Indian Economy

Concerns over Insolvency and Bankruptcy Code, 2016

- 11 Jan 2024

- 10 min read

For Prelims: Insolvency and Bankruptcy Code (IBC) 2016, National Company Law Tribunal , Financial Stability Report (FSR), Reserve Bank of India (RBI), Insolvency and Bankruptcy Board of India

For Mains: Challenges faced by the IBC, Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Why in News?

The Insolvency and Bankruptcy Code (IBC) came into effect in 2016 to achieve several objectives, including maximizing the value of debtor's assets, promoting entrepreneurship, ensuring timely resolution of cases, and balancing the interests of stakeholders.

- However, recent developments have raised concerns about the effectiveness of the code and the resolution process.

What are the Key Issues with the IBC?

- Low Repayment Percentage:

- The resolution plan approval process typically involves only about 15% payment by the purchaser, and repayment can take years without any further interest collected by the banks according to the financial stability report (FSR) released by Reserve Bank of India (RBI) in 2023.

- This has raised questions about the effectiveness of the repayment process.

- The resolution plan approval process typically involves only about 15% payment by the purchaser, and repayment can take years without any further interest collected by the banks according to the financial stability report (FSR) released by Reserve Bank of India (RBI) in 2023.

- Settlement and Recovery:

- Recent settlements and resolutions, such as the Reliance Communications Infrastructure Ltd. (RCIL) case, have raised concerns due to the low settlement amounts and extended resolution periods.

- For example, the settlement for RCIL amounted to a mere 0.92% of the debt, and it took four years to complete the resolution plan, far beyond the stipulated maximum of 330 days.

- The Financial Creditors (FCs) should ideally get principal and interest.

- Time-consuming processes for identifying and acknowledging defaults contribute to reduced recovery rates. It hampers the timely initiation of resolution proceedings, contributing to reduced recovery rates.

- Recent settlements and resolutions, such as the Reliance Communications Infrastructure Ltd. (RCIL) case, have raised concerns due to the low settlement amounts and extended resolution periods.

