Currency Exchange Rate Index | 21 Apr 2020

Why in News

The rupee has been losing value (or depreciating or weakening) against the dollar over the past few months.

- The exchange rate of rupee is one of the markers to compare Indian economy’s competitiveness vis-a-vis other economies (also amid Covid-19 outbreak).

- Another measure for comparison is looking at the growth rates of Gross Domestic Product (GDP) and Gross Value Added (GVA).

- High-frequency data like sales of automobiles etc. can also be used as a proxy to compare economies.

Key Points

- Exchange Rate

- The price of one currency in terms of the other is known as the exchange rate.

- A currency’s exchange rate vis-a-vis another currency reflects the relative demand among the holders of the two currencies.

- For e.g. If the US dollar is stronger than the rupee (implying value of dollar is higher with respect to rupee), then it shows that the demand for dollars (by those holding rupee) is more than the demand for rupees (by those holding dollars).

- This demand in turn depends on the relative demand for the goods and services of the two countries.

- Index for Exchange Rate

- Since a country interacts with many countries, it wants to see the movement of the domestic currency relative to all other currencies in a single number rather than by looking at bilateral rates.

- That is, it would want an index for the exchange rate against other currencies, just as it uses a price index (CPI or WPI) to show how the prices of goods in general have changed.

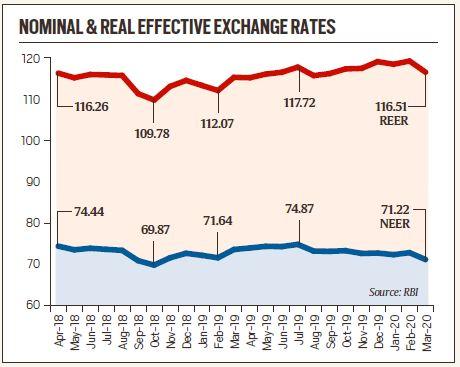

- The Reserve Bank of India tabulates the rupee’s Nominal Effective Exchange Rate (NEER) in relation to the currencies of 36 trading partner countries.

- This is a weighted index — that is, countries with which India trades more are given a greater weight in the index.

- A decrease in this index denotes depreciation in rupee’s value whereas an increase reflects appreciation.

- There is one more measure that is even better at capturing the actual change. This is called the Real Effective Exchange Rate (REER) and is essentially an improvement over the NEER because it also takes into account the domestic inflation in the various economies.

- The REER is the weighted average of NEER adjusted by the ratio of domestic prices to foreign price.

- Impact of Inflation on Exchange Rate

- Many factors affect the exchange rate between any two currencies ranging from the interest rates to political stability (less of either results in a weaker currency). Inflation is one of the most important factors.

- Illustration: Imagine that the Rupee-Dollar exchange rate was exactly 1 in the first year. This means that with Rs 100, one could buy something that was priced at $100 in the US. But suppose the Indian inflation is 20% and the US inflation is zero. Then, in the second year, an Indian would need Rs 120 to buy the same item priced at $100, and the rupee’s exchange rate would depreciate (reduce in value) to 1.20.

- Comparison between NEER and REER

- As the chart shows, in NEER terms, the rupee has depreciated to its lowest level since November 2018. The rupee has been steadily losing value — showing the Indian economy’s reducing competitiveness— since July 2019.

- In REER terms also, the rupee has depreciated in March and fallen to its lowest level since September 2019.

- The difference between trends of NEER and REER was due to India’s domestic retail inflation being lower relative to the other 36 countries. As domestic inflation started rising, the REER, too, started depreciating like the NEER.

Note

- Gross Domestic Product (GDP) is a measure of economic activity in a country. It is the total value of a country’s annual output of goods and services. It gives the economic output from the consumers’ side.

- Gross Value Added (GVA) is the sum of a country’s GDP and net of subsidies and taxes in the economy. It provides the rupee value for the amount of goods and services produced in an economy after deducting the cost of inputs and raw materials that have gone into the production of those goods and services.