Governance

India’s Semiconductor Ambitions

- 25 Oct 2024

- 16 min read

For Prelims: DLI Scheme, Development of Semiconductors and Display Manufacturing Ecosystems in India, Semiconductor Fab, System on Chip (‘SoC), India Semiconductor Mission.

For Mains: Importance of Semiconductor Fabrication, India’s Semiconductor Industry, India Semiconductor Mission (ISM), Make in India and Aatma Nirbhar Bharat Abhiyan, Challenges and Way Forward

Why in News?

Recently, India's semiconductor ambitions advanced with the Union Cabinet approving an $11 billion chip fabrication plant in Gujarat, led by Tata Group and Taiwan’s Powerchip, boosting India's goal to become a key global semiconductor player.

What is the Current Status and What are the Opportunities in India’s Semiconductor Industry?

- Current Status:

- According to a recent report published in the Economic Times, India's semiconductor market was valued at $45 billion in 2023 and is projected to rapidly grow at a CAGR of 13 per cent to surpass $100 billion by 2030.

- Opportunities:

- Large Domestic Market: As the largest populous economy in the world, India possesses a vast domestic consumption market for semiconductors.

- India has emerged as the second-largest market for 5G smartphones after China in the first half of 2024, which is expected to grow further in future.

- Government Support and Incentives: Government has approved the Semicon India programme for the development of semiconductor and display manufacturing ecosystem in the country.

- Infrastructure Development: The establishment of semiconductor manufacturing units and assembly, testing, marking, and packaging facilities is creating a strong foundation for the industry.

- Strategic Partnerships: Collaborations with global semiconductor leaders and technology partnerships with countries like the US and Japan are enhancing India's capabilities and fostering technology transfers.

- Large Domestic Market: As the largest populous economy in the world, India possesses a vast domestic consumption market for semiconductors.

What are Some of the Initiatives taken by the Government to promote Semiconductor Industry?

