Agriculture

India Latest Farm Exports Data

- 09 May 2023

- 10 min read

For Prelims: Food Price Index, India’s exports-import data and trends, Government Schemes

For Mains: Key Drivers behind Agri Exports and Imports, Government Measures to promote exports, challenges ahead

Why in News?

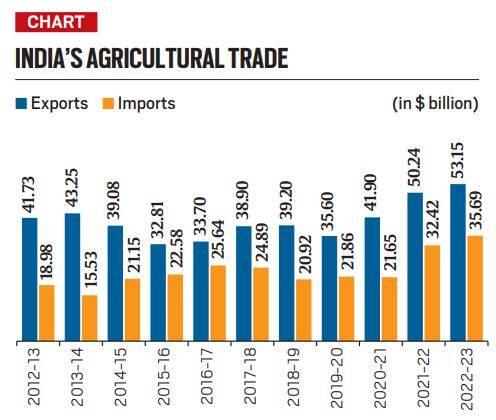

Provisional data released recently by the Department of Commerce has shown that both agricultural exports from and imports into India have scaled new highs in the fiscal year that ended March 31, 2023.

- The data shows that total farm exports were at USD 53.15 billion and imports at USD 35.69 billion during 2022-23, surpassing their previous year’s records.

- The resultant agricultural trade surplus has marginally dipped from USD17.82 billion to USD 17.46 billion.

What are the Key Drivers behind this Increase in Exports?

- Between 2013-14 and 2015-16, India's agricultural exports sharply fell from USD 43.25 billion to USD 32.81 billion, primarily due to the crash in global prices, as reflected the UN Food and Agriculture Organization's Food Price Index (FFPI).

- However, imports continued to rise, leading to a decline in the farm trade surplus.

- In recent years, the FFPI has recovered, making India's agricultural commodities more globally price competitive, resulting in a surge in exports during 2020-2023.

What is FAO’s Food Price Index?

- The FFPI is a measure of the monthly change in international prices of a basket of food commodities. It measures changes for a basket of cereals, oilseeds, dairy products, meat and sugar.

- Base Period: 2014-16.

- FFPI increases when international food prices rise.

What are the Major Exports Contributors?

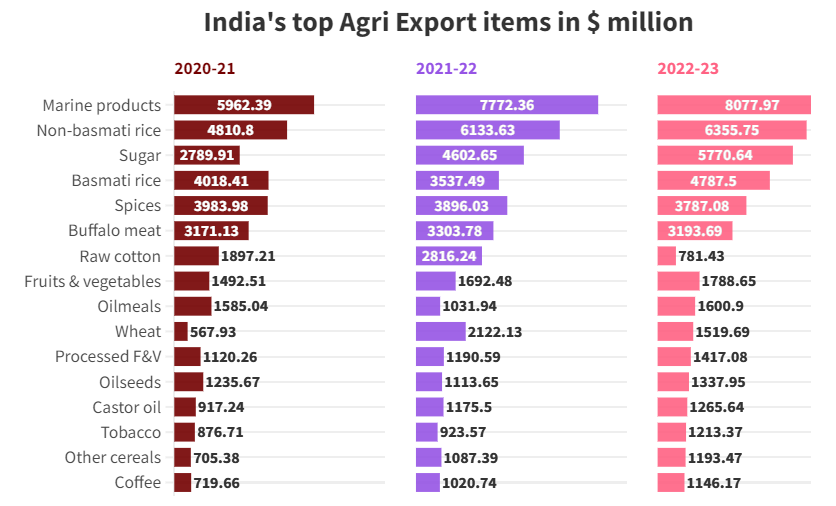

- In recent times, marine products, rice, and sugar have been the driving forces behind India's agricultural exports.

- Marine Products: Marine product exports have grown steadily from USD5.02 billion in 2013-14 to USD8.08 billion in 2022-23.

- Rice: Rice exports have also gone up during this period, from USD7.79 billion to USD11.14 billion.

- It’s been driven by non-basmati rice, which has more than doubled. On the other hand, premium priced basmati rice has witnessed a decline.

- Basmati exports are mainly to the Persian Gulf countries and, to some extent, the US and UK. Non-basmati shipments are more diversified.

- It’s non-basmati that has made India the biggest rice exporter, ahead of Thailand.

- Sugar: The recent boom in sugar exports has been the third largest contributor – from a mere USD 810.90 mn in 2017-18 to USD 5.77 bn in 2022-23 – the sugar exports have grown many folds during these years.

- India has, in the process, emerged as the world’s No. 2 exporter after Brazil.

What are the other Laggards and Losers in the Export Basket?

- Spices: Spices exports, which saw a jump during 2013-2021, have stagnated since then.

- Buffalo: Buffalo meat exports, too, have gone down and never regained their peak of USD 4.78 billion reached in 2014-15.

- Raw Cotton, Guar-Gum and Oil Meals: The drop has been even more for raw cotton, guar-gum and oil meals. Exports of the three in 2022-23 were a pale shadow of their highs of 2011-12.

