India's Lithium Mining Challenges | 31 Jul 2024

For Prelims: Lithium, Geological Survey of India, Electric vehicle (EV), Mineral (Auction) Rules, 2015, United Nations Framework for Classification of Resources, net zero by 2070, International Energy Agency

For Mains: Natural Resources Management, Mineral & Energy Resources, Lithium Mining Challenges

Why in News?

India's efforts to secure domestic lithium resources have hit a roadblock as the Ministry of Mines cancelled the auction for a lithium block in Jammu and Kashmir's Reasi district for the second time.

- The repeated setback has officials weighing the need for further exploration before attempting another auction.

What are the Key Points About the Lithium Block in J&K's Reasi district?

- Estimated Resources: In February 2023, the Geological Survey of India (GSI) established lithium-inferred resources of 5.9 million tonnes in the Reasi district in Jammu and Kashmir (J&K), which is essential for various applications, particularly in electric vehicle (EV) batteries.

- This discovery makes India the seventh-largest source of lithium globally.

- Auction Attempts: The first auction attempt took place in November 2023 but was annulled on March 13 due to fewer than three bidders qualifying.

- A second auction attempt was made but was again annulled due to no bidders qualifying.

- Regulatory Framework: According to the Mineral (Auction) Rules, 2015, the auction can proceed to a second round even if fewer than three bidders qualify. However, in this case, no bidders met the qualification criteria.

- The second auction attempt saw no qualified bidders, which highlights the extent of investor hesitation.

- Reasons for Investor Hesitation:

- Clay Deposits: The J&K lithium reserves are primarily clay deposits, which have not yet been commercially proven on a global scale. The path to commercialisation for such deposits is uncertain and may take longer time.

- Lack of Beneficiation Study: The absence of a beneficiation study to evaluate the feasibility of extracting and processing lithium has raised concerns among potential bidders about the economic viability of the project.

- Sub-Par Reporting Standards: The auction documents have been criticised for providing limited information about the block.

- Prospective bidders have expressed concerns about the block's small size and the inadequacy of the data for applying modern mineral systems-based tools.

- Exploration Stage Ambiguities: The primary reason for the low bid interest is the block's exploration status, which is currently at the G3 level according to the United Nations Framework Classification for Resources (UNFC).

- This level of exploration provides preliminary and less confident estimates of the mineral reserves, which deters investors due to the high risk and uncertainty associated with such investments.

- Economic Viability Concerns: The extraction of lithium is expensive, and with global lithium prices falling, investors are wary of potential financial losses.

- The current reporting standards do not provide enough clarity on the project's profitability, further deterring investment.

- Reserve Price: The reserve price set for the second auction attempt was based on the highest initial bid offer from the previous round. If this reserve price was deemed too high relative to the perceived value or risk of the block, it could have deterred potential bidders.

United Nations Framework for Classification of Resources (UNFC)

- The UNFC provides a structured approach to classifying mineral resources based on the stage of exploration and the confidence in the estimates. The classification is divided into four stages:

- G4-Reconnaissance: This is the initial stage of exploration, involving regional assessments and limited subsurface sampling.

- Confidence Level: Estimates are of low confidence, providing only preliminary information about the potential quantity and grade of the mineral resources.

- G3-Prospecting: At this stage, preliminary exploration is conducted to assess the potential of the mineral deposit further.

- Confidence Level: Estimates remain of low confidence, with continued uncertainty about the true value and extent of the mineral resources.

- G2-General Exploration: This stage involves more detailed exploration and sampling, providing a moderate level of confidence in the estimates.

- Confidence Level: The assessments offer a more reliable estimate of the mineral resources but are still not fully detailed.

- G1-Detailed Exploration: The most advanced stage of exploration involves comprehensive investigations, extensive sampling, and direct analysis.

- Confidence Level: Estimates at this stage are of high confidence, providing accurate and reliable data about the quantity and quality of the mineral resources.

- G4-Reconnaissance: This is the initial stage of exploration, involving regional assessments and limited subsurface sampling.

