India's Aviation Sector | 08 May 2024

For Prelims: Regional Connectivity Scheme-UDAN, Open Sky Agreement, Goods and Services Tax (GST), Carbon Neutrality, Digi Yatra

For Mains: Transformation of India's aviation sector, Government Policies & Interventions

Why in News?

After ruling the Indian skies, IndiGo is now attempting to make a mark globally with non-stop, long-haul, and low-cost flights from Indian airports.

- However, the long-haul, low-cost airline model has been a challenge for many airlines, with numerous failures and few relatively stable and profitable operations.

What is the Long-haul, Low-cost Air Travel Model?

- About:

- The long-haul, low-cost air travel model is an attempt by low-cost carriers (LCCs) to expand their operations beyond short-haul domestic and regional routes and offer non-stop, long-duration flights at lower fares.

- This model aims to replicate the success of LCCs in the short-haul segment by applying similar cost-cutting strategies and business practices to long-haul operations.

- The long-haul, low-cost air travel model is an attempt by low-cost carriers (LCCs) to expand their operations beyond short-haul domestic and regional routes and offer non-stop, long-duration flights at lower fares.

- Challenges:

- Higher fuel costs for operating larger, wide-body aircraft on long-haul routes.

- Increased operating costs for wider aircraft, such as more crew, maintenance, and airport fees.

- Difficulty in maintaining the rapid turnaround times and high aircraft utilisation levels that are critical to the LCC business model.

- Balancing the need for passenger comfort and amenities on long flights with the low-cost carrier's focus on minimising costs.

- Establishing a viable network and flight schedule that can sustain demand and profitability on long-haul, low-density routes.

- Competition from established full-service carriers with stronger brand recognition and loyalty on long-haul international routes.

- Higher fuel costs for operating larger, wide-body aircraft on long-haul routes.

- Successful Examples:

- A few long-haul LCCs like Scoot, Jetstar, and French Bee have managed to establish relatively stable and profitable operations.

- Key strategies include offering a hybrid product with some premium/business class amenities, targeting underserved routes, and leveraging strong domestic/regional networks.

What is the Progress of India’s Aviation Sector?

- India's Aviation Boom:

- India has emerged as the third-largest domestic aviation market in the world, after the USA and China.

- The industry has undergone a remarkable transformation, shedding its previous limitations and evolving into a vibrant and competitive sector.

- Proactive policies and strategic initiatives by the government have catalysed the growth of the aviation sector, fostering a conducive environment for expansion and innovation.

- India has emerged as the third-largest domestic aviation market in the world, after the USA and China.

- Infrastructure Development:

- India's airport network has witnessed a remarkable transformation, doubling its operational airports from 74 in 2014 to 148 in April 2023, facilitating increased air travel accessibility.

- Regional Connectivity Scheme-UDAN:

