Indian Economy

India’s Remittance Trends 2024

- 20 Mar 2025

- 8 min read

For Prelims: Reserve Bank of India, Remittance, Gulf Cooperation Council, Rupee Drawing Arrangement, Liberalized Remittance Scheme

For Mains: Remittances trends, Influence of global economic shifts on remittance inflows, foreign exchange

Why in News?

The Reserve Bank of India’s (RBI) 6th Round of India’s Remittances Survey (2023-24) highlights that Advanced economies (AEs), particularly the US and the United Kingdom (UK), have overtaken Gulf nations as the top contributors to remittances in India.

What are the Key Findings of the 6th Round of India’s Remittances Survey?

- Shift in Source of Remittances: India’s total remittances have more than doubled, rising from USD 55.6 billion in 2010-11 to USD 118.7 billion in 2023-24.

- The US led remittances at 27.7% in 2023-24, followed by the United Arab Emirates (UAE) at 19.2%.

- AEs, including the UK, Singapore, Canada, and Australia, contributed over 50%.

- The U.K.’s share rose to 10.8% from 3.4% (2016-17), driven by increased Indian emigration and Australia emerged as a key source with 2.3%.

- The overall share of Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Kuwait, Qatar, Oman, Bahrain) stands at 38% (2023-24), down from around 47% (2016-17).

- State-wise Distribution of Remittances: Maharashtra (20.5%) remained the top recipient, followed by Kerala (19.7%).

- Other major states include Tamil Nadu (10.4%), Telangana (8.1%), and Karnataka (7.7%). Rising trends were seen in Punjab, and Haryana.

- Mode of Remittance Transfers: Rupee Drawing Arrangement (RDA) remains the dominant channel for inward remittances, followed by direct Vostro transfers and fintech platforms.

- Digital remittances are rising, accounting for 73.5% of total transactions in 2023-24.

What are the Reasons for the Shift in Source of Remittances to India?

- Stronger Job Markets in AEs: The US, UK, Canada, and Australia offer high-paying jobs, especially for skilled Indian migrants.

- The US job market recovered post Covid-19, leading to higher remittances from Indian professionals.

- The UK-India Migration and Mobility Partnership (MMP) made it easier for Indians to get work visas, as a result, Indian migration to the UK tripled from 76,000 in 2020 to 250,000 in 2023.

- Canada’s Express Entry and Australia’s immigration system favor skilled Indian professionals, leading to high-paying jobs and increased remittances.

- Declining Job Opportunities in GCC: Many Indian migrants who returned from the Gulf during Covid-19 and later moved to AEs for better financial opportunities.

- Additionally, economic diversification and automation have reduced demand for low-skilled Indian labor in the Gulf’s construction sector.

- Meanwhile, nationalization policies like Nitaqat (Saudi Arabia) and Emiratization (UAE) favor local workers, further limiting job prospects for migrants.

- Changing Migration Patterns in India: Southern states like Kerala, Tamil Nadu, Andhra Pradesh, and Telangana now prefer AEs over the Gulf.

- Uttar Pradesh, Bihar, and Rajasthan continue to send large numbers of workers to the Gulf, lower educational attainment compared to southern states, reducing eligibility for skilled jobs in AEs.

- Rise in Education-Driven Migration & Remittances: The growing number of Indian students in AEs has also boosted remittances. Many students stay back for work, sending money home.

- Canada hosts 32% of Indian students abroad, followed by the US (25.3%), the UK (13.9%), and Australia (9.2%).

Remittance

- About: Remittances are funds sent by overseas workers to support families back home, playing a key role in household income and the economy.

- In 2024, India received a record USD 129.1 billion in remittances, the highest ever for any country in a single year, accounting for 14.3% of global remittances. Mexico and China followed as the next largest recipients.

- Regulatory Framework: The Foreign Exchange Management Act (FEMA), 1999 regulates all foreign exchange transactions in India.

- Under the Liberalized Remittance Scheme (LRS), a part of FEMA, Indian residents can remit up to USD 250,000 per year for personal and investment purposes, with higher amounts requiring RBI approval.

- However, LRS prohibits remittances for gambling, speculative trading, and terrorist financing.

