e-RUPI: Voucher Based Digital Payment System | 02 Aug 2021

Why in News

The Indian government is going to launch an electronic voucher based digital payment system e-RUPI.

- There are already many countries using the voucher system for example the US, Colombia, Chile, Sweden, Hong Kong, etc.

e-RUPI

Key Points

- e-RUPI:

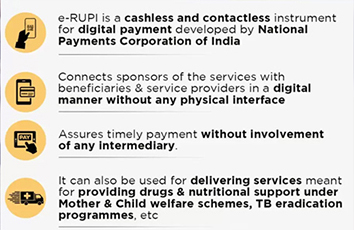

- It is a cashless and contactless method for digital payment. It is a Quick Response (QR) code or SMS string-based e-voucher, which is delivered to the mobile of the users.

- The users will be able to redeem the voucher without needing a card, digital payments app, or internet banking access, at the service provider.

- It connects the sponsors of the services with the beneficiaries and service providers in a digital mode without any physical interface.

- The mechanism also ensures that the payment to the service provider is made only after the transaction is completed.

- The system is pre-paid in nature and hence, assures timely payment to the service provider without the involvement of any intermediary.

- Different from Virtual Currency:

- In effect, e-RUPI is still backed by the existing Indian rupee as the underlying asset and specificity of its purpose makes it different to a virtual currency and puts it closer to a voucher-based payment system.

- Issuing Entities & Beneficiary Identification:

- The one-time payment mechanism has been developed by the National Payments Corporation of India on its Unified Payments Interface (UPI) platform, in collaboration with the Department of Financial Services, Ministry of Health & Family Welfare, and National Health Authority.

- It has boarded banks that will be the issuing entities. Any corporate or government agency will have to approach the partner banks, which are both private and public-sector lenders, with the details of specific persons and the purpose for which payments have to be made.

- The beneficiaries will be identified using their mobile number and a voucher allocated by a bank to the service provider in the name of a given person would only be delivered to that person.

- Uses:

- Government Sector:

- It is expected to ensure a leak-proof delivery of welfare services and can also be used for delivering services under schemes meant for providing drugs and nutritional support under Mother and Child welfare schemes, drugs & diagnostics under schemes like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, fertiliser subsidies etc.

- Private Sector:

- Even the private sector can leverage these digital vouchers as part of their employee welfare and Corporate Social Responsibility (CSR) programmes.

- Government Sector:

- Significance:

- The government is already working on developing a Central Bank Digital Currency and the launch of e-RUPI could potentially highlight the gaps in digital payments infrastructure that will be necessary for the success of the future digital currency.

- Future of Digital Currency in India: According to the Reserve Bank of India (RBI), there are at least four reasons why digital currencies are expected to do well in India:

- Increasing Penetration: There is increasing penetration of digital payments in the country that exists alongside sustained interest in cash usage, especially for small value transactions.

- High Currency to GDP Ratio: India’s high currency to Gross Domestic Product (GDP) ratio holds out another benefit of CBDCs.

- Cash-to-GDP Ratio or Currency in Circulation (CIC) to GDP Ratio or simply currency-to-GDP ratio shows the value of cash in circulation as a ratio of GDP.

- Spread of Virtual Currencies: The spread of private virtual currencies such as Bitcoin and Ethereum may be yet another reason why CBDCs become important from the point of view of the central bank.

- Will Act as a Cushion: Central bank digital currencies might also cushion the general public in an environment of volatile private virtual currencies.