Guidelines for Licencing of Small Finance Banks | 06 Dec 2019

Why in News

Recently, the Reserve Bank of India has released final Guidelines for ‘on tap’ Licencing for Small Finance Banks (SFBs).

- RBI had issued in-principle approval to ten applicants for SFB in 2015. It was mentioned that after gaining experience in dealing with these banks, RBI would grant ‘on-tap’ licensing.

- An “on-tap” facility would mean the RBI will accept applications and grant licences for banks throughout the year.

Guidelines for ‘on-tap’ Licencing

- Capital requirement: The minimum paid-up voting equity capital / net worth requirement shall be ₹ 200 crores.

- For Primary (Urban) Co-operative Banks (UCBs), desirous of voluntarily transiting into SFBs initial requirement of net worth shall be at ₹ 100 crores, which will have to be increased to ₹ 200 crores within 5 years from the date of commencement of business.

- Scheduled bank status to SFBs: SFBs will be given scheduled bank status immediately upon commencement of operations. Also, SFBs will have general permission to open banking outlets from the date of commencement of operations.

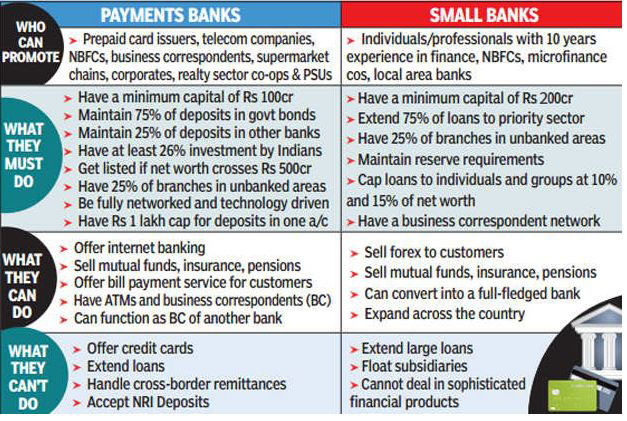

- Payments Banks conversion to SFBs: The payment banks can apply for conversion into SFB after 5 years of operations if they are otherwise eligible as per these guidelines.

Small Finance Bank

- The small finance bank will primarily undertake basic banking activities of acceptance of deposits and lending to unserved and underserved sections including small business units, small and marginal farmers, micro and small industries and unorganised sector entities.

- It can also undertake other non-risk sharing simple financial services activities such as the distribution of mutual fund units, insurance products, pension products, etc. with the prior approval of the RBI

- Eligible candidates for setting up SFB are:

- Resident individuals/professionals with 10 years of experience in banking and finance.

- The companies and societies owned and controlled by residents.

- Existing Non-Banking Finance Companies (NBFCs), Micro Finance Institutions (MFIs), Local Area Banks (LABs) and payment banks that are owned and controlled by residents.

- It needs to open at least 25% of its banking outlets in unbanked rural centres.

- The bank will be required to extend 75% of its adjusted net bank credit to the Priority Sector Lending (PSL).

- At least 50% of its loan portfolio should constitute loans and advances of up to ₹ 25 lakhs.

- The maximum loan size and investment limit exposure to a single and group would be restricted to 10% and 15% of its capital funds, respectively. They cannot extend large loans.

- If the initial shareholding by promoters in the bank is in excess of 40% of paid-up voting equity capital, it should be brought down to 40% within a period of 5 years.

- The small finance banks will be subject to Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- Banks are required to hold a certain proportion of their deposits in the form of cash is known as the CRR. This minimum ratio (that is the part of the total deposits to be held as cash) is stipulated by the RBI.

- The share of Net Demand and Time Liabilities that a bank is required to maintain safe and liquid assets, such as government securities, cash, and gold is termed as SLR.