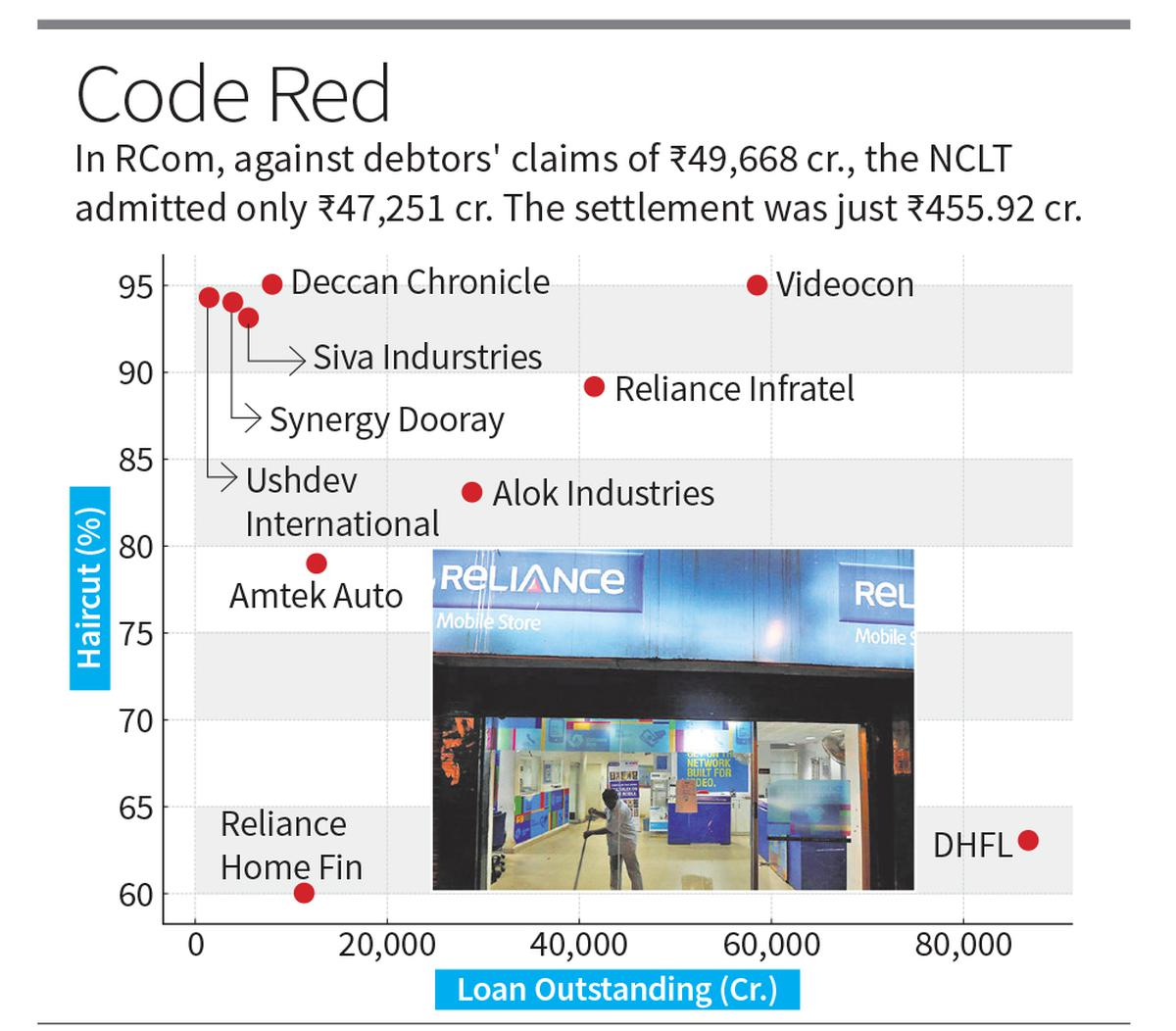

- Haircuts and Recovery Rates:

- The concept of "haircuts," which involves writing off loans and accrued interest, has gained prominence.

- Promoters are taking advantage by taking the company to cleaners and getting a substantial haircut from bankers/National Company Law Tribunal (NCLT).

- After resolutions, borrowers and Insolvency Professionals (IPs) remain wealthy, while lenders suffer and banks are absolved from liability, as only companies are declared insolvent, not the owners, leading to depositors being the losers.

- This has resulted in low recovery rates for financial creditors, with some cases realizing as little as 5% of the loan outstanding.

- The concept of "haircuts," which involves writing off loans and accrued interest, has gained prominence.

- Realizable Value:

- The FSR released by the RBI in 2023 highlights the low realizable value to creditors, with banks or financial creditors recovering an average of just 10-15% in NCLT-settled cases of large corporates. However, the RBI says the creditors realize 168.5% of the liquidation value and 86.3% of the fair value.

- As per the FSR, out of 597 liquidations, against the claim of Rs 1,32,888 crore, the amount realised was 3% of the claims admitted.

- While banks collect up-to-date interest on loans to farmers, students, MSMEs and on housing, including penalty interest for delays, corporates are treated differently.

- The amount realized from liquidations has also been minimal, raising concerns about the recovery process.

- The FSR released by the RBI in 2023 highlights the low realizable value to creditors, with banks or financial creditors recovering an average of just 10-15% in NCLT-settled cases of large corporates. However, the RBI says the creditors realize 168.5% of the liquidation value and 86.3% of the fair value.

- Regulatory Concerns:

- Regulatory Reports:

- The FSR has highlighted several concerns regarding the Corporate Insolvency Process (CIRP).

- The report indicates that the admitted claims are less than the dues, and banks or financial creditors are recovering only a fraction of the liquidation value and fair value.

- Parliamentary Standing Committee Report:

- The 32nd report of the Parliamentary Standing Committee on Finance has raised concerns about low recovery rates, with haircuts as much as 95% and the delay in the resolution process with more than 71% of cases pending for more than 180 days clearly points towards a deviation from the original objective of the code intended by the Parliament, and issues with Resolution Professionals (RPs) and Insolvency Professionals (IPs).

- It also recommends the need for a professional code of conduct for the Committee of Creditors (COCs) and fixing a ceiling on haircuts.

- The 32nd report of the Parliamentary Standing Committee on Finance has raised concerns about low recovery rates, with haircuts as much as 95% and the delay in the resolution process with more than 71% of cases pending for more than 180 days clearly points towards a deviation from the original objective of the code intended by the Parliament, and issues with Resolution Professionals (RPs) and Insolvency Professionals (IPs).

