Indian Economy

Loan Write-Offs and NPA Reduction in PSBs

- 20 Dec 2024

- 17 min read

For Prelims: Debt Recovery Tribunals (DRTs), NPA, National Asset Reconstruction Ltd (NARC), Reserve Bank of India (RBI), India Debt Resolution Company Ltd, SARFAESI Act, Insolvency and Bankruptcy Code (IBC)

For Mains: Loan Write-Off: Implication, Challenges and Way Forward, Challenges of NPA, Provisions to NPA resolution

Why in News?

A large-scale loan write-off by banks over the past few years has contributed to a significant reduction in non-performing assets (NPAs).

- As a result, banks have achieved a 12-year low NPA ratio of 2.8% of advances by March 2024.

What is the Key Data Regarding Loan Write-Offs by Banks?

- Loan Write-Offs:

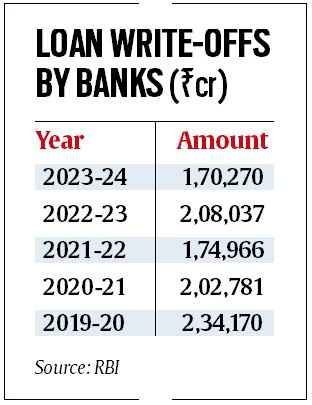

- Between FY2015 and FY2024, Indian commercial banks wrote off loans amounting to Rs 12.3 lakh crore, with Rs 9.9 lakh crore in the last 5 years alone (FY 2020-2024).

- The peak in loan write-offs occurred in FY2019 at Rs 2.4 lakh crore, following an asset quality review initiated in 2015.

- However, write-offs have decreased since then, with FY2024 recording the lowest at Rs 1.7 lakh crore, amounting to just 1% of the total bank credit.

- Public Sector Banks' Share:

- Public sector banks (PSBs) accounted for 53% (Rs 6.5 lakh crore) of the total loan write-offs in the last 5 years (FY 2020-2024).

- Recovery Rates:

- Despite loan write-offs, the recoveries from these write-offs have been relatively low, standing at only 18.7% (Rs 1.85 lakh crore) in the last 5 years (FY 2020-2024).

- Over 81% of the written-off amount (over Rs 8 lakh crore) remained unrecovered between FY 2020-2024, indicating challenges in recovering defaulted loans.

- These loan accounts were mostly wilful defaults with promoters and directors of some of the companies even fleeing the country.

- Despite loan write-offs, the recoveries from these write-offs have been relatively low, standing at only 18.7% (Rs 1.85 lakh crore) in the last 5 years (FY 2020-2024).

- Impact on NPA Ratios:

- As of September 2024, the gross NPAs of PSBs and private sector banks (PSBs) stood at Rs 3.16 lakh crore and Rs 1.34 lakh crore, respectively.

- The NPA ratio as a percentage of outstanding loans was 3.01% for PSBs and 1.86% for private sector banks.

Note:

- A wilful defaulter is a borrower or guarantor who has intentionally failed to repay a loan, with an outstanding amount of Rs 25 lakh or more.

- A large defaulter refers to a borrower with an outstanding loan balance of Rs 1 crore or more, whose account has been classified as doubtful or a loss.

- Write-offs refer to the removal of a non-performing loan or asset from a bank’s financial records, recognizing that the debt is unlikely to be recovered.

- This process does not relieve the borrower of the responsibility to repay the debt but acknowledges the improbability of recovery.

What is Non-Performing Asset (NPA)?

- About:

- It refers to loans or advances issued by banks or financial institutions that no longer bring in money for the lender since the borrower has failed to make payments on the principal and interest of the loan for at least 90 days.

- For agricultural loans, a loan granted for short duration crops will be treated as NPA, if the installment of principal or interest thereon remains overdue for two crop seasons.

- Types of NPAs:

- Gross NPA: This is the total amount of NPAs without deducting the provisional amount.

- Net NPA: This is the gross NPA minus the provision.

- Provision refers to funds left aside by banks to cover potential losses arising from bad loans or NPAs.

- Laws and Provisions Related to NPAs:

- Bad Bank:

- The National Asset Reconstruction Company Ltd (NARC) is India's designated "bad bank."

- To facilitate the sale of these assets, the government has also established the India Debt Resolution Company Ltd (IDRC), which works to sell the assets in the market.

- Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002:

- Insolvency and Bankruptcy Code (IBC), 2016:

- It also established the National Company Law Tribunal (NCLT) and the Insolvency and Bankruptcy Board of India (IBBI) to oversee the process.

- The Recovery of Debts Due to Banks and Financial Institutions Act (RDB Act), 1993.