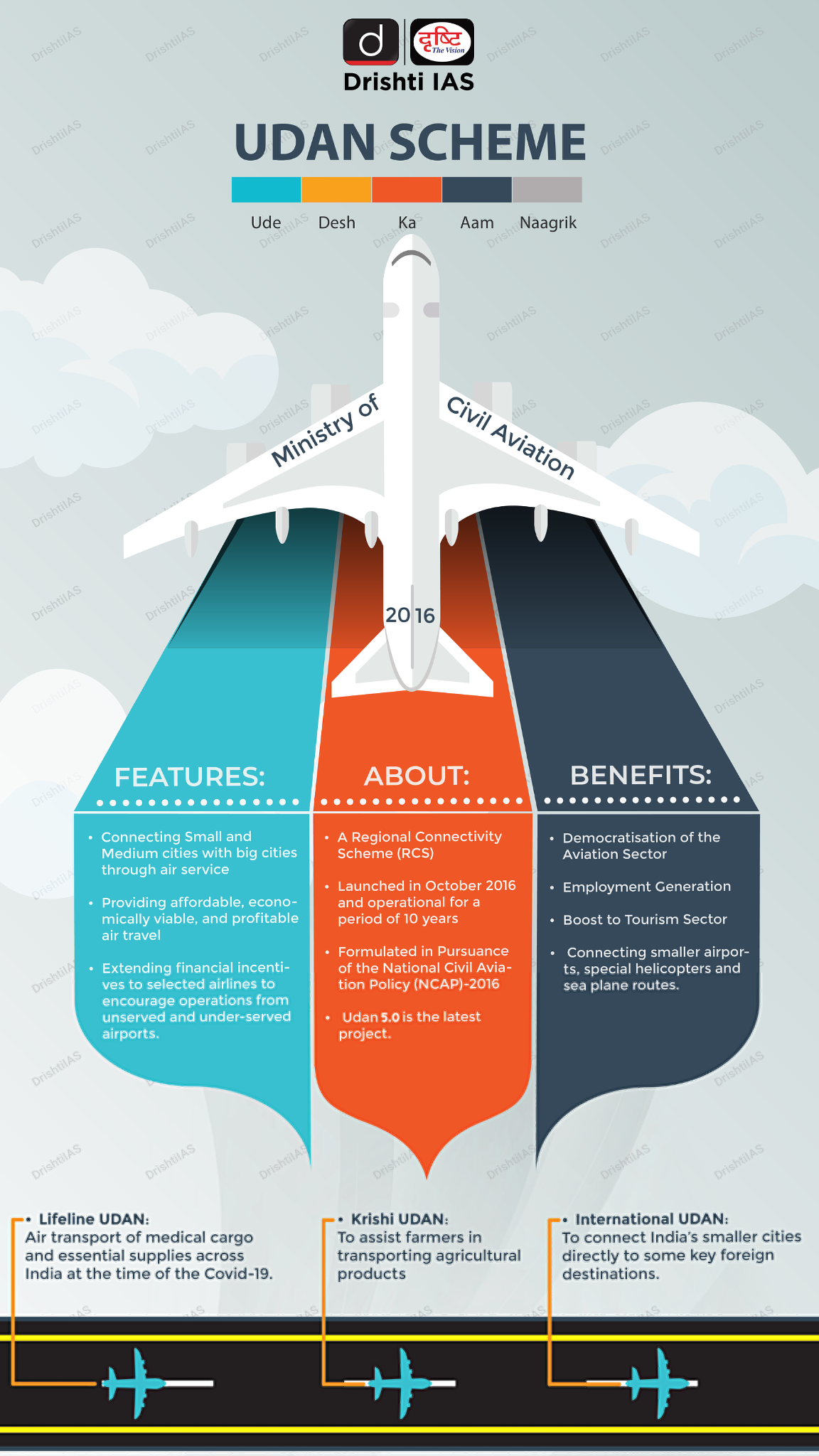

- The Regional Connectivity Scheme–Ude Desh ka Aam Nagrik (RCS-UDAN) was launched in 2016 to provide connectivity to unserved and underserved airports in the country.

- The scheme aims to revive existing airstrips and airports, bringing essential air travel access to isolated communities and boosting regional economic development.

- With 517 RCS routes operational, connecting 76 airports, UDAN has facilitated air travel for over 1.30 crore people, promoting accessibility and economic growth

- Regional Connectivity Scheme-UDAN:

- India's airport network has witnessed a remarkable transformation, doubling its operational airports from 74 in 2014 to 148 in April 2023, facilitating increased air travel accessibility.

- Passenger Growth:

- The aviation industry is experiencing a remarkable resurgence post-Covid, with a surge in passenger demand.

- From January to September 2023, domestic airlines carried 112.86 million passengers, a 29.10% increase compared to the same period in 2022.

- International airlines carried 45.99 million passengers between January and September 2023, a 39.61% increase compared to the same period in 2022.

- The aviation industry is experiencing a remarkable resurgence post-Covid, with a surge in passenger demand.