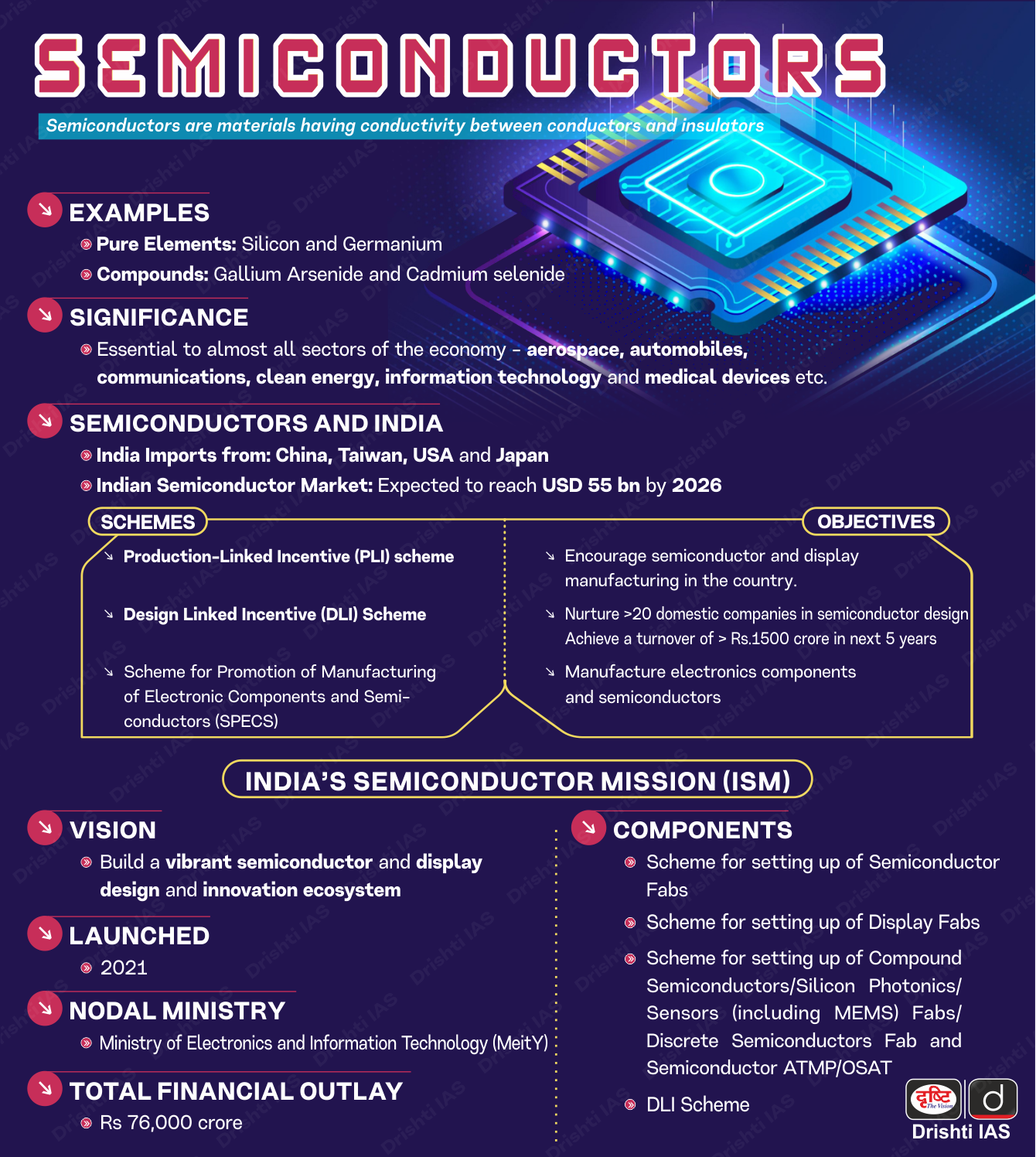

- India Semiconductor Mission (ISM)

- About:

- The ISM was launched in 2021 with a total financial outlay of Rs76,000 crore under the aegis of the Ministry of Electronics and IT (MeitY).

- It is part of the comprehensive program for the development of sustainable semiconductor and display ecosystems in the country.

- The programme aims to provide financial support to companies investing in semiconductors, display manufacturing and design ecosystem.

- Envisioned to be led by global experts in the Semiconductor and Display industry, ISM will serve as the nodal agency for efficient, coherent and smooth implementation of the schemes.

- Four schemes have been introduced under the India Semiconductor Mission:

- ‘Modified Scheme for setting up of Semiconductor Fabs in India’:

- It offers 50% fiscal support for Silicon CMOS-based semiconductor fabs, aiming to attract large investments and strengthen the country’s electronics manufacturing ecosystem and value chain.

- ‘Modified Scheme for setting up of Display Fabs in India’:

- It offers 50% fiscal support to attract investments for manufacturing TFT LCD and AMOLED display panels, strengthening the country's electronics manufacturing ecosystem.

- 'Modified Scheme for setting up Compound Semiconductor and ATMP facilities in India':

- The 'Modified Scheme for setting up Compound Semiconductor and ATMP facilities in India' provides 50% fiscal support for capital expenditure on establishing Compound Semiconductor, Silicon Photonics, Sensors, and Discrete Semiconductor fabs.

- 'Semicon India Future Design: Design Linked Incentive Scheme':

- The 'Semicon India Future Design: Design Linked Incentive Scheme' offers financial support for semiconductor design, providing up to 50% incentives on expenses (₹15 crore limit) and 6%-4% on net sales turnover over five years (₹30 crore limit).