- Bad Bank:

EASE Framework

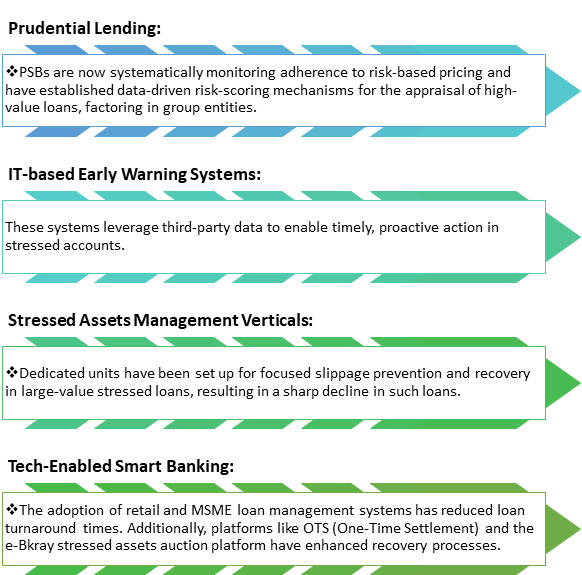

- The government has introduced the Enhanced Access & Service Excellence (EASE) framework in 2018 to improve the financial health of PSB.

- It focuses on governance, prudent lending, risk management, technology adoption, and outcome-oriented human resource management by institutionalizing incremental reforms that align with the evolving banking landscape, enhancing PSBs' efficiency and stability.

What are Loan Write-Offs by Banks?

- About:

- Loan write-offs refer to the process of removing a loan from a bank's asset records, indicating that the bank no longer expects to recover the amount.

- It is primarily an accounting measure undertaken by banks to clean their balance sheets of NPAs and improve their financial health.

- This process allows banks to focus on recoverable assets and manage their tax liabilities efficiently.

- Loan write-offs refer to the process of removing a loan from a bank's asset records, indicating that the bank no longer expects to recover the amount.

- Accounting Mechanism:

- NPA Classification and Provisioning:

- As per Reserve Bank of India (RBI) prudential norms, banks must create provisions for NPAs, which increase with the aging of the asset and are influenced by the realizable value of the collateral.

- This ensures a cautious accounting approach to mitigate financial risks associated with non-performing loans.

- Technical Write-offs:

- Technical write-offs occur when provisions match the outstanding loan amount, allowing banks to remove the loan from their balance sheets while classifying it as an off-balance-sheet item under "Advances Under Collection."

- Despite the write-off, the borrower’s liability remains, and recovery efforts persist through legal and institutional mechanisms.

- Regulatory Guidelines:

- It requires that write-offs adhere to board-approved policies focused on balance sheet management and tax efficiency.

- Banks must continue tracking written-off accounts and actively pursue recoveries to optimize returns.

- Additionally, the Income Tax Act allows deductions for written-off amounts, helping to reduce the tax burden on banks.

- NPA Classification and Provisioning:

What are the Causes of Rising NPA in India?

- Defective Lending Process: Inadequate due diligence during borrower selection and periodic review of credit profiles result in improper assessment of repayment capabilities.

- Also, lack of end-use monitoring systems facilitates the diversion of funds for non-productive purposes, further exacerbating the problem of NPAs.

- Willful Defaults and Poor Credit Culture: A rise in the number of willful defaults, contributes higher NPAs. PSBs have seen a steady increase in the number of willful defaulters with outstanding loans of Rs 2.5 million and above, rising from 10,209 in June 2019 to 14,159 by March 2023.

- Frequent loan waivers, especially for agricultural loans, have adversely impacted the credit culture.

- Promises of loan waivers encourage borrowers to default in anticipation of future waivers.

- Frequent loan waivers, especially for agricultural loans, have adversely impacted the credit culture.

- Industrial Sickness: Industrial sickness arises from ineffective management, inadequate technological advancements, and frequent shifts in government policies render industries financially unstable, leading to poor loan recovery rates for banks.

- Frauds and Malpractices: Increasing fraud cases by both bankers and borrowers have exacerbated the NPA crisis.

- In the first half of FY 2023-24, Indian banks reported a 166% rise in fraud cases to over 36,000.

- High-profile scams like the Nirav Modi-PNB fraud and Vijay Mallya-Kingfisher default have severely impacted public trust and financial stability.

- Regulatory and Policy Risks: Non-compliance with RBI guidelines, such as deficiencies in statutory and regulatory adherence, has led to penalties on banks such as the recent Rs 2.91 crore fine on Axis Bank and HDFC Bank by RBI in September 2024.

- Furthermore, practices like evergreening of loans and window dressing of balance sheets (manipulating financial statements to present a healthier financial position) have been prevalent, especially among PSBs and cooperative banks.

- These practices distort true asset quality, masking underlying financial stress and hindering accurate risk assessment.

