Indian Economy

India’s Textile Industry

- 06 Mar 2025

- 7 min read

For Prelims: Man-made fibres, Foreign Direct Investment, PM MITRA Parks, Quality Control Orders

For Mains: India’s Textile Industry, Potential and Challenges, Growth & Development

Why in News?

India’s textile industry has the potential to become a global leader, driven by a growing domestic market, and rising global interest.

- However, key issues such as high production costs, fragmented supply chains, and sustainability challenges have slowed growth and exports.

What are the Key Facts About India’s Textile Industry?

- Economic Contribution: The textile industry contributes 2.3% to India's Gross Domestic Product (GDP), projected to reach 5% by 2030.

- As of FY24, it accounts for 13% of industrial production, 12% of exports, and employs 4.5 crore workers.

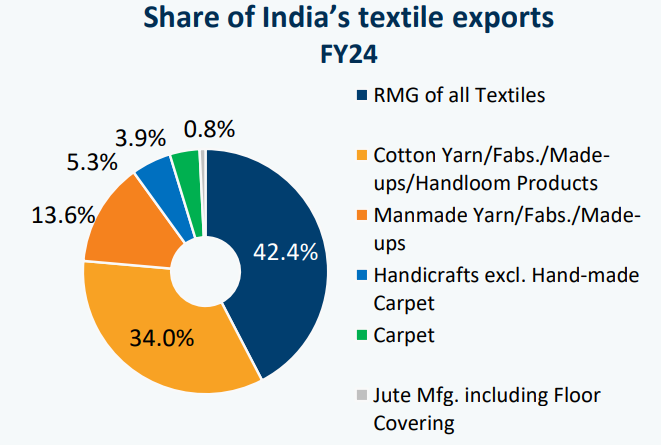

- In FY24 exports stood at USD 35.9 billion, with key markets in the US, EU, and UAE.

- Position in Global Textile Trade: India has the 2nd largest textile manufacturing capacity globally and ranks as the 6th largest exporter of textiles and apparel in 2023 (accounting for 3.9% of global trade).

- India is the 2nd largest producer of cotton in the world (23.83% of world cotton production), with production expected to reach 7.2 million tonnes by 2030.

- India is the largest producer of jute in the world, and 2nd largest producer of man-made fibres (MMF), including polyester, viscose, nylon, and acrylic.

- Market Growth Projections: India’s textile and apparel market is projected to reach USD 350 billion by 2030.

- Government Initiatives: PM Mega Integrated Textile Region and Apparel (MITRA) Parks, Production Linked Incentive (PLI) Scheme for Textiles, National Technical Textile Mission (NTTM).

- 100% Foreign Direct Investment (FDI) allowed in textiles under the automatic route to attract foreign investment.

What are the Key Challenges Facing India’s Textile Industry?

- Lack of Trade Agreements: Countries like Vietnam and China benefit from Free Trade Agreements (FTAs) with major markets, making its exports more competitive.

- India lacks similar FTAs in key textile-consuming regions like the US.

- Stagnant Growth and Declining Exports: Textile sector contracted by 1.8% annually (FY20-FY24), while apparel sector shrank by 8.2% per year.

- Apparel exports fell from USD 15.5 billion in FY20 to USD 14.5 billion in FY24.

- Expensive Raw Materials: Government-imposed Quality Control Orders (QCOs) restrict imports of polyester and viscose, forcing domestic yarn makers to rely on costlier local alternatives.

- Polyester fibre in India is 33-36% costlier than in China, while viscose fibre is 14-16% more expensive.

- Low Export Competitiveness: India's textile exports are costlier than those of China and Vietnam due to supply chain integration issues.

- Unlike vertically integrated supply chains (company takes ownership of suppliers) in China, India's fragmented supply chain spread across states and complex customs increase logistics costs and reduce competitiveness.

- Additionally, Bangladesh, as a Least Developed Country (LDC), enjoys duty-free exports, gaining a cost advantage over India in many markets due to preferential trade policies.

- Sustainability Pressures: Global brands are enforcing strict environmental norms, requiring higher renewable energy use, waste recycling, and traceability of raw materials.

- The European Union has implemented several regulations (2021-2024) covering the fashion industry, impacting nearly 20% of India’s textile exports.

Note: The global textile and garment sector contributes 6-8% of global carbon emissions (~1.7 billion tonnes/year).

- Textile production causes 20% of global water pollution from dyeing and finishing and the textile sector was the 3rd largest source of water degradation and land use in 2020.

Way Forward

- Strengthening Supply Chains: Develop Vertically Integrated Textile Parks that cover the entire production cycle from fibre to finished apparel, reducing logistical and production costs.

- Reassess QCOs on polyester and viscose fibres to allow controlled imports and lower domestic costs.

- Develop "fibre-to-fashion" hubs to reduce fragmentation and logistics costs.

- Leveraging Labour Pools: More PM MITRA parks should be established in Uttar Pradesh, Bihar, and Madhya Pradesh, where job demand is high.

- Housing near factories, similar to China’s model, can increase productivity, and improve take-home salaries and reduce attrition rate.

- Policy Reforms: Secure preferential trade agreements with EU, US, and key markets to improve competitiveness.

- Boosting MMF: Encourage higher domestic MMF consumption by offering incentives for MMF-based textile production.

- Sustainability: Provide financial incentives to MSMEs for shifting to sustainable manufacturing and renewable energy adoption.

- Fast fashion waste is projected to reach 148 million tonnes by 2030, driving increased demand for recycled textiles, a market where India has significant potential, strengthening waste management infrastructure will be key to sustainable growth.

|

Drishti Mains Question: How does the textile industry contribute to India’s economic growth, and what measures are needed to make it globally competitive? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following statements: (2020)

- The value of Indo-Sri Lanka trade has consistently increased in the last decade.

- “Textile and textile articles” constitute an important item of trade between India and Bangladesh.

- In the last five years, Nepal has been the largest trading partner of India in South Asia.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (b)

Mains

Q. Analyse the factors for highly decentralized cotton textile industry in India. (2013)