- ‘Modified Scheme for setting up of Semiconductor Fabs in India’:

- About:

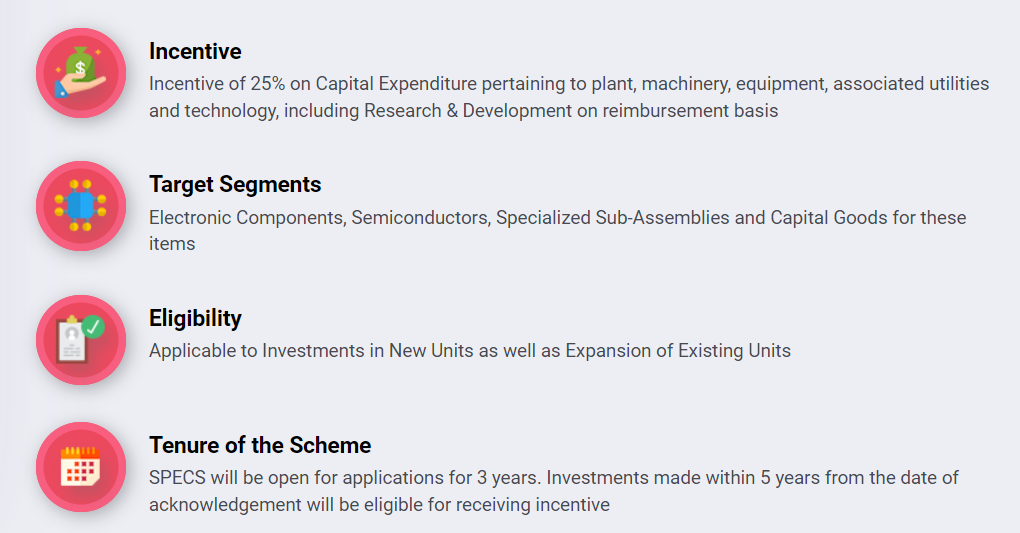

- Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS): This scheme aims to enhance India's manufacturing ecosystem for electronic components and semiconductors. With a growing market that reached $20.8 billion in 2018-19 and is expected to hit $200 billion by 2025, India is well-positioned to become a global hub, supported by skilled labor, improved infrastructure, and government initiatives. The scheme will boost domestic demand, increase value addition, and create jobs in the sector.

- Production Linked Incentive Scheme (PLI) for Large Scale Electronics Manufacturing: The PLI for Large Scale Electronics Manufacturing proposes a financial incentive to boost domestic manufacturing and attract large investments in the electronics value chain including mobile phones, electronic components and ATMP units.

- Production Linked Incentive Scheme (PLI) for IT Hardware: The Production Linked Incentive Scheme for IT Hardware proposes a financial incentive to boost domestic manufacturing and attract large investments in the value chain. The scheme seeks to incentivise companies to utilise the existing installed capacity to fulfill the increasing domestic demand.