- Furthermore, practices like evergreening of loans and window dressing of balance sheets (manipulating financial statements to present a healthier financial position) have been prevalent, especially among PSBs and cooperative banks.

- Sector-Specific Challenges: Industry-specific factors such as high operating costs in the aviation sector lead to higher NPAs.

- Indian airlines are projected to incur net losses of Rs 2,000–3,000 crore in FY 2025, primarily due to high operating expenses and low ticket prices.

- Priority Sector Lending (PSL) to agriculture and MSMEs often face repayment challenges, leading to higher NPAs in the banking sector.

- Inefficiencies in Resolution Mechanisms: Delay in the resolution of cases before Debt Recovery Tribunals (DRTs) and the slow implementation of recovery laws like the Insolvency and Bankruptcy Code (IBC) and SARFAESI Act have hindered effective NPA management.

What are the Challenges Related to NPA Recovery?

- Legal and Regulatory Hurdles: NPA recovery in India is hindered by a slow and outdated legal framework. Despite laws like the IBC and SARFAESI Act, the resolution of corporate insolvency cases takes over 400 days, as reported by the Insolvency and Bankruptcy Board of India (IBBI).

- Borrowers often exploit legal tactics to delay recovery, exacerbating the situation.

- Proper Asset Valuation and Realization: Accurate asset valuation is critical in NPA recovery. Market conditions and economic factors can lead to overvaluation or undervaluation, resulting in financial losses.

- Converting collateral into cash, especially during economic downturns or in niche markets, can be slow and challenging, with assets often failing to meet their original valuation.

- Debtor Cooperation: It is crucial for NPA recovery. Many borrowers either lack the ability or willingness to repay, resorting to tactics such as hiding or undervaluing assets, or using legal delays, significantly hampering the recovery process.

- Operational Inefficiencies: Internal inefficiencies, such as poor documentation, inadequate tracking systems, and lack of coordination, hinder NPA recovery.

- The absence of a centralized management system leads to mismanaged information, delaying recovery and increasing costs.

- Economic and Market Conditions: Economic downturns lead to a decline in asset values, making it difficult to recover full loan amounts. Market volatility, especially in sectors like real estate and machinery, further complicates the recovery process.

Way Forward

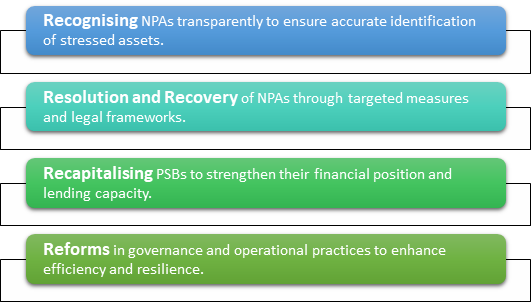

- Government Support: Implement a 4R strategy- Recognition, Resolution, Recapitalization, and Reforms to strengthen PSBs and reduce NPAs through transparent recognition, improved recovery, recapitalization, and financial ecosystem reforms.

- Enhanced Monitoring: Banks should invest in better monitoring systems to detect early signs of loan defaults and take preventive measures before loans become NPAs.

- Proactive engagement with borrowers and regular reassessment of loan performance can help mitigate the risk of defaults.

- Approval Process: Establish a structured credit approval process, including comprehensive assessments and periodic reviews of borrowers' financial health and repayment capacity.

- Institutional Mechanism: Create new Development Financial Institutions (DFIs) to support long-term industrial and infrastructure funding.

- Public-Private Collaboration: Collaborative efforts between public and private sector banks, along with specialized agencies, could improve the efficiency of recovery actions.

- Using technology and data analytics to track defaulters and locate absconding promoters could also enhance recovery efforts.

- Risk Management: Mitigate concentration risks by diversifying loan portfolios, reducing reliance on specific sectors or borrowers to minimize NPAs during downturns.

- Banks should adopt stricter lending norms and focus on financing projects with a higher probability of success.

Conclusion

While loan write-offs have provided temporary relief by reducing NPAs for Indian banks, the long-term sustainability of this approach depends on improving recovery mechanisms, strengthening legal frameworks, and enhancing the overall governance of financial institutions.

|

Drishti Mains Question: Analyze the causes of rising NPAs in Indian banks and evaluate the effectiveness of government and RBI measures to address them. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Which of the following statements best describes the term ‘Scheme for Sustainable Structuring of Stressed Assets (S4A)’, recently seen in the news? (2017)

(a) It is a procedure for considering ecological costs of developmental schemes formulated by the Government.

(b) It is a scheme of RBI for reworking the financial structure of big corporate entities facing genuine difficulties.

(c) It is a disinvestment plan of the Government regarding Central Public Sector Undertakings.

(d) It is an important provision in ‘The Insolvency and Bankruptcy Code’ recently implemented by the Government.

Ans: (b)

.png)