Increased NPAs in MSMEs | 15 Mar 2022

For Prelims: MSME and Related Schemes.

For Mains: Government Policies and Interventions, MSME sector

Why in News

Despite a host of loan restructuring schemes and packages announced by the Reserve Bank of India (RBI) and the government, the Covid pandemic has hit the Micro, Small and Medium Enterprises (MSMEs) very hard.

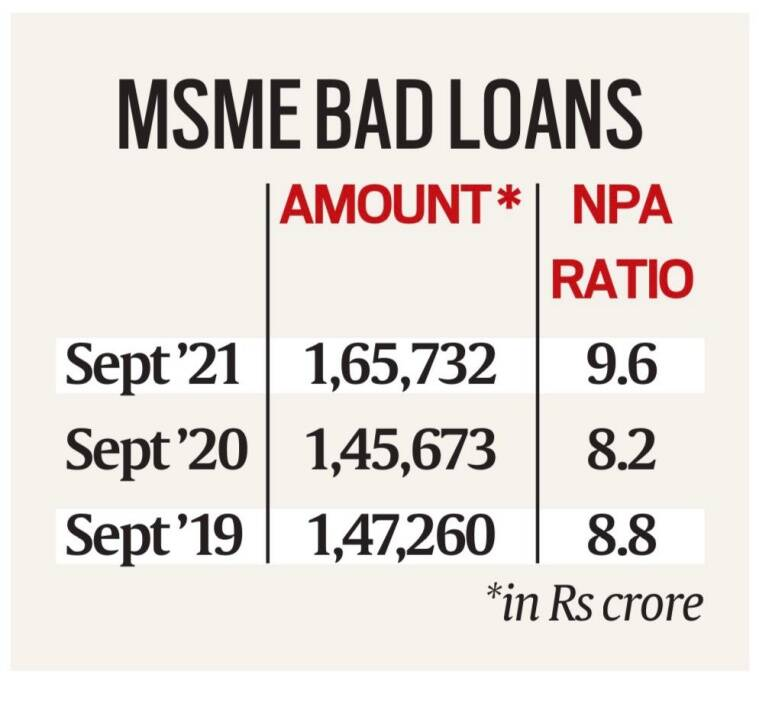

- Gross Non-Performing Assets (NPAs) of MSMEs, or loans defaulted by these enterprises, rose by Rs 20,000 crore to Rs 1,65,732 crore as of September 2021 from Rs 1,45,673 crore in September 2020.

- Bad loans of MSMEs now account for 9.6 % of gross advances of Rs 17.33 lakh crore as against 8.2 % in September 2020.

- Earlier, the Ministry of MSME launched the MSME Innovative Scheme (Incubation, Design and IPR) along with the MSME IDEA HACKATHON 2022.

What is a Non-Performing Asset?

- NPA refers to a classification for loans or advances that are in default or are in arrears on scheduled payments of principal or interest.

- In most cases, debt is classified as non-performing, when the loan payments have not been made for a minimum period of 90 days.

- Gross non-performing assets are the sum of all the loans that have been defaulted by the individuals who have acquired loans from the financial institution.

- Net non-performing assets are the amount that is realised after provision amount has been deducted from the gross non-performing assets.

What was the Effect of Covid on MSMEs?

- The rise in bad loans happened even after the RBI announced four loan restructuring schemes for MSMEs in January 2019, February 2020, August 2020 and May 2021.

- Loans of as many as 24.51 lakh MSME accounts worth Rs 1,16,332 crore were restructured under these schemes. Under the May 2021 circular issued by the RBI, loans for Rs 51,467 crore were restructured.

- The Sector being among the most pandemic afflicted sectors, thousands of MSMEs either shut down or became sick after the government announced a nationwide strict lockdown in March 2020 in the wake of the Covid pandemic.

What were the Initiatives Taken to Revive the MSMEs?

- To revive activity, the RBI and the government introduced several measures including the Emergency Credit Line Guarantee Scheme (ECLGS) which provided Rs 3 lakh crore of unsecured loans to MSMEs and businesses.

- The RBI also extended the scheme of one-time restructuring of loans to MSMEs without an asset classification downgrade and permitted bank lending to NBFCs (non banking Financial Companies-other than MFIs) for on-lending to agriculture, MSMEs and housing to be classified as Priority Sector Lending (PSL).

- The restructuring schemes and packages didn’t benefit thousands of units which were already in default.

- This is because to be eligible under the ECLGS scheme, borrower accounts were to be less than or equal to 60 days due as on 29th February, 2020.

- According to the RBI’s Financial Stability Report, credit to the MSME segment slowed down (year-on-year) by the end of September 2021 vis-a-vis March 2021.

- The decline was particularly noticeable in the sub Rs 25 crore ticket size across major bank groups.

What are the Laws and Provisions Related to NPA/Bad loans?

PYQ

Which of the following can aid in furthering the Government’s objective of inclusive growth? (2011)

- Promoting Self-Help Groups

- Promoting Micro, Small and Medium Enterprises

- Implementing the Right to Education Act

Select the correct answer using the codes given below:

(a) 1 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (d)