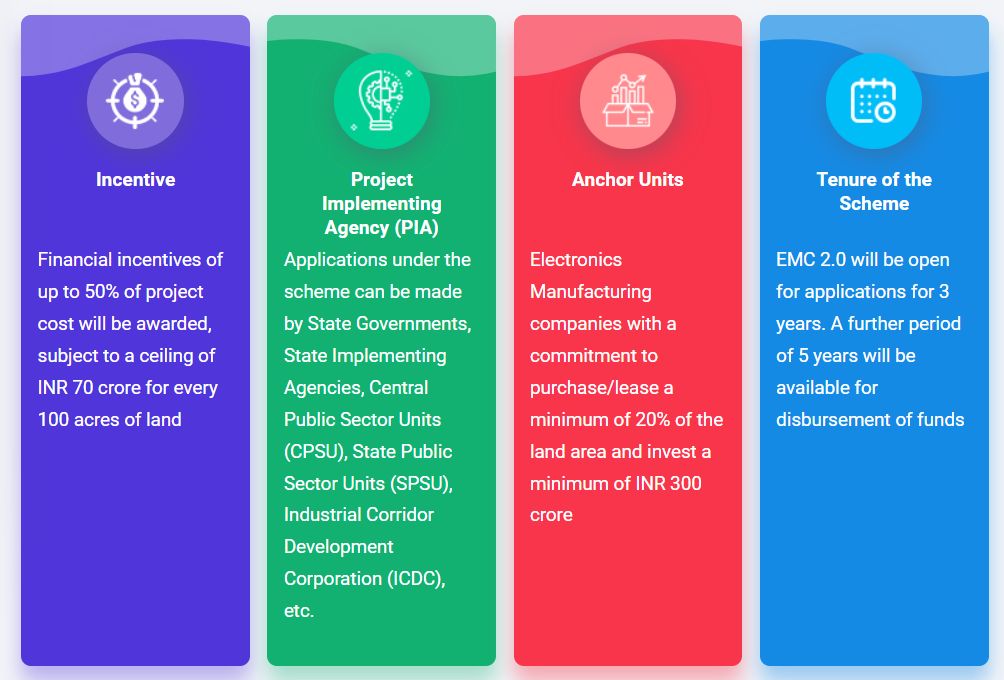

- Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme: EMC 2.0 Scheme aims to enhance infrastructure for India's electronics industry, promoting supply chain efficiency and reducing logistics costs. It offers financial incentives for building quality infrastructure and common facilities for manufacturers.

What is the Strategic Importance of Semiconductor Fabrication?

- Economic Growth: Building a semiconductor industry can attract substantial investments, create high-value jobs, and drive economic growth, particularly in the electronics manufacturing sector.

- With the global semiconductor market projected to reach USD 1 trillion by 2030, India aims to achieve a 10% share in the global semiconductor market by 2030.

- Moreover, domestic semiconductor production is essential for a wide array of downstream industries, supporting economic resilience and strategic interests.

- Technological Sovereignty and Self-Reliance: Developing domestic semiconductor fabrication capabilities will reduce India's reliance on foreign suppliers, ensuring greater control over critical technologies and enhancing national security.

- This aligns with India's strategic goals to achieve technological self-reliance and supports initiatives like "Make in India" and "Aatma Nirbhar Bharat Abhiyan."

- Moreover, India imports about 65-70% of its electronic components, mainly from China. Establishing local manufacturing can mitigate this dependency.

- Elevating India’s Status Globally: As semiconductors are considered the "new oil" of the economy, India's emergence as a key player in this industry can elevate its global status and establish it as a hub for technology and electronics manufacturing.

- Fostering Technological Advancements: Investing in semiconductor fabrication encourages research and development, leading to technological advancements and fostering a culture of innovation within the country. This is essential for sustaining long-term growth and competitiveness.

- Embracing the Fourth Industrial Revolution: India is embracing the Fourth Industrial Revolution, also known as Industry 4.0, which heavily depends on semiconductors. The country has the potential to be a leader in emerging technologies such as artificial intelligence (AI), drones, and quantum computing.

- A strong semiconductor ecosystem will be crucial for facilitating advancements in these areas, driving innovation, and enhancing productivity across various sectors.

What are the Challenges faced by the Semiconductor Industry in India?

- Supply Chain and Infrastructural Bottlenecks: Semiconductor manufacturing faces challenges in establishing reliable supply chains for raw materials and building the necessary infrastructure, such as cleanrooms and fabs.

- Semiconductor fabrication is a highly intricate process, often involving between 500 and 1,500 steps, taking place in cleanrooms to avoid contamination. Developing this ecosystem requires significant investment and technological expertise.

- Capital-Intensive: Setting up semiconductor manufacturing plants requires substantial capital investment, alongside sustained R&D expenditure. The financial burden of these projects is often daunting for many companies.

- Beyond infrastructure, companies need to invest in advanced technology, talent, and equipment, further increasing the capital requirements for semiconductor production.

- Talent Gap: India faces a critical shortage of skilled professionals in chip design, fabrication, testing, and packaging, hindering its ability to scale semiconductor production.

- According to a report by TeamLease Degree Apprenticeship, the semiconductor industry in India is projected to encounter a shortage of 250,000-300,000 professionals by 2027.

- Global Competition and Market Dominance: The global semiconductor market is largely controlled by a few countries, with Taiwan and South Korea accounting for 80% of the global chip foundry base. India faces stiff competition from these established players, along with China and other semiconductor hubs.