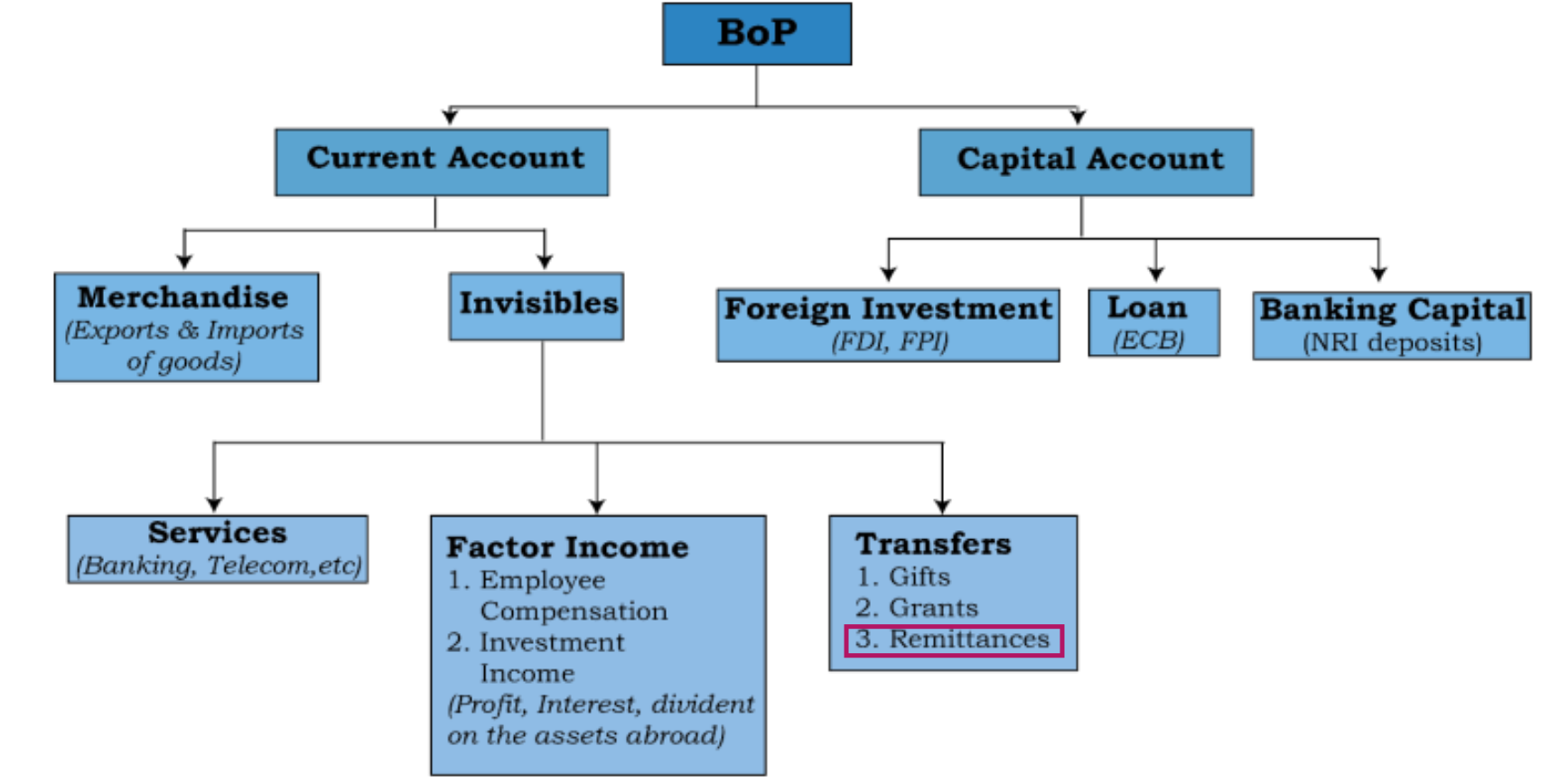

- Remittances are recorded under the current account of the Balance of Payments (BoP) as unilateral transfers. They represent foreign income inflows that do not create liabilities.

|

Drishti Mains Question: Analyze the impact of shifting migration trends on India’s Remittances and domestic labor market. |

UPSC Civil Services Examination, Previous Year Questions

Prelims

Q1. Which of the following constitute Capital Account? (2013)

- Foreign Loans

- Foreign Direct Investment

- Private Remittances

- Portfolio Investment

Select the correct answer using the codes given below:

(a) 1, 2 and 3

(b) 1, 2 and 4

(c) 2, 3 and 4

(d) 1, 3 and 4

Ans: (b)

Q2. With reference to digital payments, consider the following statements: (2018)

- BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account.

- While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Q3. Which of the following is a most likely consequence of implementing the ‘Unified Payments Interface (UPI)’? (2017)

(a) Mobile wallets will not be necessary for online payments.

(b) Digital currency will totally replace the physical currency in about two decades.

(c) FDI inflows will drastically increase.

(d) Direct transfer of subsidies to poor people will become very effective.

Ans: (a)

Mains

Q. ‘Indian diaspora has a decisive role to play in the politics and economy of America and European Countries’. Comment with examples. (2020)