Geography

Including Non-Mineralised Areas in Mining Leases

- 07 Dec 2024

- 9 min read

For Prelims: Mining Leases, Mines and Minerals (Development and Regulation) Act, 1957, Supreme Court, Waste management, Indian Bureau of Mines (IBM), Illegal Mineral Extraction, District Mineral Foundation (DMF), National Mineral Exploration Trust (NMET), The Mines and Minerals (Development and Regulation) Amendment Act, 2023, Critical Minerals, Foreign Direct Investment, Net-Zero Emissions By 2070.

For Mains: Significance of India's Mineral Policy, Economic Governance, Sustainable Resource Management, And Environmental Regulations.

Why in News?

Recently, the Centre has allowed state governments to include non-mineralised areas within existing mining leases for dumping mine waste and overburden, streamlining operations and addressing industry challenges.

- The Ministry of Mines clarified that under the Mines and Minerals (Development and Regulation) Act, 1957, non-mineralized areas for ancillary activities like waste disposal can be included within a mining lease.

- This interpretation is supported by the Mines Act, 1952, and Rule 57 of the Mineral Concession Rules, 2016, which allow ancillary zones to be included in the lease area.

What are the Supreme Court Rulings for Regulating Mining and Minerals?

- Centre’s Primary Authority: In 1989, a seven-judge Bench in India Cement Ltd. v. the state of Tamil Nadu case ruled that mining regulation falls primarily under the Centre’s authority via the Mines and Minerals (Development and Regulation) Act, 1957, and Entry 54 of the Union List.

- State Authority on Taxes: In State of Orissa v. M.A. Tulloch & Co. Case, it was held that states could only collect royalties, not impose additional taxes, as royalties were classified as taxes.

- A 2004 judgment in State of West Bengal v. Kesoram Industries Ltd. Case questioned this classification, leading to a nine-judge review.

- Overturning 1989 Verdict: In July 2024, the Court ruled in favor of states (overturned 1989 judgement), asserting their power to tax mineral rights under Entry 50 of List II (State List) while limiting Parliament to imposing constraints to ensure mineral development isn’t hindered.

- However, some judges expressed concerns that unchecked state taxation could disrupt federal uniformity in mineral pricing and development, urging Parliament to intervene for consistency.

Goa Foundation v. Union of India Case, 2014: Against Dumping Outside Valid Lease Areas

- Prohibition of External Dumping: The Supreme Court ruled that dumping mine waste or overburden outside the boundaries of valid mining leases is prohibited to prevent environmental and legal violations.

- Protection of Non-Lease Areas: The ruling emphasized that non-lease areas must not be used for mining-related activities, ensuring their preservation and proper regulation.

- Alignment with Mining Laws: The Court’s decision reinforced compliance with the Mines and Minerals (Development and Regulation) Act, 1957, and related laws that restrict unauthorized use of land.

- Impact on Mining Practices: Mining operations were required to include waste management within leased areas, prompting changes in planning and land allocation.

What are the Implications of the Recent Inclusion of Non-Mineralised Areas?

- Streamlined Operations: Including non-mineralised areas in mining leases ensures safe and efficient management of overburden and waste, addressing industry operational challenges.

- Overburden, consisting of rocks, soil, and materials removed to access minerals, must be properly managed for safe mining.

- Non-mineralized areas, lacking significant mineral deposits, can be allocated by state governments for overburden disposal and added to mining leases without auction if they are contiguous.

- Aligned with 2014 Ruling: The move aligns with the Supreme Court’s 2014 ruling against dumping outside valid lease areas.

- Efficient Land Utilisation: Allowing waste disposal within lease areas ensures optimal use of non-mineralised zones without necessitating separate auctions for such purposes.

- Industry Growth: Eases operational hurdles, encouraging sustainable mineral extraction and fostering growth in the mining sector.

- States can allocate contiguous or non-contiguous non-mineralised areas for waste management if it benefits mineral development, providing operational flexibility.

- Safeguards Against Misuse: States must ensure non-mineralised areas are verified, consult the Indian Bureau of Mines (IBM) for extent determination, and notify IBM about supplementary leases, preventing illegal mineral extraction.

What is the Mines and Minerals (Development and Regulation) Act, 1957?

- Pivotal Legislation: This Act governs India’s mining sector, aiming to develop the industry, conserve minerals, and ensure transparency and efficiency in exploitation.

- Initial Objectives: Focused on promoting mining, conserving resources, and regulating concessions.

- 2015 Amendment: The 2015 Amendment introduced key reforms, including the Auction Method for transparency, the establishment of District Mineral Foundation (DMF) for mining-affected areas, National Mineral Exploration Trust (NMET) to boost exploration, and stringent penalties for illegal mining.

- 2021 Amendment: Captive mines are operated by companies to extract minerals for their own use, with up to 50% of their annual production allowed for sale in the open market after fulfilling the requirements of the end-use plant.

- Merchant mines are operated to produce minerals for sale in the open market, with the extracted minerals sold to various buyers, including industries without their own mines.

- Auction-only concessions ensure that all private-sector mineral concessions are granted through auctions.

