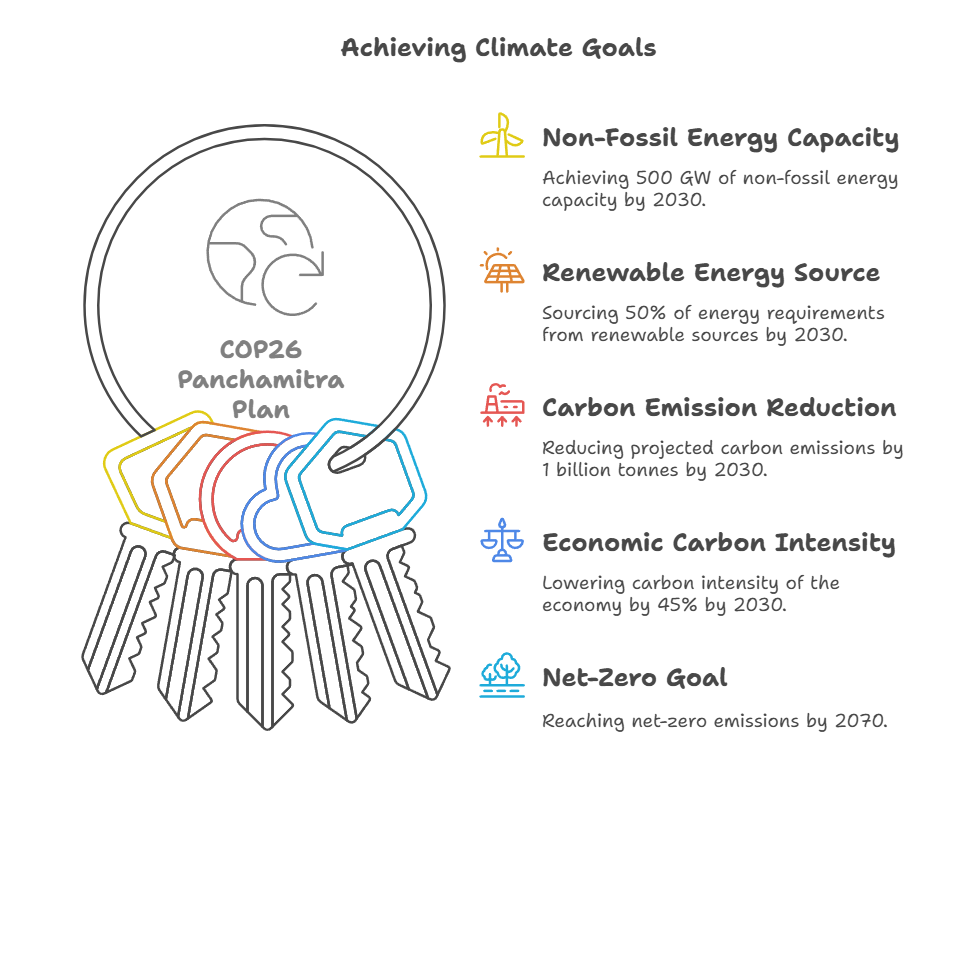

- India's Net-Zero Ambitions: At COP26 UNFCCC, India pledged to achieve net-zero emissions by 2070 under the Panchamrit strategy that requires over USD 10 trillion in investments.

- Threat to Financial Institutions: The financial services industry faces 72% of the potential financial impact of climate change, which banks can mitigate by funding green infrastructure, renewable energy, energy-efficient buildings, and industrial decarbonization.

- Investment Deficit: India needs USD 1.4 trillion in aggregate investments, or USD 28 billion annually, to reach its 2070 net-zero goal.

- As of February 2023, India’s green bond issuances totaled USD 21 billion only, with the private sector contributing 84%.

What are the Current Green Energy Financing Initiatives in India?

- NCEEF: National Clean Energy and Environment Fund (NCEEF) funds clean energy ventures and research through Clean Environment Cess on coal.

- IREDA uses part of the NCEEF fund to lend to banks at the rate of 2%, enabling concessional loans for renewable energy projects.

- IREDA also sources funds from global banks e.g., the World Bank gave USD 100 million for solar parks.

- IREDA uses part of the NCEEF fund to lend to banks at the rate of 2%, enabling concessional loans for renewable energy projects.

- Recognition of PSL: In April 2015, RBI classified renewable energy as a priority sector lending (PSL), requiring banks to allocate up to 40% of net credit.

- Loans up to Rs 15 crore per borrower is given to cover solar, biomass, wind, micro-hydel, and non-conventional energy utilities.

- Green Banks: Green banks accelerate clean energy financing by funding environmentally sustainable projects.

- In India, IREDA, SBI and other banks offer concessional loans for renewable energy projects.

- Green Bonds: They are market-based financial instruments for raising capital for environmentally beneficial projects. E.g., Green Masala Bonds by IREDA.

- Crowdfunding: It is a decentralized funding model using small private investments for renewable energy. E.g., Crowdfunding platform Bettervest’s support for MeraGao Power and Boond Engineering in rural India.

What are Challenges in Green Energy Financing in India?.