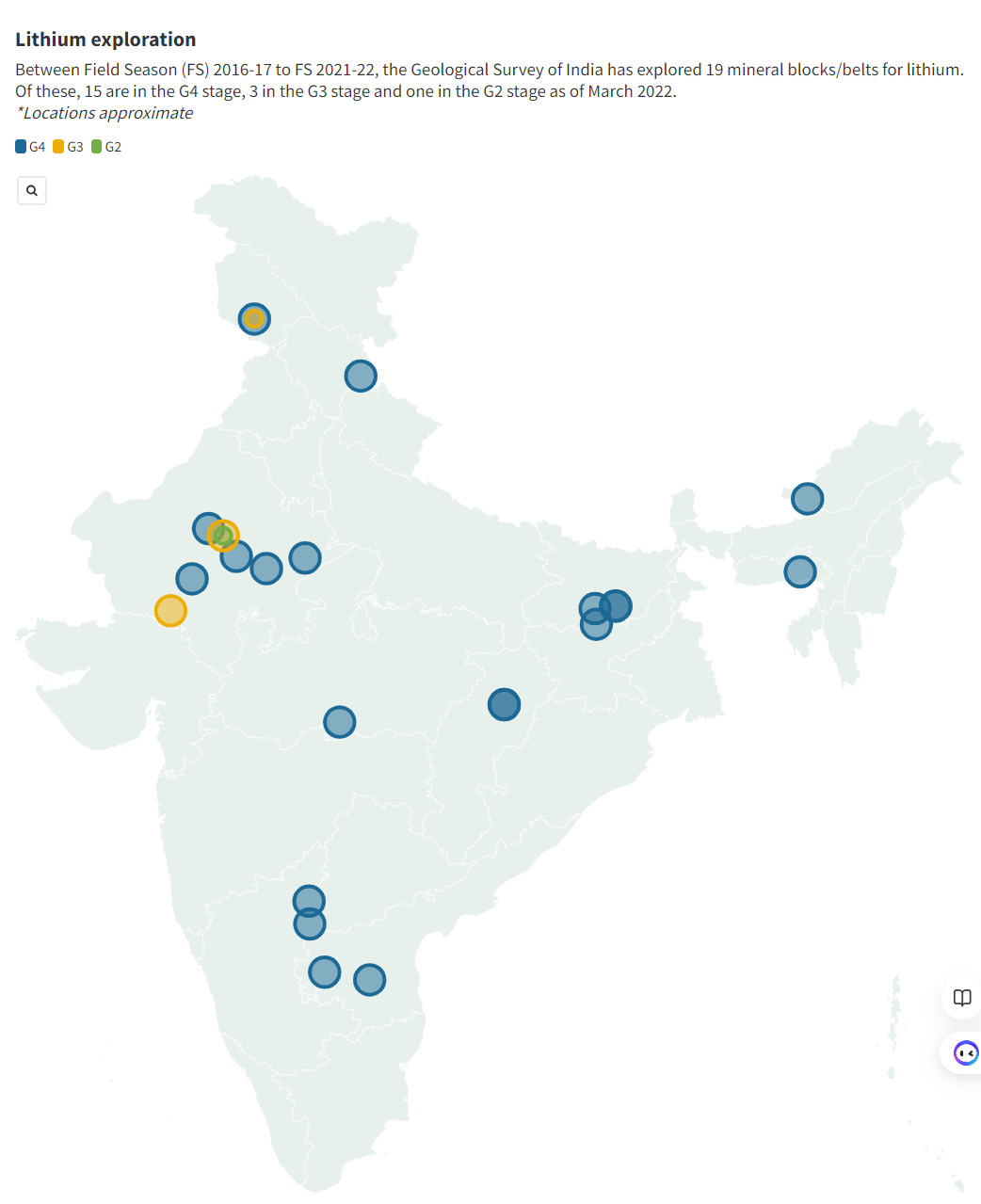

What is the Status of Lithium Exploration in India?

- Successful Auction in Chhattisgarh: India’s first successful lithium auction took place in Korba district, Chhattisgarh. The block was auctioned to Maiki South Mining Pvt Ltd in June 2024.

- The bid included a premium of 76.05%, reflecting strong interest and competitive bidding.

- Additional Findings in Korba: A private exploration company funded by the National Mineral Exploration Trust (NMET) has identified hard rock lithium deposits in Korba, with concentrations ranging from 168 to 295 parts per million (ppm).

- Challenges in Other States:

- Manipur: Lithium exploration efforts in Kamjong district have been stalled due to local resistance. The NMET committee has decided to pause further actions in this area.

- Ladakh: Exploration in the Merak block near the India-China border has yielded disappointing results, leading the NMET committee to suggest dropping the exploration efforts there.

- Assam: Exploration in Dhubri and Kokrajhar districts has not been promising, with the NMET recommending against further upgrades or exploration in these areas.

Significance of Lithium for India

- Lithium is a soft, silvery-white alkali metal with high reactivity, low density, and excellent electrochemical properties.

- It is found naturally in various minerals and is extracted and refined into lithium metal or its compounds.

- India has pledged to reduce its emissions towards net-zero by 2070, requiring lithium as a critical component in EV batteries, and renewable energy storage systems.

- India needs 27 GW of grid-scale battery energy storage systems by 2030, requiring massive amounts of lithium.

- The World Economic Forum warns of global lithium shortages due to rising demand for EVs and rechargeable batteries, estimated to reach 2 billion by 2050. The world's lithium supply is under strain, with 54% of reserves in Argentina, Bolivia, and Chile.

