Indian Economy

GST Council and National Anti-profiteering Authority

- 17 Jun 2019

- 3 min read

The GST Council in its recent meeting has discussed the proposal of extending the tenure of the National Anti-profiteering Authority (NAA) to one more year (till 30 November 2020).

- National Anti-profiteering Authority (NAA) came into existence ( just after the rollout of GST) for two years to deal with complaints by consumers against companies for not passing on GST rate cut benefits.

- Extension for NAA, (before its two-year sunset clause) is being seen necessary as there are many pending cases that need to be resolved before its dissolution.

National Anti-profiteering Authority

- The National Anti-Profiteering Authority (NAA) was constituted under Section 171 of the Central Goods and Services Tax Act, 2017.

Background

- The formation of NAA comes in the background of rate-reduction of a large number of items by GST Council which has made tremendous price reduction effect but the consumers will be benefited only if the traders are making the quick reduction of prices of respective items.

Functions of National Anti-profiteering Authority

- The anti-profiteering clause under the Goods And Services Tax (GST) Act mentions that any reduction in the rate of tax on any goods or services or the benefit of input tax credit must be passed on to the consumer by way of commensurate reduction in the prices of the respective goods or services.

- The Authority’s main function is to ensure that traders are not realizing an unfair profit by charging high price from consumers in the name of GST and to examine and check such profiteering activities and recommend punitive actions including the cancellation of Registration.

Governance

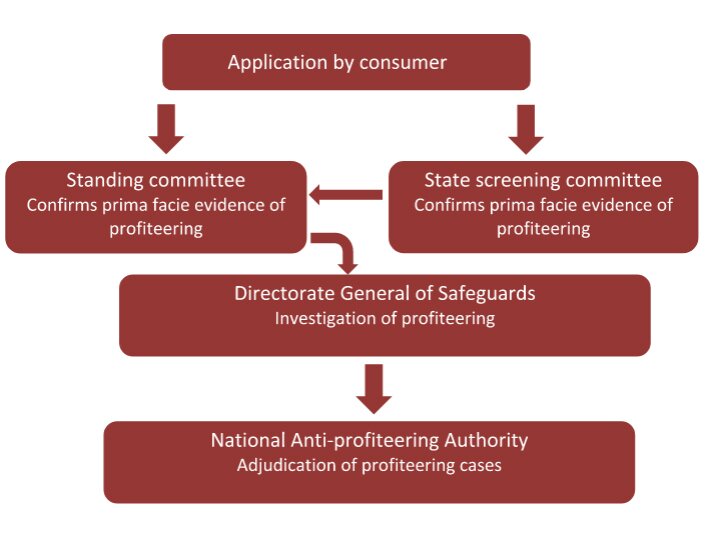

- NAA comprises of Chairman, four Technical members, a Standing Committee, Screening Committees in every State and the Directorate General of Safeguards in the Central Board of Excise & Customs (CBEC).

- The orders of the NAA can be appealed against only in the high court.