Food Inflation | 17 May 2022

For Prelims: Inflation, Food Inflation, CPI, RBI

For Mains: Food Inflation and issues, Growth & Development

Why in News?

Food prices around the world have soared to record levels this year as the Russia-Ukraine war slashes key exports of wheat and fertiliser from those countries, at the same time as droughts, floods and heat fuelled by climate change claim more harvests.

What are the Causes of Food Inflation?

- Russia-Ukraine Conflict:

- Russia and Ukraine supply about 30% of global wheat exports, but those have fallen as a result of the conflict.

- High Stock of Wheat:

- National stocks of wheat – mostly eaten in the countries where it is grown – remain relatively high.

- But the drop in exports from Russia and Ukraine has driven up competition for the remaining wheat on the global market, leading to higher costs that are particularly painful for poorer, debt-ridden countries that rely heavily on imports.

- Almost 40% of Africa’s wheat imports come from Ukraine and Russia, while rising global wheat prices have sent bread prices in Lebanon 70% higher.

- Food Stock and Commodity Markets:

- Since the last food price crises of 2007-2008 and 2011-2012, governments have failed to curb excessive speculation and ensure transparency of food stocks and commodity markets.

What has been the Recent Trend in Inflation?

- The Food and Agriculture Organisation’s food price index has shown a 29.8% year-on-year increase for April 2022.

- Moreover, all commodity group price indices have posted huge jumps: Cereals (34.3%), vegetable oils (46.5%), dairy (23.5%), sugar (21.8%) and meat (16.8%).

- Simply put, food inflation is already rising across-the-board globally — because of supply disruptions from the war, dry weather in South America, high crude prices inducing greater diversion of corn, sugar, palm and soyabean oil for bio-fuel, and so on.

How Global Prices of Food Affect Domestic Prices?

- The transmission of the above global inflation to domestic food prices basically depends on how much of a country’s consumption/production is imported/exported.

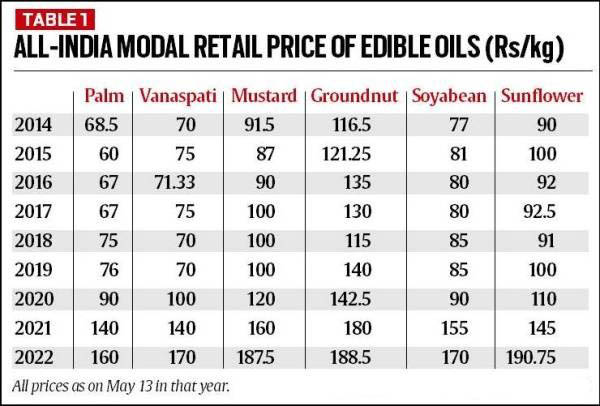

- Such transmission is evident in edible oils and cotton, where up to two-thirds of India’s consumption and a fifth of its production are imported and exported, respectively.

- In the case of wheat, the heat wave from mid-March severely impacting yields, both public stocks and overall domestic availability are under pressure, even as open market prices have risen to export parity levels.

- Not surprisingly, the Centre has decided to slash wheat allocations and offer more rice under its flagship free-grains scheme. Export demand is, likewise, helping maize trade well above its Minimum Support Price (MSP). But that, alongside higher oil meal prices, will also push up livestock feed costs and, in turn, translate into inflation in milk, egg and meat.

- For now, though, the consolation is that there is little to no inflation in pulses, sugar, onion, potato and most summer vegetables.

- To that extent, food inflation isn’t yet “generalised” in India.

- Sugar is one commodity where retail prices haven’t gone up much, despite record exports by mills.

- The reason for it is production also hitting a historic high.

How can food inflation be tackled?

- Consuming Less Meat and Dairy:

- Because a large share of the world’s grain goes to feeding livestock, persuading people to eat less meat and dairy could boost grain supplies dramatically.

- The global shortage of cereals on export markets this year is expected to be 20-25 million tonnes – but if Europeans alone cut their consumption of animal products by 10%, they could reduce demand by 18-19 million tonnes.

- Because a large share of the world’s grain goes to feeding livestock, persuading people to eat less meat and dairy could boost grain supplies dramatically.

- Improving Grain Storage:

- Improving grain storage particularly in countries highly reliant on imports, and helping those countries grow more staple food at home – not the cash crops for export that have often replaced staples – could also help.

- Planting a Wider Variety of Crops:

- And globally, planting a wider variety of crops in order to reduce dependence on just a few grains, with markets dominated by a small number of exporters, could boost food security.

- Policy Shifts:

- Policy Shifts in countries like Africa’s new continental free trade area – could eventually allow some poorer nations to reduce their dependence on distant producers and fragile supply chains.

- Investing in Climate-Smart Farming:

- In addition, investing in climate-smart farming, to protect harvests as the planet warms, would help shore up global food supplies, while providing debt relief could give the poorest countries more fiscal space to manage food price fluctuations.

- Step-up Domestic Production:

- In short, while global food inflation is a reality, the only way to contain the effects of it getting “imported” is to step up domestic production.

Way Forward

- There should be consistency in import policy as that sends appropriate market signals in advance. Intervening through import tariffs is better than quotas which leads to greater welfare loss. This also calls for more accurate crop forecasts using satellite remote sensing and GIS techniques to indicate shortfall/surplus in a crop year much in advance.

- Moreover, a decade old CPI base year of 2011-12 that gives nearly half of the weight to food items needs to be revised and updated to reflect the change in food habits and lifestyle of the population. With the rising middle-class, spending on non-food items has increased and this needs to be better reflected in the CPI, thereby enabling RBI to better target the non-volatile segment (core inflation).