- Lithium’s role in green technologies and energy storage makes it a vital resource as countries aim to meet climate goals and transition to cleaner energy.

- India imports 70–80% of its lithium and 70% of its lithium-ion from China, which could put its growth and domestic industries at risk if tensions between the countries continue.

What are the Challenges in Extraction and Investment of Lithium in India?

- Extraction Challenges: Lithium extraction from hard rock pegmatite deposits is difficult, requiring specialised technology and expertise. Extracting lithium from pegmatite ores involves multiple complex and costly processing stages.

- Environmental Concerns: Lithium extraction, particularly through open-pit mining, can have substantial environmental impacts, including habitat destruction and pollution. Proper management and mitigation measures are required to minimise these effects.

- Transportation: In remote areas like J&K's Reasi district, inadequate infrastructure for transportation and logistics can hinder efficient extraction and increase costs.

- Nascent Industry: India’s lithium sector is still developing, with substantial time required to establish a functional mining and processing infrastructure.

- Lithium projects, especially from brine assets, typically take 6 to 7 years from discovery to production, according to the International Energy Agency (IEA).

- Lack of Processing Infrastructure: China currently dominates the lithium processing sector, handling 65% of the global market. India lacks a foothold in this critical area.

- Limited Domestic Expertise: India’s limited experience in developing mining assets abroad and its nascent expertise in lithium mining contribute to challenges in accelerating domestic projects.

- Investment Challenges: India’s current mineral reporting standards, based on the United Nations Framework Classification for Resources (UNFC), do not align with the Committee for Mineral Reserves International Reporting Standards (CRIRSCO) used globally.

- The UNFC standards lack the detail needed to assess economic viability comprehensively.

- Local Tensions: The ethnic and religious tensions could complicate efforts to attract investment and manage resource development. Past conflicts and ongoing violence make the area particularly unstable.

- Global Competition and Dependency: China controls 77% of the global lithium-ion battery manufacturing capacity, creating a strategic challenge for other nations, including India, which seeks to reduce its dependency on Chinese supplies.

- Investors have multiple opportunities in the global mining market. If other regions offer more attractive or lower-risk opportunities, investors might prioritise those over the regions like the J&K lithium block.

Way Forward

- Attract Foreign Expertise: Attracting foreign companies with expertise in lithium mining and processing will be crucial for accelerating India’s domestic lithium exploration and mining activities.

- Lessons from the Lithium Triangle: Bolivia, Chile, and Argentina, which house the world's largest lithium reserves, offer valuable lessons. Chile and Bolivia have implemented state-controlled or regulated lithium extraction processes.

- Recent environmental and social challenges in these countries underscore the importance of robust regulatory frameworks and community engagement.

- Integrate sustainability principles into the entire lifecycle of lithium mining, from extraction to end-of-life battery management.

- Local Involvement: Plans for lithium exploration include involving local communities and prioritising them for employment opportunities. However, the broader socio-economic impacts on agriculture, animal husbandry, and tourism need to be addressed.

- Government Incentives: Government initiatives, including Production-Linked Incentive (PLI) schemes, aim to improve the ease of doing business and incentivize investments in the critical minerals sector can draw interest from major players like Ola Electric and Reliance New Energy.

- Further Exploration: Additional exploration could provide more clarity about the resource and potentially make the block more attractive to investors. However, this approach involves time and additional investment.

- Government-Initiated Development: Another option is for the government to undertake prospecting or mining operations directly through a government-owned company, as permitted under the Mines and Minerals (Development and Regulation) (MMDR) Act. This approach could ensure the development of the block despite the lack of private investor interest.

- Easing Business Conditions: Amendments to mining regulations and improved ease of doing business are expected to support the development of India’s lithium industry.

- Negotiate trade agreements that ensure fair access to global markets and protect India’s interests in the lithium supply chain.

|

Drishti Mains Question: Q. Evaluate the challenges and opportunities in the management and exploitation of lithium resources in India, considering recent developments and setbacks. Q. How does India's dependency on lithium imports from China impact its strategic and economic interests? Suggest measures to reduce this dependency. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prleims

Q. Which one of the following pairs of metals constitutes the lightest metal and the heaviest metal, respectively? (2008)

(a) Lithium and mercury

(b) Lithium and osmium

(c) Aluminium and osmium

(d) Aluminium and mercury

Ans: (b)

Exp:

- Light metals are metals of low atomic weight while heavier elements generally have high atomic weight.

- Osmium is a hard metallic element which has the greatest density of all known elements. Osmium has an atomic weight of 190.2 u and its atomic number is 76.

- Lithium having an atomic number 3 and atomic weight of 6.941u is the lightest known metal.

- Therefore, option (b) is the correct answer.

Mains

Q. Despite India being one of the countries of Gondwanaland, its mining industry contributes much less to its Gross Domestic Product (GDP) in percentage. Discuss. (2021)