Indian Economy

GDP Revival Forecast: RBI

- 10 Oct 2020

- 6 min read

Why in News

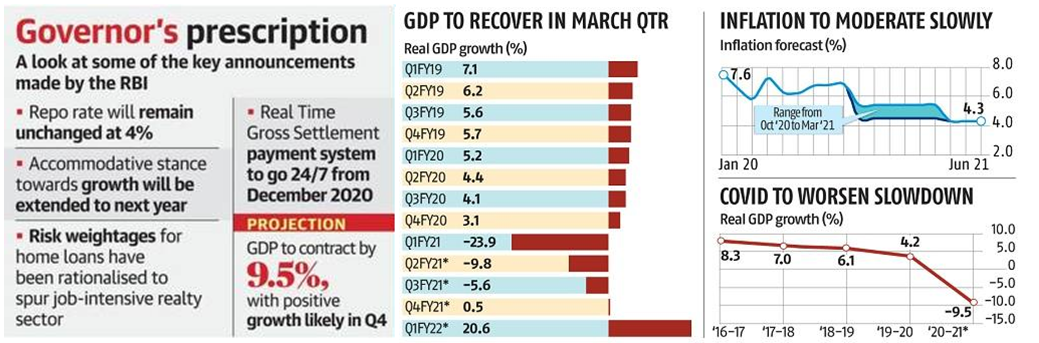

The Monetary Policy Committee of the Reserve Bank of India (RBI) has announced the extension of its accommodative policy stance for the rest of this year as well as 2021-22 and forecasted a GDP revival in coming months.

- RBI had previously introduced a number of measures in its Monetary Policy Report for dealing with the Covid-19 induced economic setback.

Key Points

- Decisions:

- RBI has kept key policy rates unchanged to revive growth of the economy and mitigate the economic impact of Covid-19 pandemic.

- The Repo and reverse repo rate unchanged at 4% and 3.35% respectively because of high inflation.

- Risk weights, i,e, the capital required to be set aside on individual home loans, have been relaxed and the loan limit for retail and small business borrowers have been raised.

- This would give a boost to the job-intensive real estate sector that has been suffering in the pandemic.

- Real-Time Gross Settlement (RTGS) will be available round the clock.

- Targeted Long Term Repo Operations (TLTRO) of Rs 1,00,000 crore for the revival of specific sectors, and Open Market Operations (OMOs) for State Development Loans (SDLs) have been announced.

- This will assure market participants of access to liquidity and easy finance conditions.

- Long Term Reverse Repo Operation (LTRO) is a mechanism to facilitate the transmission of monetary policy actions and the flow of credit to the economy. This helps in injecting liquidity in the banking system.

- Open Market Operations (OMO) is one of the quantitative monetary policy tools which is employed by the central bank of a country to control the money supply in the economy.

- OMOs are conducted by the RBI by way of sale or purchase of government securities (g-secs) to adjust money supply conditions.

- The central bank sells g-secs to commercial banks to remove liquidity from the system and buys back g-secs to infuse liquidity into the system.

- RBI has kept key policy rates unchanged to revive growth of the economy and mitigate the economic impact of Covid-19 pandemic.

- Forecasts:

- GDP Revival

- Real gross domestic product (GDP) in FY21 will fall by 9.5%.

- GDP growth may break out of contraction and enter a positive zone by Q4 of the current fiscal year (2020-21)

- Starting from a modest recovery the economic activity is expected to gain traction in Q3.

- The real GDP growth in 2020-21 is expected to be negative at -9.8% in Q2 of 2020-21,-5.6% in Q3 and 0.5% in Q4.

- Real GDP is likely to grow by 20.6% in the Q1 of 2021-22.

- Decline in Inflation:

- Inflation is expected to decline in the next 3 months and is likely to ease to the projected target of around 4% (within a band of +/- 2%) by Q4 of FY’21.

- Supply chain disruptions is the major factor driving up inflation. As supply chains are restored, the inflation would come down.

- The retail inflation growth was 6.69%, as of August 2020.

- Restart of Economy

- The economy is likely to witness a three-speed recovery i.e. individual sectors showing varying paces with fastest, modest and slowest recovery rates.

- Apart from agriculture, sectors such as fast-moving consumer goods, automobiles, pharma and power would revive first.

- GDP Revival

Monetary Policy Committee

- The Monetary Policy Committee is a statutory and institutionalized framework under the Reserve Bank of India Act, 1934, for maintaining price stability, while keeping in mind the objective of growth.

- The Governor of RBI is ex-officio Chairman of the committee.

- The committee comprises six members (including the Chairman) - three officials of the RBI and three external members nominated by the Government of India.

- Decisions are taken by majority with the Governor having the casting vote in case of a tie.

- The MPC determines the policy interest rate (repo rate) required to achieve the inflation target (4%).

- An RBI-appointed committee led by the then deputy governor Urjit Patel in 2014 recommended the establishment of the Monetary Policy Committee.

Repo Rate and Reverse Report Rate

- It is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds.

- It is used by monetary authorities to control inflation.

- In the event of inflation, central banks increase the repo rate as this acts as a disincentive for banks to borrow from the central bank. This ultimately reduces the money supply in the economy and thus helps in arresting inflation.

- The central bank takes the contrary position in the event of a fall in inflationary pressures.

- Ideally, a low repo rate should translate into low-cost loans for the general masses. When the RBI slashes its repo rate, it expects the banks to lower their interest rates charged on loans.

- Reverse repo rate is the rate at which the RBI borrows money from commercial banks within the country.

-min.jpg)