- Cultivation of genetically modified Bt cotton and high global prices had enabled India to become the world’s top producer (ahead of China) and No. 2 exporter (after the US) of the natural fibre.

- But with the yield gains from Bt tapering off and the regulatory regime not permitting new gene technologies, the country has turned from a net exporter to an importer of cotton.

- Guar-gum (a thickening agent used in extraction of shale oil and gas) and oil meal exports rode the global commodity price boom from 2003-04 to 2013-14.

- They haven’t shown the same buoyancy in the more recent post-Covid boom, partly due to domestic crop shortages – especially in cotton and soyabean – not generating adequate surpluses for exports.

- Cultivation of genetically modified Bt cotton and high global prices had enabled India to become the world’s top producer (ahead of China) and No. 2 exporter (after the US) of the natural fibre.

What have been the Major Contributors to the Import basket?

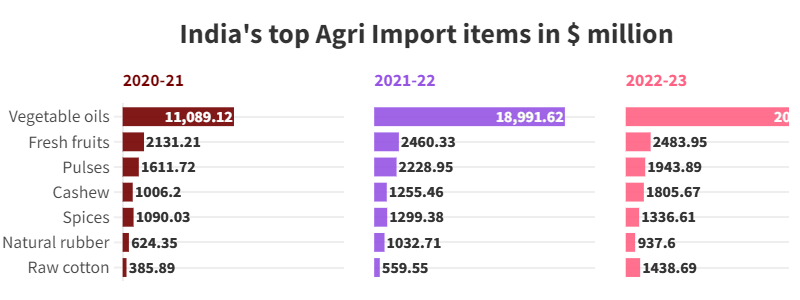

- India's basket of imported farm produce is less dominated by agricultural products compared to its exports.

- Among these imports, the most significant is vegetable oils, whose imports have more than doubled in value terms between 2019-20 and 2022-23.

- Imports meet roughly 60% of India’s vegetable oil requirements while the dependence on pulses imports is hardly 10% now.

- The value of pulses imports has also come down – halved - from USD4.2 billion in 2016-17 to USD1.9 in 2022-23.

- Imports of spices, cashew, and cotton – commodities where India has traditionally been a net exporter – have shown a rising trend.

- Spice imports going up are a reflection of reduced-price competitiveness, while cotton imports have risen as an outcome of stagnant or falling domestic production.

What are the Risks Ahead for Trade?

- International Prices: The latest FFPI reading for April 2023 is down from March 2022 and the 2022-23 average. A decrease in food prices could lead to a reduction in export earnings, particularly for those products that are more price sensitive.

- Domestic Inflation: More specifically food inflation fears ahead of the 2024 national elections could negatively affect the trade because of export-import parity.

- The government’s measures to tame domestic inflation like banning wheat and broken rice exports and the slapping of a 20% duty on all non-parboiled non-basmati shipments could further have adverse impacts on agricultural trade.

- If the situation doesn’t normalize more curbs on exports are expected with further liberalization of imports if the monsoon season delivers subnormal rainfall. season delivers subnormal rainfall.

What are some Measures taken by the Government to Promote Agri Export?

- Agriculture Export Policy (2018): It aims to harness export potential of Indian agriculture to make India a global power in agriculture and raise farmers’ income.

- ‘District as Export Hub’ Initiative: The initiative's goal is to identify export products and services across all districts and establish systems to promote them. Its aim is to assist small businesses, farmers, and MSMEs in accessing foreign export markets.

- Transport and Marketing Assistance for Specified Agriculture Products: It is a Central Sector Scheme to mitigate the freight disadvantage for the export of agriculture products.

- Trade Infrastructure for Export Scheme (TIES): It aims at enhancing the country's export competitiveness by bridging gaps in export infrastructure.

- Market Access Initiatives (MAI) Scheme: The scheme aims to promote India's exports by supporting market development activities for Indian exporters. The scheme provides financial assistance for export promotion activities.

- The Export Promotion Schemes of APEDA: APEDA has launched several schemes like financial assistance, market accessibility schemes etc. to promote the export of agricultural products.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. In India, which of the following can be considered as public investment in agriculture? (2020)

- Fixing Minimum Support Price for agricultural produce of all crops

- Computerization of Primary Agricultural Credit Societies

- Social Capital development

- Free electricity supply to farmers

- Waiver of agricultural loans by the banking system

- Setting up of cold storage facilities by the governments

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3, and 4 and 5 only

(c) 2, 3 and 6 only

(d) 1, 2, 3, 4, 5 and 6

Ans: c

Q. What is/are the advantage/advantages of implementing the 'National Agriculture Market' scheme? (2017)

- It is a pan-India electronic trading portal for agricultural commodities.

- It provides the farmers access to nationwide market, with prices commensurate with the quality of their produce.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither1 nor 2

Ans: c

Mains

Q. What are the main constraints in transport and marketing of agricultural produce in India? (2020)

-min.jpg)