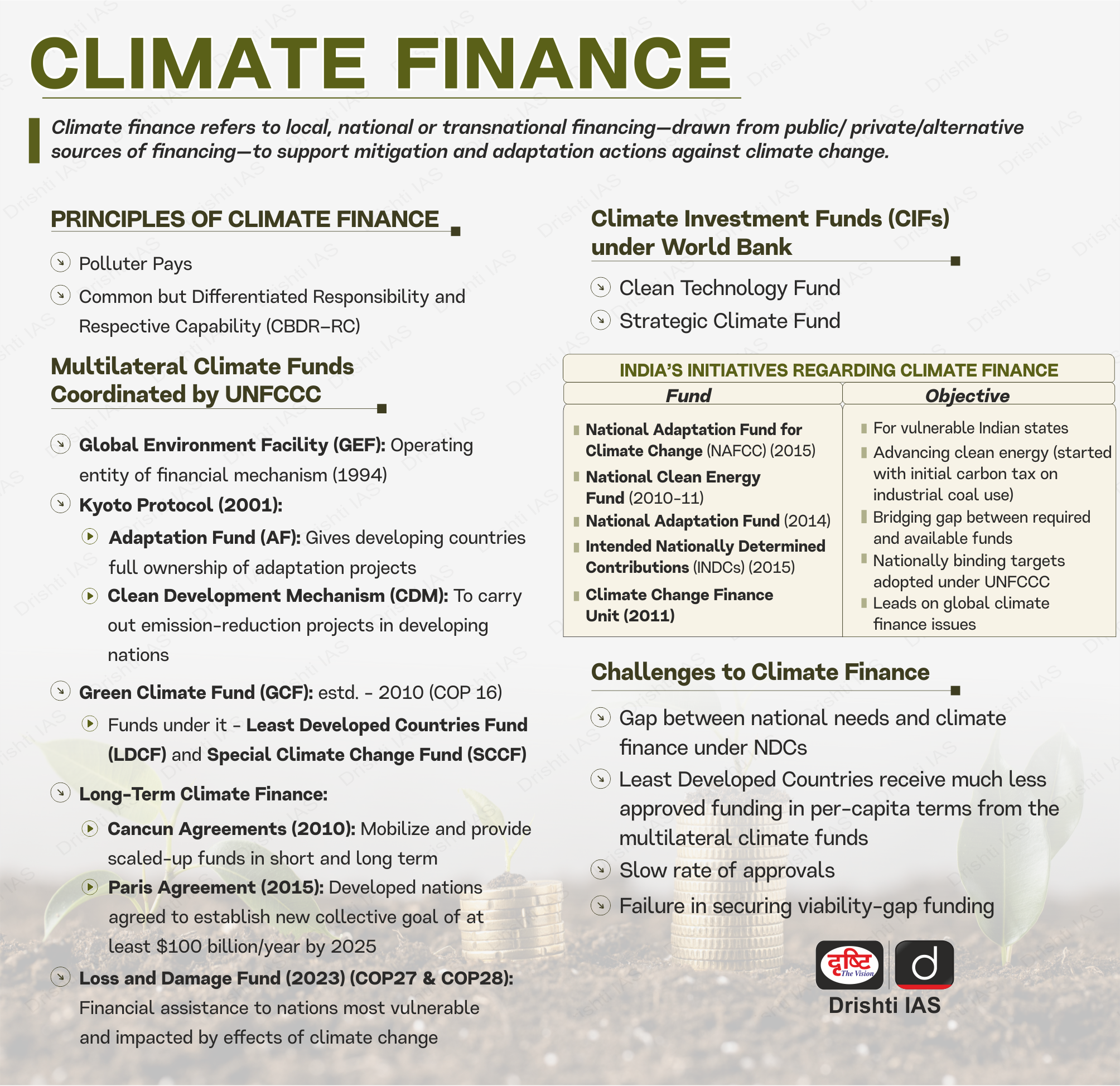

- Limited International Finance: At COP29 UNFCCC, developed nations pledged to mobilize at least USD 300 billion annually by 2035 to support climate mitigation that is insufficient compared to the required financing.

- Several experts highlight that mobilising USD 1 trillion per year by 2030 is required to help developing countries cope with climate change.

- High Borrowing Costs: High interest rates, long gestation period and a lack of fiscal incentives for lenders make green finance costly, often rendering projects financially unviable.

- Diversion of Funds: NCEEF was created for clean energy initiatives, but much of its funds have been diverted to non-renewable projects like GST compensation and Namami Gange.

- Institutional Barriers for Green Banks: India has yet to institutionalize green banks due to a lack of clear RBI guidelines and legal recognition, impacting their credibility and fund mobilization.

- Underdeveloped Green Bond Market: Green bonds need high credit ratings, which many renewable projects lack due to poor financial health. Investor skepticism persists over fund utilization.

Way Forward

- Enhancing Climate Finance: Leverage platforms like the Global Green Bond Market and multilateral institutions (World Bank, AIIB) to mobilize concessional funding.

- Provide sovereign guarantees and interest rate subsidies for green infrastructure projects while introducing a Tax-Free Green Bond Scheme to attract investors.

- Green Banking Ecosystem: Institutionalize Green Banks under RBI with clear regulations and a legal framework, while promoting public-private co-financing to attract global green capital.

- Alternative Financing Mechanisms: Expand Green Infrastructure Investment Trusts (Green InvITs) to boost private participation and develop carbon credit markets linked to green financing instruments.

- Microfinancing: Support women-led green businesses and provide affordable climate risk insurance for small farmers to support adaptation rather than focusing only on mitigation.

|

Drishti Mains Question: Discuss the role of green finance in achieving India's net-zero target by 2070. What are the major challenges, and how can they be addressed? |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q. Which of the following statements regarding ‘Green Climate Fund’ is/are correct? (2015)

- It is intended to assist developing countries in adaptation and mitigation practices to counter climate change.

- It is founded under the aegis of UNEP, OECD, Asian Development Bank and World Bank.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Mains

Q. Describe the major outcomes of the 26th session of the Conference of the Parties (COP) to the United Nations Framework Convention on Climate Change (UNFCCC). What are the commitments made by India in this conference? (2021)

Q. Explain the purpose of the Green Grid Initiative launched at the World Leaders Summit of the COP26 UN Climate Change Conference in Glasgow in November 2021. When was this idea first floated in the International Solar Alliance (ISA)? (2021)