- Regulatory Reports:

- Limited Judicial Bench Strength:

- The IBC resolution process is impeded by a shortage of judges, resulting in a deceleration of case processing. This, in turn, contributes to prolonged resolution times.

What are the Key Highlights of the Insolvency and Bankruptcy Code, 2016?

- About:

- The Insolvency and Bankruptcy Code (IBC), 2016 provides a framework for resolving the bankruptcy and insolvency of companies, individuals, and partnerships in a time bound manner.

- Insolvency is a state where the liabilities of an individual or an organization exceeds its asset and that entity is unable to raise enough cash to meet its obligations or debts as they become due for payment.

- Bankruptcy is when a person or company is legally declared incapable of paying their due and payable bills.

- The Insolvency and Bankruptcy Code (Amendment) Act, 2021 amends the Insolvency and Bankruptcy Code, 2016.

- This amendment aims to provide an efficient alternative insolvency resolution framework for corporate persons classified as micro, small and medium enterprises (MSMEs) under the code.

- It aims for ensuring quicker, cost-effective and value maximizing outcomes for all the stakeholders.

- The Insolvency and Bankruptcy Code (IBC), 2016 provides a framework for resolving the bankruptcy and insolvency of companies, individuals, and partnerships in a time bound manner.

- Objectives:

- Maximizing the value of debtor’s assets.

- Promoting entrepreneurship.

- Ensuring timely and effective resolution of cases.

- Balancing the interests of all stakeholders.

- Facilitating a competitive market and economy.

- Providing a framework for cross-border insolvency cases.

- IBC Proceedings:

- Insolvency and Bankruptcy Board of India (IBBI):

- IBBI serves as the regulatory authority overseeing insolvency proceedings in India.

- The IBBI's Chairperson and three whole-time members are appointed by the government and are experts in the fields of finance, law, and insolvency.

- It also has ex-officio members.

- The IBBI's Chairperson and three whole-time members are appointed by the government and are experts in the fields of finance, law, and insolvency.

- IBBI serves as the regulatory authority overseeing insolvency proceedings in India.

- Adjudication of Proceedings:

- National Companies Law Tribunal (NCLT) adjudicates proceedings for companies.

- Debt Recovery Tribunal (DRT) handles proceedings for individuals.

- Courts play a pivotal role in approving the initiation of the resolution process, appointing professionals, and endorsing the final decisions of creditors.

- Procedure for Insolvency Resolution under the Code:

- Initiated by either the debtor or creditor upon default.

- Insolvency professionals manage the process, providing financial information to creditors and overseeing debtor asset management.

- A 180-day period prohibits legal action against the debtor during the resolution process.

- Committee of Creditors (CoC):

- Formed by insolvency professionals, the CoC comprises financial creditors.

- The CoC determines the fate of outstanding debts, deciding on debt revival, repayment schedule changes, or asset liquidation.

- Failure to decide within 180 days leads to the debtor's assets going into liquidation.

- Formed by insolvency professionals, the CoC comprises financial creditors.

- Liquidation Process:

- Proceeds from the sale of the debtor’s assets are distributed in the following order of order:

- First insolvency resolution costs, including the remuneration to the insolvency professional, second secured creditors, whose loans are backed by collateral and third dues to workers, other employees, forth unsecured creditors.

- Proceeds from the sale of the debtor’s assets are distributed in the following order of order:

- Insolvency and Bankruptcy Board of India (IBBI):

Way Forward

- Implement measures to ensure a higher repayment percentage in the resolution plans. This may involve stricter evaluation criteria for approving plans, emphasizing the need for a substantial upfront payment by the purchaser, and incentivizing timely repayments.

- RBI's decision to implement a maximum ceiling of credit to a single corporate house at Rs 10,000 crore is crucial for reducing the burden of banks during write-offs.

- As the original objectives have not been fulfilled, a full review of IBC and NCLTs is urgently needed.

- Reevaluate the concept of "haircuts" and implement measures to prevent abuse by promoters. Introduce safeguards that ensure a fair distribution of losses between promoters and financial creditors.

- Enhance transparency in the resolution process by ensuring regular updates on the status of cases and reasons for delays.