Indian Economy

Floating Rate Loans

- 16 Aug 2023

- 5 min read

For Prelims: Reserve Bank of India (RBI), Equated Monthly Installments (EMIs), Floating Rate Loans

For Mains: Concept of floating rate loans , Challenges in the financial institutions

Why in News?

Recently, the Reserve Bank of India (RBI) will introduce a comprehensive framework to enhance transparency and establish proper rules for resetting Equated Monthly Installments (EMIs) for floating rate loans.

- This move aims to address borrower concerns and ensure fair practices by financial institutions.

What are Floating Rate Loans?

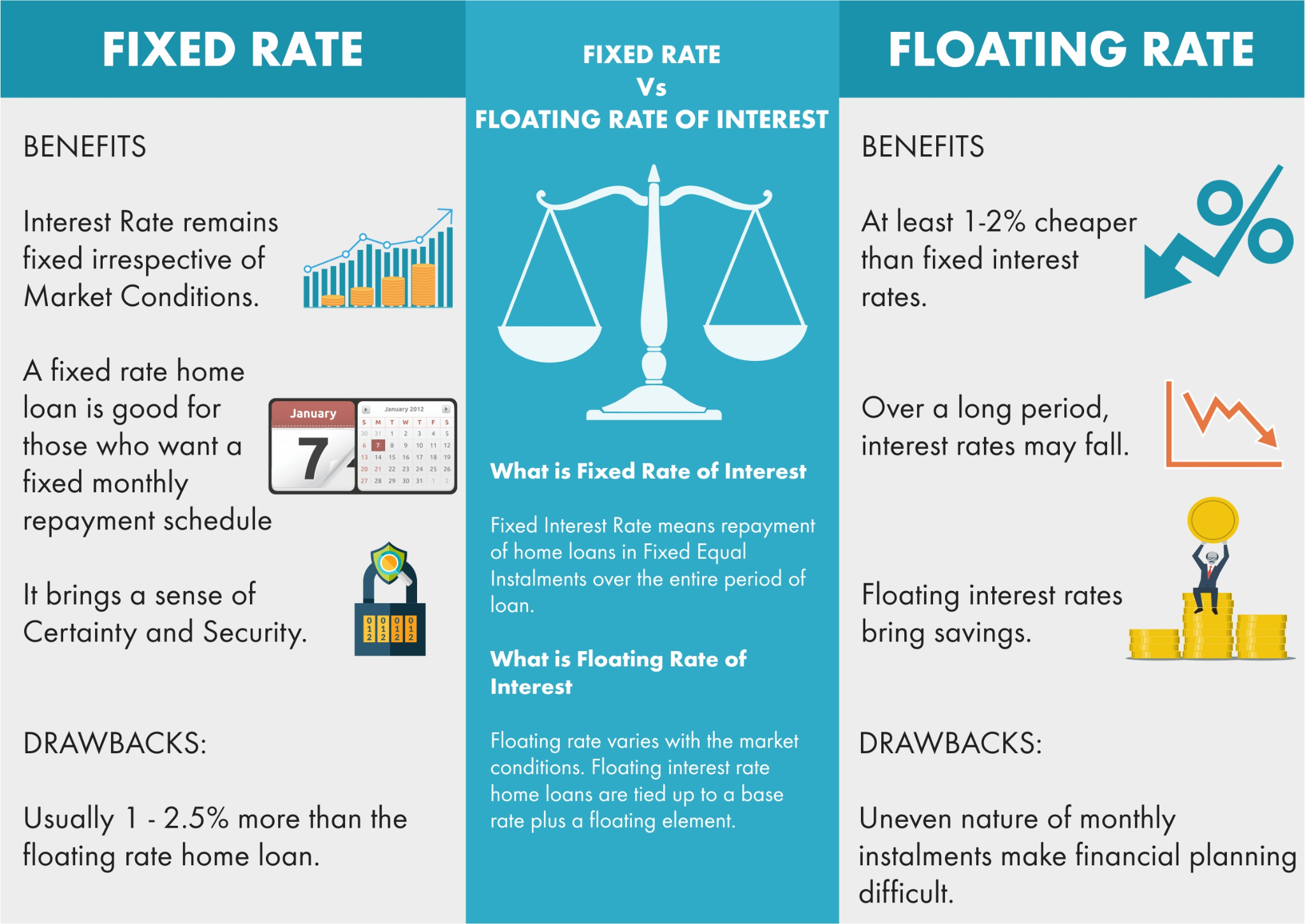

- Floating rate loans are loans that have an interest rate that changes periodically, depending on a benchmark rate or the base rate.

- This base rate, such as the repo rate - rate at which RBI lends money to financial institutions - is influenced by market forces.

- Floating-rate loans are also known as variable or adjustable-rate loans, as they can vary over the term of the loan.

- Floating rate loans are common for credit cards, mortgages, and other consumer loans.

- Floating rate loans are beneficial to borrowers when interest rates are expected to drop in the future.

- In contrast, a fixed interest rate loan requires a borrower to pay set installments during the loan tenure. It offers a greater sense of security and stability in times of fluctuations in the economy.

What is the Need for the New Transparent Framework?

- Until recently, the RBI had been raising the repo rates in order to contain inflation. With a rise in repo rates, the floating rates too increase. This translates into higher EMIs for borrowers.

- But it has been found that instead of asking for higher EMIs, some banks are simply increasing the tenure of the loan without informing the borrower.

- This is making loan repayments unreasonably long and without proper consent from borrowers.

- Prevent borrowers from being harmed by changes in the internal benchmark rate and the spread during the term of the loan.

- Address issues faced by borrowers such as lack of information about foreclosure charges, switching options, and key terms and conditions.

What are the Features of the Framework Proposed by RBI?

- Lenders should communicate clearly with borrowers on resetting the tenor and/or EMI.

- RBI has asked lenders to offer borrowers an option to switch to fixed-rate home loans or foreclosure of loans whenever they want.

- Banks would also need to disclose various charges incidental to the exercise of these options beforehand to borrowers and properly communicate key information to borrowers.

- This would result in borrowers taking a more informed and calculated decision while repaying their home loans.

- Lenders should not engage in unethical or coercive loan recovery practices, such as harassment, intimidation, or violation of privacy.

How will the Framework Benefit Borrowers and Lenders?

- Borrowers will have more clarity, transparency, and choice regarding their floating rate loans, and will be able to exit or switch them without any penalty or hassle.

- Borrowers will be protected from unfair or arbitrary changes in interest rates or EMIs by lenders and will be able to plan their finances better.

- Borrowers will be treated with dignity and respect by lenders, and will not face any harassment or abuse during loan recovery.

- Lenders will be able to maintain good customer relations and trust and avoid reputational risk or legal action due to improper lending conduct.

- Lenders will be able to improve their asset quality and risk management and ensure compliance with regulatory norms and expectations.