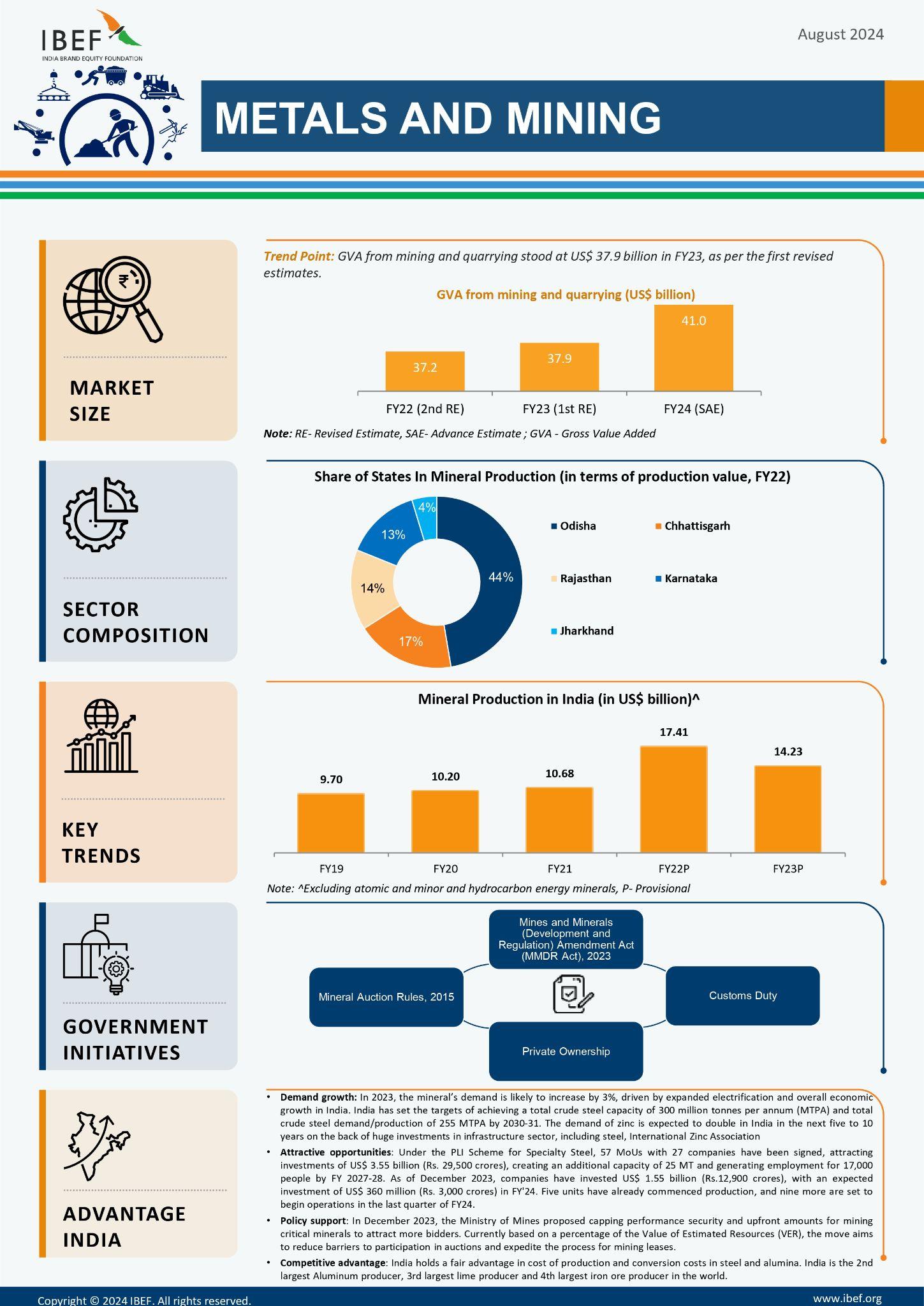

- 2023 Amendment: The Mines and Minerals (Development and Regulation) Amendment Act, 2023 aims to enhance the exploration and extraction of critical minerals vital for India's economic growth and national security.

- Key changes include removing six minerals from the list of 12 atomic minerals reserved for state agency exploration and allowing the government to exclusively auction concessions for critical minerals.

- Exploration licenses have been introduced to attract foreign direct investment and engage junior mining companies in exploring deep-seated and critical minerals.

- The amendments focus on reducing import dependence and encouraging private sector participation to accelerate the mining of essential minerals like lithium, graphite, cobalt, titanium, and rare earth elements, supporting India's energy transition and commitment to net-zero emissions by 2070.

|

Drishti Mains Questions: Evaluate the role of the Mines and Minerals (Development and Regulation) Act, 1957 in regulating India’s mining sector and its amendments. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. What is/are the purpose/purposes of ‘District Mineral Foundations’ in India? (2016)

- Promoting mineral exploration activities in mineral-rich districts

- Protecting the interests of the persons affected by mining operations

- Authorizing State Governments to issue licences for mineral exploration

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains:

Q. What are the consequences of Illegal mining? Discuss the Ministry of Environment and Forests’concept of GO AND NO GO zones for coal mining sector. (2013)