- Carbon Neutrality:

- The Ministry of Civil Aviation (MoCA) has taken initiatives to work towards carbon neutrality and achieving net zero carbon emissions at airports in the country.

- Airport operators have been advised to map carbon emissions and work towards carbon neutrality and net zero emissions in a phased manner.

- Greenfield airports are being encouraged to prioritise carbon neutrality and net zero emissions in their development plans.

- Airports like Delhi, Mumbai, Hyderabad, and Bengaluru have achieved Level 4+ ACI Accreditation and become carbon neutral.

- 66 Indian Airports are operating on 100% Green Energy.

- The Ministry of Civil Aviation (MoCA) has taken initiatives to work towards carbon neutrality and achieving net zero carbon emissions at airports in the country.

What are the Challenges Facing India's Aviation Industry?

- High Fuel Costs:

- Aircraft Turbine Fuel (ATF) expenses can represent 50-70% of an airline's operational costs and import taxes add to the financial burden.

- Dollar Dependency:

- Fluctuations in the dollar rate impact profits as major expenses like aircraft acquisition and maintenance are dollar-denominated.

- Cutthroat Pricing:

- Airlines often engage in aggressive price competition to attract passengers, leading to thin profit margins amidst high operational costs.

- Limited Competition:

- Currently, IndiGo and a resurgent Air India hold the majority share, possibly nearing 70% combined. This concentration of power can lead to:

- Limited Competition: With fewer major players, there's a risk of reduced competition on routes, potentially leading to higher fares for consumers.

- Pricing Power: The dominant airlines may have more leverage to influence ticket prices, especially if they coordinate strategies.

- Currently, IndiGo and a resurgent Air India hold the majority share, possibly nearing 70% combined. This concentration of power can lead to:

- Grounded Fleet:

- A large portion (over a quarter) of Indian aeroplanes are grounded due to safety concerns and financial issues, hindering capacity.

- Environmental Concerns:

- Pressure to reduce carbon emissions and adopt sustainable practices can add complexity to growth strategies.

India’s Initiatives Related to Aviation Industry

- UDAN Scheme (Ude Desh ka Aam Nagrik).

- National Civil Aviation Policy, 2016

- Goods and Services Tax (GST) rate reduced to 5% from 18% for domestic Maintenance, Repair and Overhaul (MRO) services.

- Open Sky Agreement

- Digi Yatra for Seamless Travel: This digital platform facilitates a contactless experience for air travellers, with features like facial recognition and paperless check-in.

Way Forward

- Diversification of Fuel Sources: Emulate initiatives to incorporate biofuels into the fuel mix, reducing dependence on traditional ATF and mitigating the impact of import taxes.

- Implement fuel hedging strategies to manage the volatility of fuel prices, a practice used by many international airlines.

- Ancillary Revenue Streams: Develop ancillary revenue streams such as cargo services, in-flight sales, and premium services to bolster profits.

- Competitive Pricing Strategies: Utilise advanced yield management systems to optimise pricing and maintain profitability without engaging in detrimental price wars.

- Strengthen customer loyalty programs to encourage repeat business and reduce the need for aggressive pricing tactics.

- Regulatory Reforms: Advocate for regulatory reforms that encourage new entrants and prevent monopolistic practices in the industry.

- Route Rationalisation: Encourage airlines to explore under-served routes, thereby increasing competition and offering more choices to consumers.

- Consider aircraft leasing options to maintain operational flexibility and reduce financial burdens associated with owning a fleet.

- Carbon Offset Programs: Implement carbon offset programs like the ICAO Carbon Emissions Calculator (ICEC) to measure and mitigate the environmental impact.

|

Drishti Mains Question: Q. Evaluate the progress of India's aviation sector, considering factors such as infrastructure development, passenger growth, and the impact of government policies. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains

Q. Examine the development of Airports in India through joint ventures under Public–Private Partnership (PPP) model. What are the challenges faced by the authorities in this regard? (2017)