- Nvidia’s Dominance in AI Chips: In the chip design market, companies like Nvidia dominate, especially in high-end graphics and AI chips, creating barriers for India to penetrate this segment. Similarly, ARM holds significant market share in designing architectures for processors.

- EUV Technology Monopoly: Advanced semiconductor manufacturing is heavily dependent on Extreme Ultraviolet Lithography (EUV) technology, produced solely by the Netherlands-based company ASML.

- The monopoly of this technology challenges India by restricting access to advanced chip-making equipment.

- Environmental Concerns: The semiconductor industry uses large quantities of hazardous chemicals, such as hydrochloric acid, toxic metals, and volatile solvents, which pose significant environmental risks.

- Managing these environmental concerns adds complexity and cost to semiconductor production.

What is the Way Forward for India’s Semiconductor Journey?

- Talent Development: Developing training programs in semiconductor design, fabrication, and testing aligned with industry demands is essential for creating a skilled talent pool in advanced technologies.

- In 2023, the government announced that over 300 leading institutions across India would start offering specialized semiconductor courses, marking a positive step in the right direction.

- Research and Development (R&D): To stay competitive in the global semiconductor market, India must significantly boost investments in R&D. This includes supporting indigenous product design and intellectual property (IP) development, which can empower smaller companies and startups to compete globally.

- Incentives and Policies: Continued government support through incentives and favorable policies will attract more investments. The India Semiconductor Mission (ISM) and state-level initiatives are steps in the right direction.

- Several states have introduced initiatives with favorable policies and incentives to support semiconductor manufacturing, such as UP's Semiconductor Policy 2024.

- These state-level efforts complement the ISM.

- Several states have introduced initiatives with favorable policies and incentives to support semiconductor manufacturing, such as UP's Semiconductor Policy 2024.

- Global Partnerships: India’s role in the global semiconductor industry can be strengthened through "chip diplomacy" — fostering international collaboration and joint ventures, helping India overcome capital expenditure barriers and accelerate its growth.

- Focus on Niche Technologies: India should focus on developing niche technologies like MEMS (Micro-Electro-Mechanical Systems) and sensors, which are becoming increasingly important for industries like IoT, automotive, and telecommunications.

- These technologies offer India the opportunity to lead in specialized areas within the global semiconductor market.

- Promoting Private Sector Participation: Private companies bring in agility, risk-taking ability, and access to global networks, which are crucial for rapid growth.

- The Tata Group in collaboration with Taiwan's Powerchip Semiconductor Manufacturing Corporation (PSMC) is building India's first semiconductor fabrication plant in Gujarat.

- More private sector initiatives must be promoted and incentivised.

- The Tata Group in collaboration with Taiwan's Powerchip Semiconductor Manufacturing Corporation (PSMC) is building India's first semiconductor fabrication plant in Gujarat.

- Seizing Opportunities Amid Tensions: The ongoing trade and geopolitical tensions between the US and China have reshaped the semiconductor landscape, creating openings for countries like India to strengthen their position in the industry through government-funded initiatives and strategic partnerships, such as the collaboration with Taiwan’s Powerchip.

Conclusion

India’s semiconductor production efforts, backed by ambitious projects like the Tata Group’s fabrication plant, mark a turning point in its technological capabilities. This move not only strengthens India’s economic and strategic imperatives but also positions the country as a potential key player in the global semiconductor landscape.

|

Drishti Mains Question: What is the significance of establishing a domestic semiconductor fabrication industry for India? Discuss the challenges faced by India's semiconductor industry, and suggest strategies to address them. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Which one of the following laser types is used in a laser printer? (2008)

(a) Dye laser

(b) Gas laser

(c) Semiconductor laser

(d) Excimer laser

Ans: (c)

Q. With reference to solar power production in India, consider the following statements: (2018)

- India is the third largest in the world in the manufacture of silicon wafers used in photovoltaic units.

- The solar power tariffs are determined by the Solar Energy Corporation of India.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)