Indian Economy

Greedflation

- 29 Jun 2023

- 8 min read

For Prelims: Greedflation, Inflation, Disinflation, Disinflation, Deflation, Reflation, Wage-Price Spiral, RBI.

For Mains: Greedflation and its impact on the economy.

Why in News?

Recently, there has been an increasing consensus in Europe and US that Greedflation is driving the rising cost of living rather than just Inflation.

- To understand greedflation it is important to know how inflation works.

What are the Key Terms Related to Inflation?

- Inflation:

- Inflation is the rate at which the general price level rises.

- If it is reported that the inflation rate was 5% in June 2023 it implies that the general price level of the economy was 5% more than what it was in June 2022.

- Disinflation:

- Disinflation refers to the trend when the inflation rate decelerates.

- It refers to a period when even though prices are rising, it is happening at a slower rate each passing month.

- For example, it was 10% in April, 7% in May and 5% in June.

- Deflation:

- Deflation is the exact opposite of inflation. Imagine if the general prices level in June 2023 was 5% lower than what it was in June 2022. That’s deflation.

- It is a general decline in prices for goods and services, typically associated with a contraction in the supply of money and credit in the economy.

- Reflation:

- Reflation typically follows deflation as policymakers try to pump up economic activity either by government spending more and/or interest rates being reduced.

What Causes Inflation?

- Causes:

- Cost Push Inflation: Prices get pushed up because input costs have risen.

- For Example: If crude oil prices went up by 10% overnight because of a supply disruption, then the general price level will be pushed up because energy costs have gone up.

- Demand Pull Inflation: Prices are pulled up because there is excess demand.

- For Example: If RBI (Reserve Bank of India) cuts interest rates sharply, making people buy a house quite affordable since the interest rate has fallen, then the sudden surge in demand for new houses will pull up home prices.

- Cost Push Inflation: Prices get pushed up because input costs have risen.

- Measures to Curb Inflation:

- Monetary Policy: When there is too much demand in the economy, central banks increase interest rates as their Monetary Policy measure (contractionary monetary policy) to align demand with supply. Similarly, if inflation arises from cost pressures, central banks still raise interest rates.

- The primary objective is to contain demand because central banks have limited tools to directly boost supply.

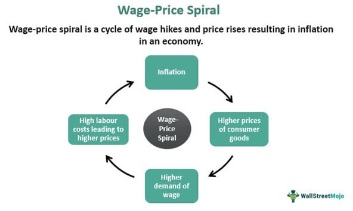

- They aim to prevent the Wage-Price Spiral, where rising prices lead to higher wages, increasing production costs and further price increases.

- Fiscal Policy: If there is inflationary pressure, the government can reduce spending or increase taxes to decrease aggregate demand and dampen price pressures in the economy.

- Fiscal policy is the use of government revenue collection (mainly taxes but also non-tax revenues such as divestment, loans) and expenditure to influence the economy.

- Monetary Policy: When there is too much demand in the economy, central banks increase interest rates as their Monetary Policy measure (contractionary monetary policy) to align demand with supply. Similarly, if inflation arises from cost pressures, central banks still raise interest rates.

What is the Wage-Price Spiral?

- When prices rise, workers demand higher wages, but this only increases overall demand without improving supply.

- As a result, inflation worsens because higher wages lead to increased purchasing power, which drives up prices.

- Central banks raise interest rates to reduce economic activity and demand, which can result in job losses. Despite its drawbacks, this approach is used by central banks to prevent a cycle of rising wages and prices, known as a wage-price spiral, and to curb inflation.

What is Greedflation?

- About:

- Greedflation refers to the situation where corporate greed drives inflation. Rather than a wage-price spiral, it is a Profit-Price Spiral where companies exploit inflation by raising prices excessively, going beyond covering their increased costs, and aiming to maximize their profit margins. These further fuels inflation.

- There is a growing consensus in developed countries, like Europe and the US, that greedflation is the true culprit.

- Greedflation refers to the situation where corporate greed drives inflation. Rather than a wage-price spiral, it is a Profit-Price Spiral where companies exploit inflation by raising prices excessively, going beyond covering their increased costs, and aiming to maximize their profit margins. These further fuels inflation.

- Scenario:

- During crises like natural disasters or pandemics, prices often surge as businesses raise them due to increased input costs.

- However, in some cases, businesses exploit the situation by making excessive profits through significantly higher price mark-ups.

- Impact:

- Greedflation disproportionately impacts low-income and middle-class individuals, reducing their consumption and lowering their standards of living.

- While it benefits the wealthy by increasing the value of their assets, widening the wealth gap and exacerbating income inequality.

- Sharp price increases and speculation driven by greed can create bubbles and unsustainable market conditions. This makes financial markets more susceptible to crashes and crises, posing risks to overall economic stability.

- Inflationary pressures caused by greedflation can result in divergent policies among countries. Each nation may adopt different strategies to combat inflation, leading to conflicting approaches.

- This can exacerbate global imbalances, trade tensions, and geopolitical conflicts as countries seek to protect their own interests and competitiveness.

- Greedflation disproportionately impacts low-income and middle-class individuals, reducing their consumption and lowering their standards of living.

Is Greedflation Happening in India?

- Trend:

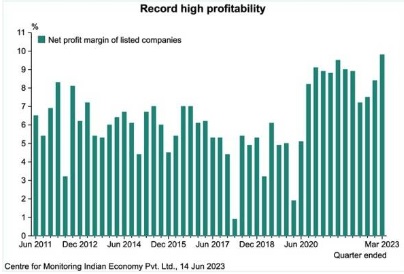

- The net profits of listed companies can be seen at a record high.

- Indian listed companies'(4,293) net profits surged to Rs.2.9 trillion in March 2023, over 3.5 times the pre-pandemic average of Rs.0.83 trillion from December 2017 to Dec 2019, indicating exceptional post-pandemic profit generation.

- Existence of Greedflation:

- In India, 60% of the growth in net profit can be attributed entirely to the increase in profit margin. The increase in sales contributed an additional 36% and the rest was a bonus from a combination of the two, which suggests the presence of greedflation.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q.1 With reference to Indian economy, demand-pull inflation can be caused/increased by which of the following?

- Expansionary policies

- Fiscal stimulus

- Inflation-indexing of wages

- Higher purchasing power

- Rising interest rates

Select the correct answer using the code given below:

(a) 1, 2 and 4 only

(b) 3, 4 and 5 only

(c) 1, 2, 3 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (a)

Q.2 Consider the following statements: (2020)

- The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

- The WPI does not capture changes in the prices of services, which CPI does.

- Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)